The hydrogen economy envisions a future energy infrastructure where low-carbon hydrogen is utilized to decarbonize critical industrial sectors and long-haul transportation while satisfying the increasing demand for low-carbon energy. This transformation will not happen rapidly, but there are significant opportunities in developing infrastructure across the whole hydrogen value chain.

By Chingis Idrissov, Technology Analyst at IDTechEx

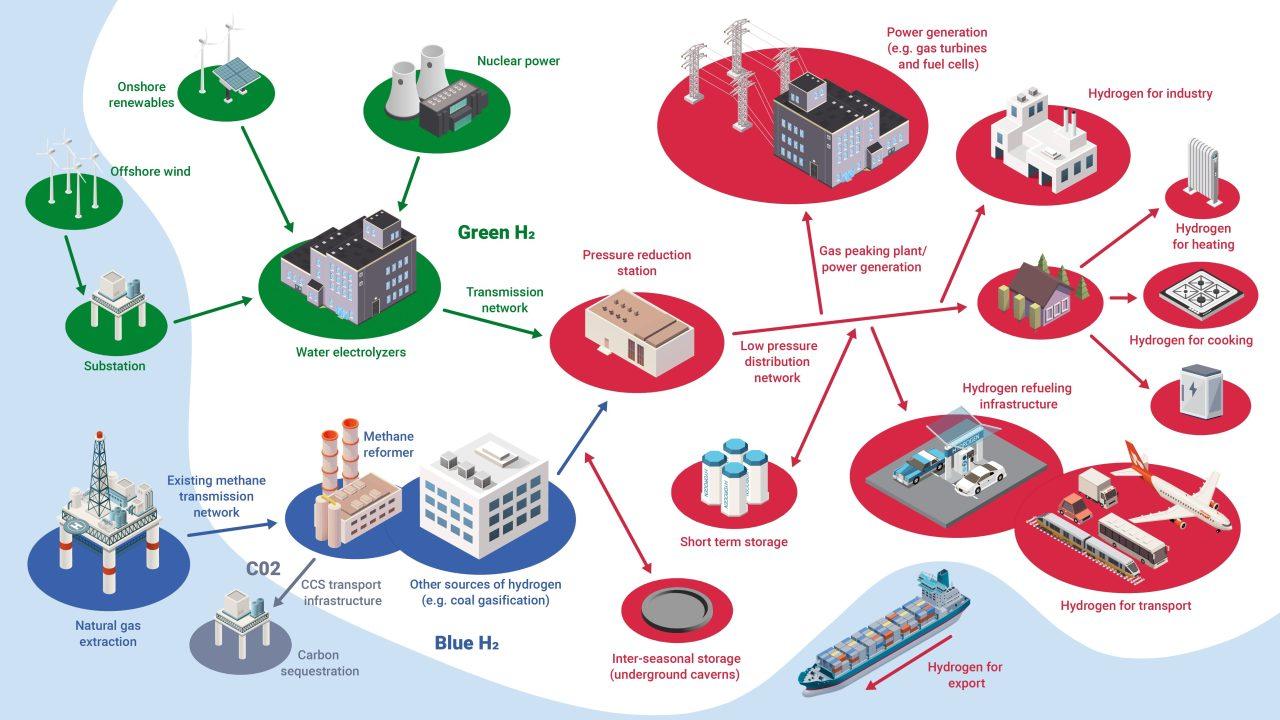

For this vision to materialize, various value chain components, including low-carbon hydrogen production, storage, and distribution infrastructure, must align with demand from hydrogen end-use sectors. Like the oil & gas industry, the hydrogen value chain is divided into upstream (production), midstream (storage & transport), and downstream (end-use sectors) elements. Each of these hydrogen value chain components brings its own technical and socio-economic challenges.

In their new “Hydrogen Economy 2023-2033: Production, Storage, Distribution & Applications” report, IDTechEx analyzes the technologies, techno-economics, key commercial activities (including projects, established and emerging companies), major innovations, and market trends across all value chain components.

