The US dollar was little changed on Thursday despite upbeat economic data, as negotiations between Greece and its Eurozone partners stalled just five days before a critical payment deadline to the International Monetary Fund.

The dollar index, a trade-weighted average of the greenback against a basket of six world currencies, moved within a narrow range of 95.09-95.51. The dollar index would subsequently settle at 95.16, declining 0.1%.

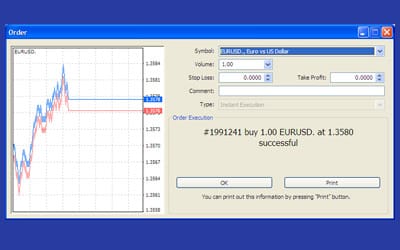

The dollar strengthened somewhat against the euro, with the EUR/USD exchange rate falling to a daily low of 1.1153. The pair would later consolidate at 1.1186, declining 0.2%. The EUR/USD is likely to test the 1.1154 support, which is also the low from June 24. A break below that level would lead to 1.1135, the low from June 23. On the upside, resistance is likely to be found at 1.1229 and 1.1292.

The USD/JPY lost ground on Thursday, but remained close to the 124.00 handle. The pair slipped 0.2% to 123.63. The USD/JPY faces immediate support at 123.30, the low from June 25, followed by the psychological 123.00 level. On the upside, resistance is likely to be found at 123.95, followed by 124.36.

The dollar lost ground to the British pound, as the GBP/USD rose 0.3% to 1.5751. The pair faces support at 1.5637 and resistance at 1.5795.

Greek headlines continued to roil the financial markets on Thursday, as the prospects of a new bailout agreement continued to fade after a promising start to the week. Greece’s troika of creditors – the IMF, European Union and European Central Bank – rejected Athens’ proposal on Wednesday. Greek Prime Minister Alexis Tsipras held overnight negotiations with Eurozone counterparts in a desperate bid to break the deadlock. According to analysts, Greece’s tax system and pension structure continue to be major sticking points for the troika.

The Greek bailout crisis overshadowed upbeat US data, which pointed to a broadening economic recovery.

Initial jobless claims rose slightly last week, reaching a seasonally adjusted 271,000, well below the key 300,000 threshold that is typically associated with a firming labour market. Jobless claims had fallen to 268,000 the prior week.

Meanwhile, US consumer spending soared in May, climbing at the fastest rate in nearly six years. Personal spending rose 0.9% from April, following a gain of just 0.1% the previous month, the Department of Commerce reported.

The uptick in consumer spending was associated with another solid increase in personal income. Personal income from all sources rose 0.5% in May following an identical increase in April. That was the strongest two-month increase since the first half of 2014.

Tradersdna is a leading digital and social media platform for traders and investors. Tradersdna offers premiere resources for trading and investing education, digital resources for personal finance, market analysis and free trading guides. More about TradersDNA Features: What Does It Take to Become an Aggressive Trader? | Everything You Need to Know About White Label Trading Software | Advantages of Automated Forex Trading