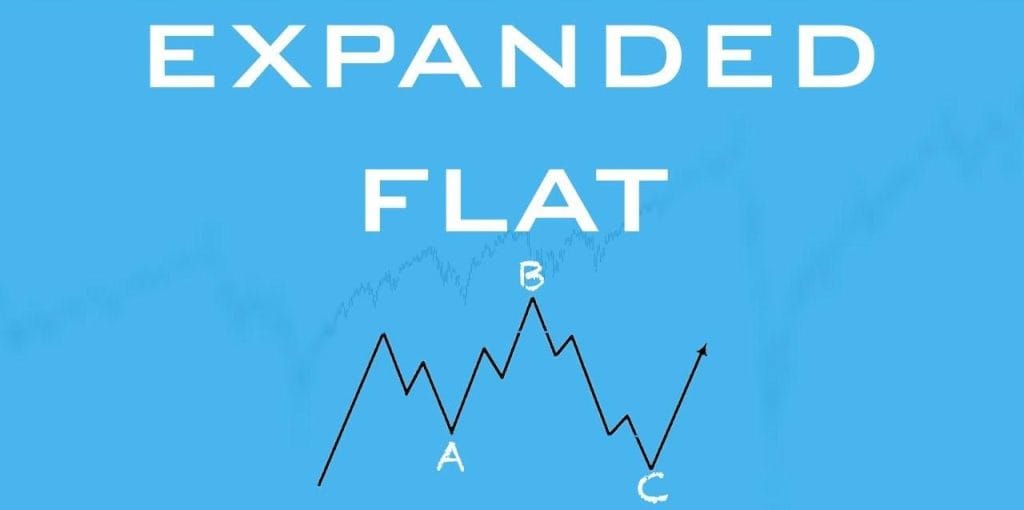

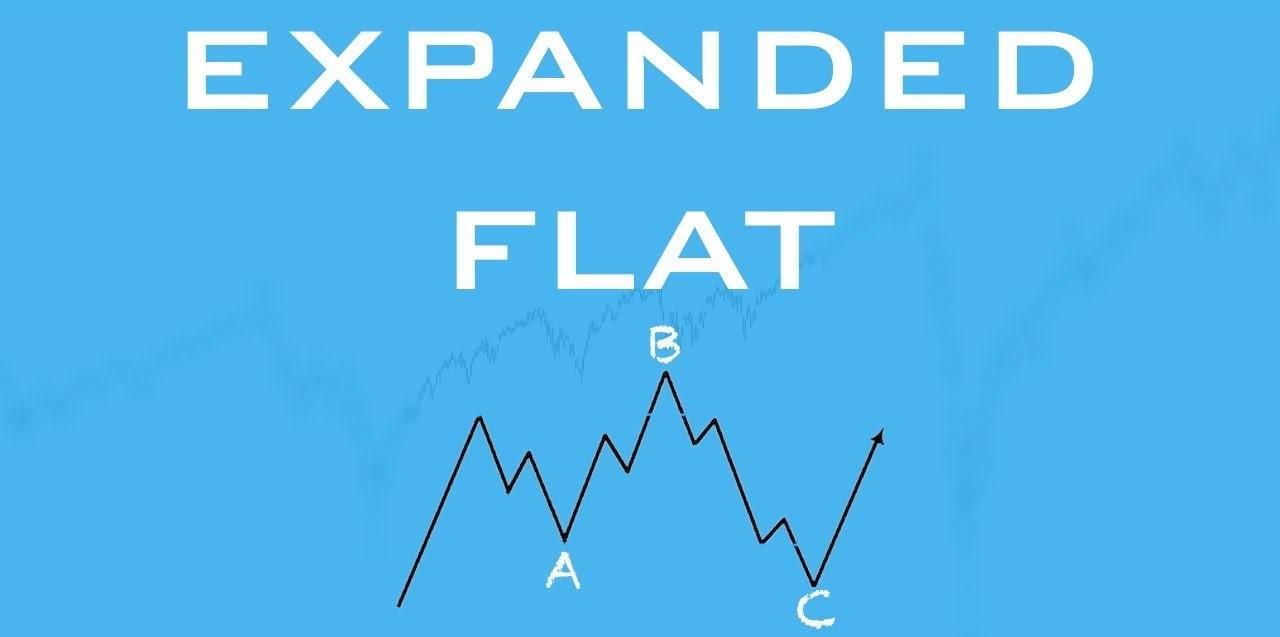

The expanded flat is a corrective pattern in Elliott Wave Theory, characterised by three waves—A, B, and C—where waves B and C extend beyond wave A. Could understanding the expanded flat be the key to unlocking better trading decisions?

