While it’s important to have a good trading strategy in place, there is one important variable in any strategy that is often ignored by traders – themselves. Even the best trading strategy in the world will fail if the person executing it doesn’t stick to it, or spend time evaluating their trades retrospectively.

That’s why it’s essential to keep a trading journal, a comprehensive record of all your trades and the results of those trades. This enables you to measure the effectiveness of your strategy, and also evaluate just how closely you are actually sticking to it. A trading journal can show you exactly where you are going right – and more importantly, where you are going wrong. Having this in front of you can help to highlight aspects of your trading that might require some improvement.

That’s why it’s essential to keep a trading journal, a comprehensive record of all your trades and the results of those trades. This enables you to measure the effectiveness of your strategy, and also evaluate just how closely you are actually sticking to it. A trading journal can show you exactly where you are going right – and more importantly, where you are going wrong. Having this in front of you can help to highlight aspects of your trading that might require some improvement.

So why isn’t everyone doing it? Well, the reason for this is that keeping a journal isn’t as easy as you might like. It requires quite a high level of discipline, and not every trader – particularly non-professionals – has the necessary diligence to note down all the necessary details for each and every trade. And unless you get the complete picture, it’s not really worth doing, as you won’t be able to draw many useful conclusions from an assortment of incomplete data.

Because traders are often so focused on their trading activities, they often put off the task of noting down their trades until after the trading session, assuming that they will be able to remember them. The problem with this is that the brain is quite good at remembering the first and last events in any sequence, but not so good at the ones in between.

For example, everyone can remember their first and last days at school, but can you remember your fifth day at school, or the fourth last? Unless something very momentous happened on those dates, the chances are that you won’t be able to provide any specific information about them.

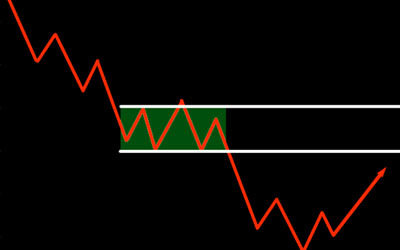

In the context of trading a trading journal that is maintained after the fact, it usually means that the entry and exit point of the trade are accurately recorded, but the thought process as the trade is in progress is largely forgotten. This means that the journal is missing crucial details such as the thoughts, emotions, and analysis of the trader, meaning that mistakes are overlooked and the progress of the trader is stunted.

There is, however, one way in which you can achieve these aims without necessarily making much extra work for yourself – making a video recording of yourself while you are trading. This is something that professional traders have been doing for years, using a camcorder trained on their trading screen and hitting ‘record’ just before they opened each trade.

Thankfully, it’s much easier to do this now, and you don’t need to buy and set up any bulky equipment. All you have to do is download some software (such as Ezvid or Rylstim) to record video footage of your computer screen, and have it switched on while you trade.

This allows you to review your trading, as well as how the market moved, after the fact. While you might not be able to remember everything that occured during the session, a video recording has no such problems. It allows you to have a more detailed assessment of your trading decisions, and the thought process behind them to evaluate your performance with. It can reveal flaws in your approach that you might not ordinarily notice. For example, there might have been signals that you missed, your analysis might have been wrong, or it may just have been that there was a problem with the way you executed the trades.

Another benefit of recording yourself is that it will make you more focused and alert while you are trading, conscious that you are being recorded and that you will be scrutinizing your performance at a later date.

As with any type of trading journal, you need to be pretty disciplined in order to make this work. For starters, you need to take the time to review the tapes on a regular basis in addition to the time that you set aside for trading. The only way to do it is to establish it as part of your routine, setting aside an hour or two after each and every trading session to evaluate your performance. Of course, it adds considerably to your time commitment, but if you aren’t willing to put in the hours, you probably shouldn’t be risking your money on the financial markets in the first place!

Tradersdna is a leading digital and social media platform for traders and investors. Tradersdna offers premiere resources for trading and investing education, digital resources for personal finance, market analysis and free trading guides. More about TradersDNA Features: What Does It Take to Become an Aggressive Trader? | Everything You Need to Know About White Label Trading Software | Advantages of Automated Forex Trading