Low-Carbon Hydrogen Production (Green & Blue H2)

At present, over 95% of the world’s hydrogen comes from fossil fuel-based grey and black hydrogen produced by steam methane reforming and coal gasification plants. These production assets emit large amounts of CO2. Hence, many companies worldwide are focused on developing new low-carbon hydrogen production assets, either blue (natural gas reforming with CO2 emissions captured and stored/utilized) or green (water electrolysis powered by renewable energy). These projects will be located near industrial users like refineries, often in industrial zones with many potential users. This allows for future expansion as these sectors begin to decarbonize and generate demand for low-carbon hydrogen.

IDTechEx projects that the low-carbon hydrogen market will grow substantially over the next decade, reaching US$130 billion by 2033 based on projected production capacities. Yet, the upstream is only one part of the value chain that needs to be developed. While most acknowledge the need for substantial production infrastructure, many underestimate the need for a vast midstream (storage & distribution) infrastructure to connect the upstream and downstream assets.

Hydrogen Storage & Distribution

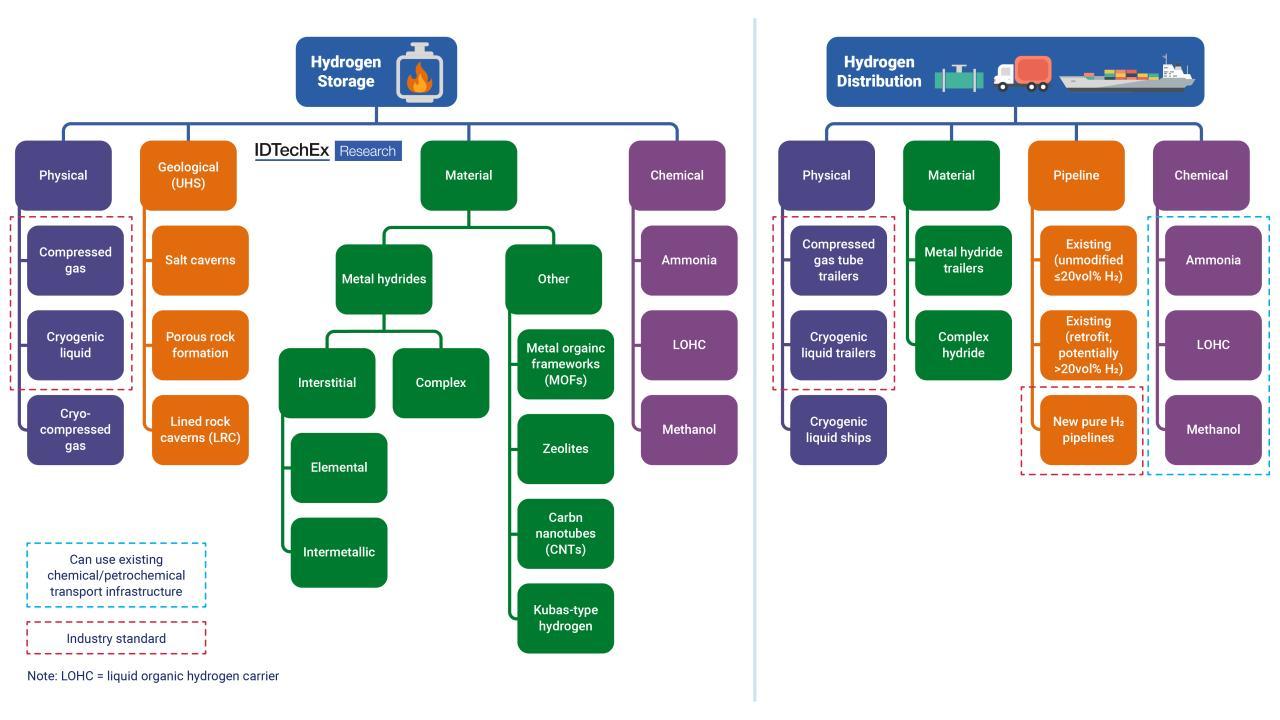

Despite its excellent energy characteristics (energy density of 120 MJ/kg), one of the primary challenges with hydrogen is its complicated storage and transportation due to its extremely low density (0.084 kg/m3) at ambient conditions. Hence, large volumes of hydrogen must be compressed to high pressures (100 to 700 bars) or liquefied at cryogenic temperatures (boiling point of -253°C) to store adequate amounts.