In the technical analysis and Elliott Wave Theory, various corrective patterns help traders understand market behaviour and anticipate future price movements. One of these patterns, the “expanded flat pattern,” is a unique corrective structure that frequently appears in financial markets. It offers traders valuable insights into the psychology of price corrections, enabling them to gauge market sentiment and forecast potential trend continuations.

Corrective patterns like the expanded flat are particularly significant in volatile markets; recent data shows that around 30% of corrections in trending assets follow flat or expanded flat structures.

Understanding these patterns can improve traders’ accuracy in identifying turning points and managing risk. In cryptocurrency markets alone, expanded flat patterns have appeared in nearly 25% of major corrections, reflecting the pattern’s relevance across asset classes.

In this article, we will explore the expanded flat pattern in detail, covering its characteristics, how to identify it, and strategies to trade it effectively.

Understanding the expanded flat pattern

The expanded flat pattern is a corrective pattern that belongs to the flat family in the Elliott Wave Theory. Generally, flat patterns occur when the market is correcting a previous impulse wave, and the price moves sideways with little overall change in trend direction. An expanded flat is an evolved form of this basic flat structure, distinguished by specific price movements that make it appear “expanded.”

In simple terms, an expanded flat pattern features three main waves labelled A, B, and C. The B wave in an expanded flat is typically longer than the A wave and often exceeds the starting point of the A wave. The C wave then usually ends beyond the termination of the A wave, creating a broader range in price movement. This formation gives the expanded flat pattern its name, as the corrective structure appears “expanded” compared to standard flat patterns.

Types of expanded flat patterns

There are several variations within expanded flat patterns, based on the extent of the movement within waves B and C:

- Regular Expanded Flat: In this variation, wave B extends slightly beyond the start of wave A, while wave C drops slightly below the endpoint of wave A. The difference in extension is minor.

- Running Expanded Flat: This form appears when wave B extends significantly beyond the start of wave A, yet wave C fails to reach the endpoint of wave A. It often indicates a strong primary trend that may resume quickly after the correction.

- Overshooting Expanded Flat: Here, both wave B and wave C extend considerably. Wave B may shoot well beyond the start of wave A, while wave C drops substantially below the endpoint of wave A.

Characteristics of the expanded flat pattern

To correctly identify an expanded flat pattern, traders need to look for specific characteristics in each wave segment. Understanding these characteristics is essential for distinguishing the expanded flat from other similar corrective patterns.

These characteristics create a unique price structure that allows the expanded flat pattern to “expand” across a broader range than other flat corrections. The expanded flat is seen as an indication of market indecision or increased volatility, with prices moving beyond previous high and low levels before continuing in the overall trend direction.

Here’s a breakdown of each wave:

- Wave A: This wave represents the first leg of the correction and generally moves against the primary trend. Wave A can take various forms but is usually a three-wave structure, showing a corrective movement. In an expanded flat, this wave does not significantly disrupt the main trend, as the following waves continue within the general trend’s bounds.

- Wave B: Wave B is what makes the expanded flat pattern distinct. This wave tends to retrace beyond the starting point of wave A, often extending 105% to 138% of wave A. This means that wave B travels in the direction of the original trend and “expands” beyond the start of wave A. Traders should note that wave B in an expanded flat pattern usually forms a three-wave structure, but it may also be complex and challenging to interpret.

- Wave C: The final wave of the pattern, wave C, is typically a five-wave structure. It moves in the opposite direction to wave B and often extends beyond the end of wave A. In most cases, wave C extends between 100% and 165% of wave A, forming a symmetrical or slightly elongated shape relative to the rest of the pattern.

