So, 2024 has arrived and we hope everyone had a fantastic Christmas break. Last week saw the markets still in semi holiday mode with some reversals of previous trends with the USD and Yields moving higher.

The Dollar started 2024 on the front foot powering ahead against all the majors. The DXY closed up 11% following Friday strong payrolls number but eyes will be on the following weeks CPI print to see if this can be followed through on.

The Euro continues to remain under pressure. With the USD strong the Euro lost ground, but further weak German data added more pressure on the single currency. One positive is Eurozone inflation dropped below 3% and is heading towards the ECB target of 2%.

The GBP had a good week to start the year. It closed the week flat vs the strong dollar and rallied vs the single currency with EURGBP losing just shy of 1%.

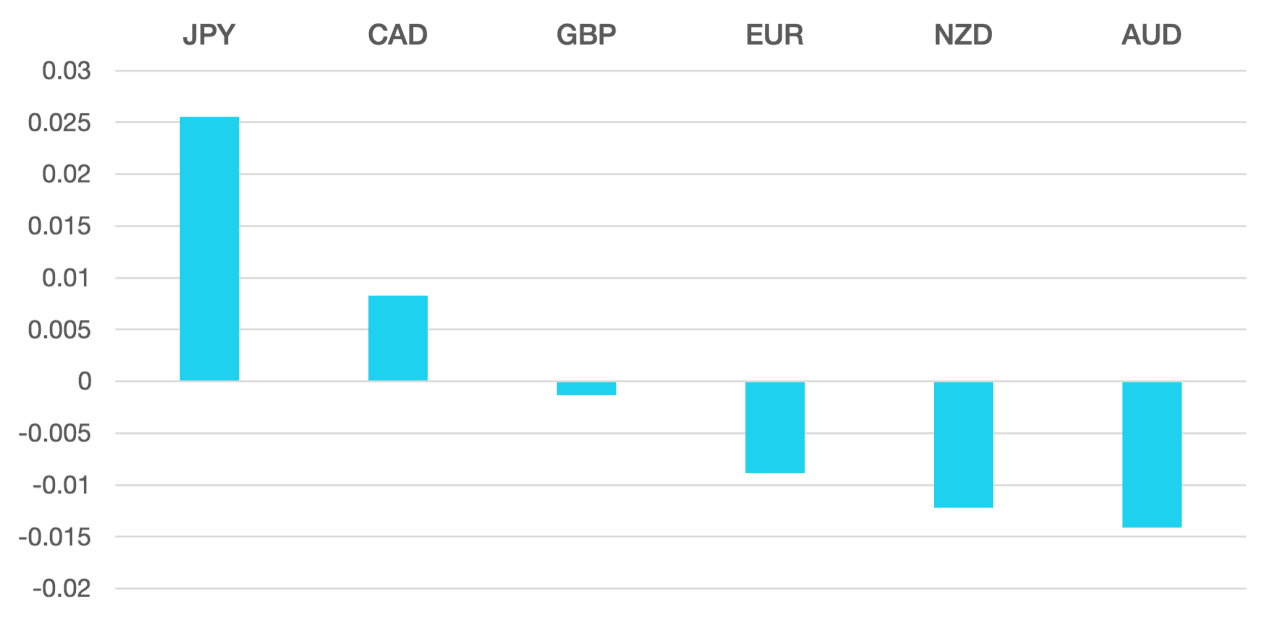

Commodity currencies had a difficult week as strong dollar and yields pushed risk currencies lower. AUD, NZD struggled all week ending the week over 1% lower respectively. Yen had the toughest time losing around 2.6% over the week as the safe haven USDJPY took centre stage.

Oil continues to fluctuate with ever increasing volatility. The continued attacks on shipping in the Red Sea pushed Oil higher ending the week 3.6% higher.

The week ahead is focused on the US CPI print as this will give the market an indication on how the Fed may react in the upcoming meeting. The Fed is forecasting the lowering trend in inflation and the markets are pricing in several rate cuts for 2024. Any surprise here could lead the market to revise the rate cuts.

Weekly Majors Market Performance

What is Cromwell FX?

Cromwell FX is a quantitative FX manager offering superior risk adjusted returns. The portfolio is the most liquid pairs . The strategy is fully automated and adhere to strict rick management procedures to control leverage and position limits.

The post Happy New Year first appeared on trademakers.

The post Happy New Year first appeared on JP Fund Services.

The post Happy New Year appeared first on JP Fund Services.