Although these methods are the most commercially and technologically mature, they have significant drawbacks. They consume considerable amounts of energy, thus reducing the effective energy content of the hydrogen. Depending on the pressure, compression uses around 10-30% of the hydrogen’s original energy content. Liquefaction is even more energy-intensive, consuming 30-40% of the hydrogen’s energy content. These factors considerably affect applications in mobility and energy storage by drastically reducing the round-trip energy efficiency. Furthermore, safety risks are associated with compressed gas storage, while liquid H2 storage is prone to boil-off, which causes some stored hydrogen to be wasted. These issues make transportation, especially internationally, expensive and inefficient.

Promising alternatives for stationary storage include metal hydride systems for small-scale stationary storage and underground storage facilities (like salt caverns) for large-scale diurnal or seasonal storage. For transportation, pipelines will play a significant role in connecting production to end-use. Several worldwide players are developing new pure H2 pipelines, with some looking to repurpose existing natural gas pipelines. Ammonia and liquid organic hydrogen carriers (LOHCs) are considered promising, especially for international transport, as they can leverage existing chemical and petrochemical transport infrastructure.

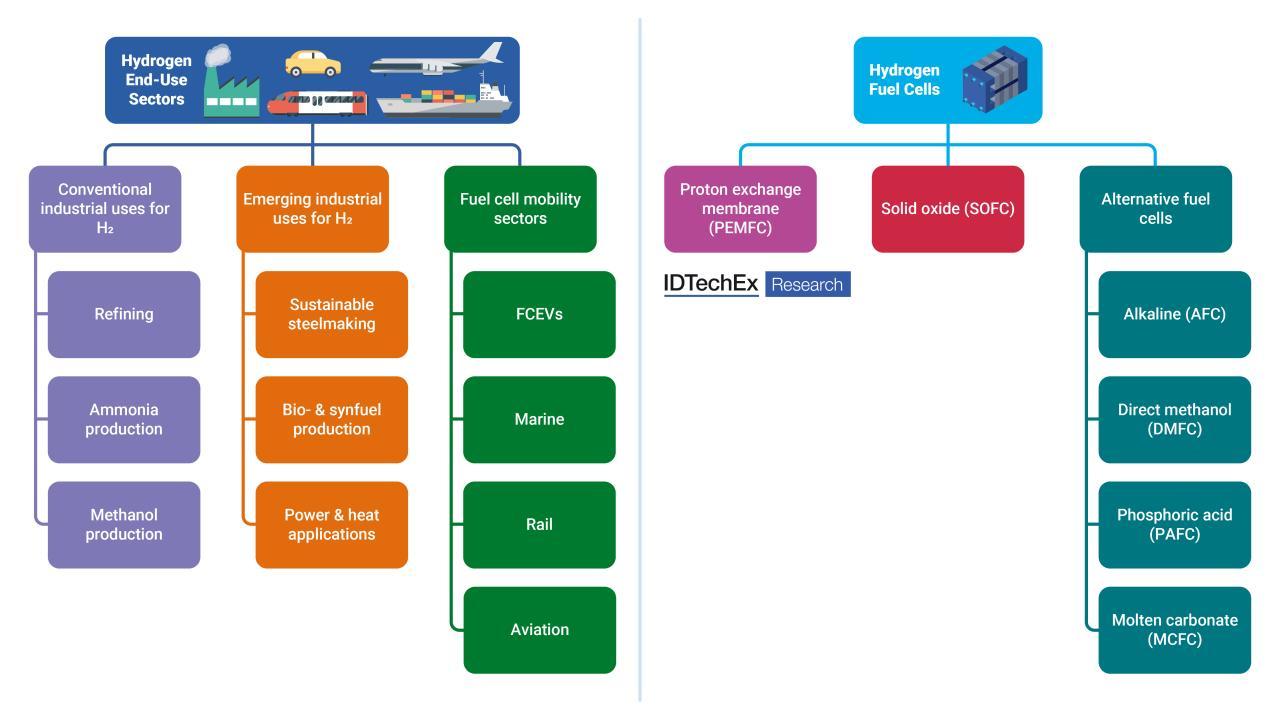

End-Use Sectors for Low-Carbon Hydrogen & Hydrogen Fuel Cells

Hydrogen will play a significant role in decarbonizing industries where it is conventionally used, including refining and the production of ammonia and methanol. These sectors will decarbonize primarily by replacing grey hydrogen with blue and green hydrogen. Another promising sector is steelmaking, where hydrogen can serve as a reducing gas to produce direct reduced iron (DRI). Many steelmakers consider this process the future of sustainable steel as it will eventually replace the carbon-intensive blast furnace process. Emerging industrial uses of hydrogen include bio- and synfuel production as well as power and heat applications (energy storage, combined heat, and power generation, heating for residential/commercial and industrial sectors).

