Strategy is definitely one of the key to succeed in the trading business…..

It doesn’t matter if you use fundamental analysis or technical analysis. Every active investor needs a strategy….

Regardless of the fact that you can make correct stock predictions, catch the right momentum trading moves and use all the stock market indicators correctly… you will end up giving back your profits without an effective strategy.

There is no strong and quick rule of what technique you ought to utilize. It’s really an individual decision relying upon your trading strategy, objectives and abilities.

Remember… you need to have a technique and your technique must fit you. The first and most critical step in constructing a stock trading strategy is to know yourself.

Some questions that will help you get on track in understanding your trading personality are.

Do you like the action of trading?

Are you a risk taker or do you like to stay away from risks?

Can you tolerate large drawdowns?

Are you analytical?

Do you make fast decisions?

Are you really serious about using the Stock Trading Business to create a Living?

If you want to delve deeper into your trading personality, I strongly suggest two excellent books.

Brett Steenbarger “The Psychology of Trading” and “Trade Your Way to Financial Freedom” by Van Tharps. These will reach deeper into the mind of traders and they’ll help create the best system for you.

Some of the newbie traders thought that there is a unique strategy or technique that holds the key to success. They think that Wall Street experts hold some sort of special tactic that will never be imparted to them.

As far as every successful trader is concern this is not basically true. The key to successful trading lies within you! Indeed whatever profitable trading tactic that you use without the best possible outlook you will still lose in the stock market game

That’s right! It is a game. It needs incredible mind control to be an effective technical trader similar with chess or considerably poker.

The primary key for overall success in stock market game is to learn how to properly handle the two mind-boggling strengths of fear and greed.

Let’s begin with greed

According to Personality & Spirituality, greed is the tendency to selfish craving, grasping and hoarding. We all have the potential for greedy tendencies, but in people with a strong fear of lack or deprivation, Greed can become a dominant pattern. One good example that relates to technical trading is the point at which you are in a winning position and want to keep it for extra benefits.

Needing simply somewhat more even after your target price is hit still a certain way to inevitable loss of trades. Also, eagerness becomes an integral factor when you break your eagerness becomes an integral factor when you break by trading excessively extensive size. Generally, what brings about losing trades is due to trading excessively large size basically wanting the enormous score.

In some case, to be an effective trader you also need to have the desire fuelled by greed in order to succeed however this greed should be controlled.

And that brings us to fear

The fear of losing trades is a strong motivator. This is something that keeps you from taking a trade. The fear of losing trades is a strong motivator. To be successful in trading business, one must understand that misfortunes are merely piece of the diversion. You can never win in the event that you don’t play.

Also, you as a trader must learn to be neutral at all time. Try not to get upset when you have a loss, try not to get too happy when you win on a trade. Just remain neutral. It is extremely easy for fear to kick in, this happens to all us, this is why it is crucial that you stick to your plan.

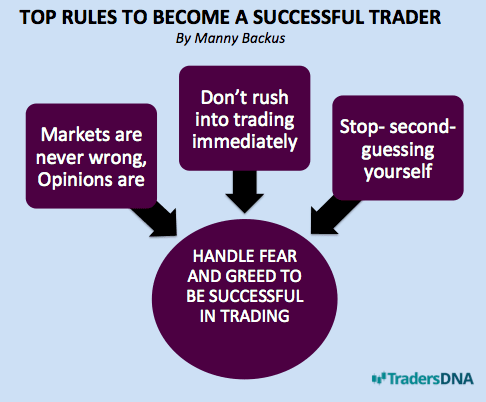

Furthermore, I have listed 3 guidelines below on how to handle fear and greed to be a successful trader.

• Markets are never wrong, opinions are

Listen to the opinions of brokers, if you wish, but don’t ignore what the market’s price is telling you! says Jesse Livermore, aka the Great Bear of Wall Street. This is the thing that keeps you in the game even when it goes against you. Understanding this helps control carelessness which can be a result of greed. Conceding that the market is constantly right and you truly don’t comprehend what will happen next is troublesome. If you believe that you are right with the trade so just hold on even if the price is going against you.

• Don’t rush into trading immediately

This helps control eagerness and fear by constraining you to see there is no hurry. On the off chance that you miss a trade or even a few consecutively, there will be extra open doors. There is no compelling reason to get stressed or feel rush about any trade. Also, trading is a procedure where multiple trades produce results. There is no reason to bet in everything by letting voracity take control.

• Stop second-guessing yourself

Remind yourself that you thoroughly thought things through and have made the best decision. Technical traders are well known for second guessing in every trade. The nature of price charts makes this flaw very easy to fall into. So better accept what the market provides for you on an everyday premise. Don’t attempt to constrain more out of the market than what it gives you.

Many strategies can make money, BUT, because of your own psychology, beliefs and preferences many of these may not work for you. Whether you are interested in forex trading, stock trading or options trading, you must have a valid trading strategy that suits your personality to help guide your decisions.

Tradersdna is a leading digital and social media platform for traders and investors. Tradersdna offers premiere resources for trading and investing education, digital resources for personal finance, market analysis and free trading guides. More about TradersDNA Features: What Does It Take to Become an Aggressive Trader? | Everything You Need to Know About White Label Trading Software | Advantages of Automated Forex Trading