Is the Innovative Forex Trading Industry the vanguard of the Finance and Tech ongoing Revolution?

Perhaps a textbook case of innovation, has been the dramatic growth and popularity of foreign currency trading in the past decade. Certainly in the last four years when according to FXIC Conference hosted in March 2013 in NY, US, more companies have entered the FX space in the last 12 months than at any time in history.

After a 2012 year which many in the retail FX sector players would like to forget 2013 seem to get record trading volumes. The industry independent research and advisory firm, covering the world of online Forex and CFD trading LeapRate’s sponsored by Leverate, moved up another 2% in February following an rise 18% in January, to $206 billion per day according to its Retail FX Volume Index. February’s 2013 index figure was the highest ever, setting an all-time record for retail forex trading. FX trading volumes seems to continue to surge in 2013, led by Japan, as a global “risk-on” trade environment continues.

2013 seem to be a new shift year for the Forex trading as a whole. Traditionally this industry has been one of the most fast forward in the financial sector and although recently has been disrupted new opportunities seem to be around the corner for the brokers and players offering new technology solutions and innovative value creation to traders. New opportunities are appearing in latency, algorithm trading and also in Mobile trading usage that keeps rising and the percentage of mobile trading volume increasing.

Companies such as FXCM, OANDA, Saxo Bank, GFT Markets, Forex.com, IG Markets, FXDD, eToro, FxPros, MahiFX, CitiFX, VantageFX and others have been innovating on the retail trading digital arena, somehow opening new ways for the finance industry and increasing the potential for self directed investors and traders to find new ways to leverage their money, investments and portfolios in a democratised way never seen before.

The fast evolving ecosystem of the Web, mobile, trading algoritms and platform has been the greatest accelerator, transforming the way traders and investors conduct their portfolios.

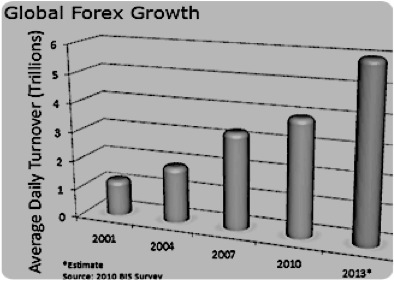

The size of the average daily forex turnover has been exploding. If in early 2005, CLS settled sides worth around $2 trillion Forex turnover on average per day, settlements averaged more than $4.5 trillion a day in 2011, according to the BIS Quarterly Review, March 2012. The trend will grow in the next years.

There are many factors affecting the fast growing size of forex trading and its related industry. As the size of the online Forex market increases new challenges come with it. Technology subjects such as Datacenters, Connectivity, Latency and Ecosystems are criticial in the FX tech innovative industry. On the other hand regulations threaten to affect major markets eg. US, Japan, China ect. Moreover the impact of algorithm trading, social networking shape also the landscape and industry course on the Forex sector. To add this new Valuations and publicly-traded multiples vs. M&A multiples, to name a few will open new opportunities and challenges.

And if more FX companies have entered the space in the last 12 months than at any time in history a lot of forex players will probably disappear with all the challenges going on and increasing needs to comply with FSA regulation and many other regulatory and volatility factors. So it is inevitable that rethinking the forex trading industry is now critical.

FXIC – Forex Industry Conference

Online trading offerings are becoming more social and innovation is at its fastest pace ever as companies seek to gain market share. It is perhaps fitting that Shift Forex hosted its inaugural global FX industry event in New York City.

FXIC – Forex Industry Conference is an event that brings together traditional and FX buy-side funds, retail and institutional FX brokerages, banks and non-bank liquidity providers, regulators and industry associations, marketing and technology providers, and non-FX brokerage firms exploring or growing an FX offering. The event is a place to find natural synergies through one-off conversations at the event, a place to organizing focused meetings between sponsors and attendees where natural partnership or idea exchange exists.

The Forex Industry Conference organised by Shift Forex a boutique consultancy with expertise across technology, liquidity, risk management, compliance, sales, and marketing is a special location for discussing the present trends in the Forex fast growing, innovative and changing industry in a time when finance and tech walk hands in hands and capital markets are more volatile than ever and propense for high volatility.

The conference featuring five panels covering areas impacting the industry is one of the top events in paralel with Forex Magnates conference and FxWeek other related initiatives. The FXIC event taped into the heart of the FX community, assembling buy- and sell-side participants, brokers and technology providers, media and compliance for two days of networking and thought exchange.

Highlights from the event:

“The Euro looks untenable – Jim Trott, former Chief Dealer at Bank of England. Possibly an exit from the Euro will take place – inevitable. First to go will be closely watched by others. Disruption in the markets to follow.

We are going to see an acceleration in more liquid CFDs like oil. Interesting discussion on binary options. Binary/FX audiences are dissimilar, more of a gambling mentality for the former.”

Notable attendees include K Duker – Chief Executive Officer of OANDA, Drew Niv, Chief Executive Officer of FXCM, Kurt vom Scheidt, Saxo Bank COO, Bob Savage – FX Concepts, Chief Strategist, Track.com, CEO, Salomon Sredni, Chief Executive Officer of TradeStation Group, Sanjay Madgavkar, Global Head-FX Prime Brokerage for Citi, William Goodbody, Knight Capital, Managing Director and many other Forex industry personalities.

The event brought together traditional and FX buy-side funds, retail and institutional FX brokerages, banks and non-bank liquidity providers, regulators and industry associations, marketing and technology providers, and non-FX brokerage firms exploring or growing an FX offering.

Key Topics for the conference Included:

- Following the Money: Global Industry Growth Trends

- A Growing, Shrinking Pie: Industry Consolidation and M&A

- Re-Centralising FX: Datacenters, Connectivity, Latency and Ecosystems

- Taming the Wild West: The Impact of Global Regulation

- Blurring the Lines: The Intersection of Margin and Credit

Hayden Richards is the Associate Publisher, Chief Operations Officer and Co-founder of IntelligentHQ. He specialises in finance, trading, investment, and technology, with expertise in both buy-side, sell-side. Contributing and advising various global corporations, Hayden is a thought leader, researching on global regulatory subjects, digital, social media strategies and new trends for Businesses, Capital Markets and Financial Services.