Hydrogen also offers an alternative to electrification in fuel cell mobility sectors. Fuel cell electric vehicles (FCEVs) are gaining traction worldwide, particularly in Asia, with the increasing development of refueling infrastructure and new vehicle concepts for light-, medium- and heavy-duty vehicles. Long-haul transport sectors, including marine, rail, and aviation, also aim to use hydrogen fuel cell propulsion systems.

Fuel cells are a key technology that would be used to power these transportation sectors. These transportation sectors will require the efficient integration of fuel cell stacks with suitable hydrogen storage methods, heat exchangers and other balance of plant (BOP) components. Most attention is currently focused on the proton exchange membrane fuel cell (PEMFC), as they will power the FCEV segment. However, solid oxide fuel cells (SOFC) are also gaining traction, particularly in the maritime sector. Fuel cell technologies can also be applied in off-grid and backup power as well as combined heat and power (CHP) generation, which is another growing segment for the fuel cell market.

What to Expect From This Report?

IDTechEx projects that the low-carbon hydrogen market will grow substantially over the next decade, reaching US$130 billion by 2033 based on projected production capacities. Their new report, “Hydrogen Economy 2023-2033: Production, Storage, Distribution & Applications”, evaluates the necessary components to foster the growth of the hydrogen economy, offering a comprehensive review of the entire value chain. It includes technological analyses of all relevant technologies, techno-economic comparisons, detail on key commercial activities (including projects as well as established and emerging companies), major innovations, and market trends across all value chain components.

Key Takeaways From This Report

This report draws on IDTechEx’s extensive knowledge across many aspects of the sector. Covering hydrogen production, storage, distribution, fuel cells and end-use applications, the report provides:

– An introduction to the hydrogen economy, recent policy developments in hydrogen, and discussion of key trends in the industry.

– Analysis of underlying technologies across all value chain components, including hydrogen production (e.g., electrolyzers), storage (e.g., metal hydrides), distribution (e.g., pipelines), and end-use sectors (e.g., sustainable steelmaking).

– Techno-economic comparisons and benchmarking of hydrogen production, storage and distribution methods.

– Recent innovations and new technologies across all value chain components.

– Potential decarbonization pathways for hydrogen end-use sectors.

– Commercial activities, including key players and projects under development.

– SWOT analyses and key takeaways from various parts of the value chain.

– Assessments of technical and commercial readiness.

– Granular 10-year market forecasts for hydrogen demand by applications (7 sectors), hydrogen production by source

– 28 company profiles covering established and emerging players across various parts of the value chain.

To find out more about this IDTechEx report, including downloadable sample pages, please visit www.IDTechEx.com/HydrogenEconomy.

Upcoming Free-to-Attend Webinar

The Hydrogen Economy: A Vision for the Next Decade

Chingis Idrissov, Technology Analyst at IDTechEx and author of this article, will be presenting a webinar on the topic on Thursday 10 August 2023 – The Hydrogen Economy: A Vision for the Next Decade.

Key takeaways from this webinar include:

– Introduction to the hydrogen economy and hydrogen’s market drivers

– Overview of low-carbon hydrogen production

– Hydrogen storage & distribution pathways, players and applications

– Overview and comparison of hydrogen end-use sectors and fuel cells

– Outlook on the hydrogen economy

Click here to find out more and register your place on one of the three sessions available.

Tradersdna is a leading digital and social media platform for traders and investors. Tradersdna offers premiere resources for trading and investing education, digital resources for personal finance, market analysis and free trading guides. More about TradersDNA Features: What Does It Take to Become an Aggressive Trader? | Everything You Need to Know About White Label Trading Software | Advantages of Automated Forex Trading