Whether it’s ready or not, there’s a revolution sweeping its way through the financial services sector. The rise of social media has presented unique challenges to this naturally conservative industry.

Progress has been mixed as it tries to come to terms with a rapidly changing client base that is tech savvy and organically creating its own host of strong online communities, sharing information more quickly, and with more transparency, than ever before. For an industry that has been traditionally slow to adapt to modern technologies, the social media revolution has been something of a challenge.

But the rise of social media is very real, and it’s essential for any industry, no matter how traditionally regulated and conservative, to not just get to grips with the realities of this newly social world, but to truly interact and become part of this world itself if it’s to succeed and harness the full potential that this new social media world presents.

Understanding the new customer lifecycle

Customers now demand the power to transfer payments, seek out and share financial information, and manage their accounts online – and this consumer power should not be feared, but embraced by the financial services industry as an exciting means forward that presents many more potential rewards than it does risks.

How social media can help

Transforming customer engagement

Social media platforms, like Facebook, Twitter and blogs, are not simply a further avenue for sales, or trivial marketing tools – there is a far more fundamental transformation of the customer engagement process at work here. For the industry to realise the full potential of these new social networks they need to be fully embraced, and that includes all of the facets that have made them so attractive to the 1 billion+ social media users already out there right now.

In this new world of information sharing that means genuinely listening out for customer complaints, visibly interacting with customers via social media connections, and bringing customers together to discuss and share their opinions of financial services companies, and their experience with financial products and services.

A whole new customer dialogue

As well as giving valuable feedback to the financial services industry, a whole new dialogue is being created and strengthened between the world of finance and consumers. There truly is a revolution going on here, and those willing to embrace it will benefit from customer loyalty, and more. At a time when relations between the general public and the financial services world are notably strained, social media represents a peaceful, useful and instantly effective new means of communication that can help build consumer confidence in the industry once more.

Social media’s role in the customer evaluation process

In more ‘traditional’ aspects of the financial services industry, social media has already proven to be an early success story. In terms of the pre-sales process, consumers have long held word of mouth dear, and there has simply never been a more powerful word of mouth tool than the social media platform. With opinions, customer reviews and ratings being shareable instantly online, potential customers can now find the information that they demand – that is, the shared experiences of existing financial customers – at the click of a mouse or swipe of a touchscreen.

Social media’s post-sales power

Social media platforms are already being put to good use by the financial services industry as a means of engaging with customers post-sale, increasing customer loyalty through this engagement, and in turn harnessing the sales power that is inherent in existing customers themselves – as online advocates for the financial brand, service or product in question. A good post-sales service is always good for business, and social media platforms have only helped to strengthen the potential rewards in this area, as well as speeding up the delivery of these rewards.

Trading via social media

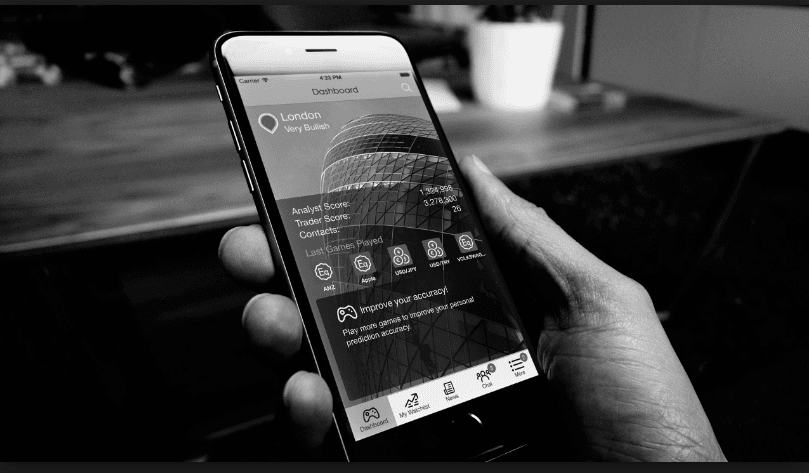

Social media offers brokers the opportunity to offer new ways for independent traders and investors to leverage the wisdom of crowds and the expertise of successful traders. Platforms such as eToro’s OpenBook and Alpari’s TraderConnect take the social paradigms of sites like Twitter and Facebook and apply them to online trading to create a whole new type of trading experience. As well as giving investors a chance to observe or copy the trades of others, it can also provide an additional revenue for successful traders by charging people for the privilege of following their trades.

The Challenges

Striking the Right Balance

Social media undoubtedly creates a new frontier for the financial services market – put simply, these are uncharted waters. There is a need, and a willingness now, to create and strengthen customer dialogue via social media, with new levels of transparency being an essential part of the process, while still adhering to strict regulatory practices and honouring customer privacy – a balance that has left many financial companies overly cautious and fearful of the new medium.

The new transparency

Transparency itself is something that the industry is making strides to come to terms with – and it’s essential that it does so. On an unprecedented scale, consumers now have the power to control a brand’s image through their shared experiences, reviews and opinions on sites like Twitter, Facebook and more. As a result, the emphasis on customer service is now key, especially now that the power of word of mouth has been taken to the extreme. You can see more info related to twitter growth hacks at Twesocial.com

Adapting to new consumer power

Creating a positive brand image, both pre and post-sale, is not only made more essential by the rise of social media, it is ironically also made all the more easy to achieve via social media by those that are willing to grasp these new platforms fully.

Plotting a solid course forward

While there’s no question that this new terrain may prove difficult, and that social media may be a new phenomenon, enough water had passed under the bridge now for us to have a tighter grasp of the trends that lay ahead, and to set out solid, workable, and successful plans for the future of social media management.

Tradersdna is a leading digital and social media platform for traders and investors. Tradersdna offers premiere resources for trading and investing education, digital resources for personal finance, market analysis and free trading guides. More about TradersDNA Features: What Does It Take to Become an Aggressive Trader? | Everything You Need to Know About White Label Trading Software | Advantages of Automated Forex Trading