Investors would love to see if their hard-earned money reap their well-earned rewards after a hard day’s work. That’s a given. Also, it is a given that investors want to place these hard-earned money to institutions that are highly respectable, that are trustworthy, and the most important of all, those that would give these investors the highest possible yields of return in the shortest amount of time possible; if there is a magic box that would exponentially multiply an X amount of money overnight, that box would be wanted by every person on this planet.

But that is not the case here, let’s be honest. In our world, we try to maximize our earning potential by placing our money to the best possible caretakers out there – but this is not always the case. Sometimes, the institutions that offer the concerned services are deemed to be not the best, due to external and internal factors, such as bad track record, unfavorable external conditions, unsound policies, etc. When these situations happen, it is our nature to avoid institutions in general that cannot handle the heat, so to say. And we get the information we need from the news, analysts, ratings agencies, market observers and the market itself. Yes, the market tells the investor whether it is the good time go dive in or not. Whatever market it is, be it a stock market, bond market, commodities market, options market, they all have a common denominator – market performance indicates attractiveness to invest, IN REAL TIME. But let me emphasize one market, the foreign exchange market, since I believe it reflects not only the market attractiveness to invest.

The foreign exchange market is considerably one, if not the most, of the liquid markets out there. Trading happens round the clock, except for predetermined breaks. Everybody can trade on it, since it is traded over-the-counter. Because of this, a person can just search for an economic, finance, political, or policy journal and there is a good chance that such person will find an article regarding the foreign exchange market. The large curiosity of today’s people in the foreign exchange market can be drawn from experience. We have seen the currency pairing EURUSD tumble when something goes wrong, or a particular policy move has not been anticipated by one party. Let me take the current situation of EURUSD.

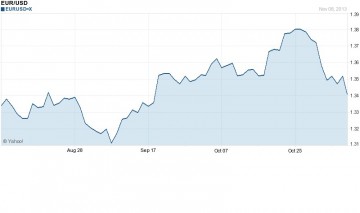

Source: Yahoo! Finance

As can be clearly seen, it has been a roller-coaster for the EURUSD. Why? Because the American government and the European policymakers seem can’t make up their minds on how their respective economies will move forward. We had the US government shutdown a few weeks back (which was “resolved” by kicking the can till next year), the ECB slashing their interest rates to maintain attractiveness to investors, the internal lingering problems in the Eurozone just to name some. But that is not all what is affecting the levels of EURUSD. The prevailing impulse and feeling in the market has to be taken into consideration – how do investors view the bigwigs of these two currencies. Prices are also influenced on the mentality of the trading public – do they want higher risk or not.

You might say that other markets are also influenced by policymakers and other sudden shaking in the market. But what makes the foreign exchange market special is the fact that it is not regulated meaning the raw market sentiment is seen, with minimum intervention from the central banks. Plus, it is traded almost 24/7 so a sudden change of policy of a particular country will be instantaneously reflected on the market prices.

Tradersdna is a leading digital and social media platform for traders and investors. Tradersdna offers premiere resources for trading and investing education, digital resources for personal finance, market analysis and free trading guides. More about TradersDNA Features: What Does It Take to Become an Aggressive Trader? | Everything You Need to Know About White Label Trading Software | Advantages of Automated Forex Trading