The psychology behind the expanded flat pattern

To better understand the expanded flat pattern, it helps to look at the psychology driving each wave:

- Wave A: This initial move against the main trend represents a temporary sentiment shift. Market participants are uncertain, leading to a correction.

- Wave B: Wave B reflects a bullish or bearish resurgence where the majority of market participants believe the primary trend will resume. This is why wave B often retraces beyond the starting point of wave A, as traders jump back into the trend with renewed enthusiasm.

- Wave C: The final leg of the pattern (wave C) indicates a final correction and a realisation among participants that the trend may require a stronger consolidation. This wave is often the most volatile, as it retraces in the opposite direction before the trend ultimately continues.

Identifying an expanded flat pattern

To effectively identify an expanded flat pattern, traders should employ a combination of price observation, Fibonacci retracement levels, and wave analysis techniques. Here are a few steps to assist in identifying this pattern accurately:

- Look for a Sideways Correction: The expanded flat is generally found within a sideways corrective pattern, so identifying the broader context of a correction is the first step.

- Analyse Wave B’s Extension: If Wave B retraces beyond the beginning of Wave A, it’s a strong indicator that the pattern may be an expanded flat. Fibonacci retracement levels can help here, as wave B typically retraces 105% to 138% of wave A.

- Observe Wave C’s Extension: Wave C should extend beyond the end of wave A. Traders can use Fibonacci extensions here, as wave C is often around 100% to 165% of wave A. If these extensions align, there’s a good chance of confirming the expanded flat pattern.

- Confirm Wave Structure: Each wave should follow the general guidelines of an expanded flat. Wave A and wave B are typically three-wave structures, while wave C is a five-wave structure. Recognising these wave counts can provide greater confidence in identifying the pattern.

Strategies for trading the expanded flat pattern

Trading an expanded flat pattern can be profitable for experienced traders who understand the intricacies of Elliott Wave Theory and corrective structures. Here are some strategies that can be useful when trading this pattern:

- Wait for the completion of Wave C

Since wave C marks the final corrective move, many traders wait for its completion before entering the market. Once wave C is complete, it signals a likely continuation of the main trend. Traders can enter a long (or short) position after wave C if it aligns with the primary trend direction.

Example: If an expanded flat pattern forms during an uptrend, wave C will likely move downwards before the uptrend resumes. A trader can wait for wave C to end and then take a long position to capitalise on the resumption of the uptrend.

- Set entry points with Fibonacci levels

Using Fibonacci retracement and extension levels can provide precise entry and exit points. Traders can measure the length of Wave A and set Fibonacci levels at likely retracement points for Wave B and Wave C. Wave C, for instance, may end around the 100% to 165% Fibonacci extension level, which can signal a potential entry point.

- Utilise stop-loss orders

Expanded flat patterns can exhibit significant volatility, so using stop-loss orders is essential to limit potential losses. Traders can place a stop-loss slightly below the low of wave C in a bullish trend or above the high of wave C in a bearish trend to manage risk.

- Combine with other indicators

To improve the accuracy of entries and exits, traders can combine expanded flat patterns with other technical indicators such as moving averages, Relative Strength Index (RSI), or MACD. These indicators can confirm trend strength and provide additional context on whether the correction is ending and the primary trend is resuming.

Common mistakes and pitfalls in trading expanded flat patterns

Trading expanded flat patterns can be challenging due to the complexity of wave structures. Here are some common mistakes and how to avoid them:

- Misidentifying waves: It’s easy to confuse an expanded flat with other patterns, such as a regular flat or a triangle. To avoid this, traders should verify that Wave B extends beyond the start of Wave A and that Wave C exceeds Wave A’s endpoint.

- Entering before wave C completes: Many traders make the mistake of entering the trade too early, thinking the pattern is complete when wave C still has room to develop. Waiting for confirmation of wave C’s completion reduces the risk of premature entries.

- Ignoring market context: It’s essential to consider the overall trend and market conditions. An expanded flat pattern is typically a corrective structure, so traders should assess the primary trend’s strength to avoid trading against it.

Final thoughts

The expanded flat pattern is a powerful corrective structure within Elliott Wave Theory, often providing critical insights into market psychology and helping traders anticipate trend continuations. While identifying and trading this pattern requires practice and a thorough understanding of wave analysis, mastering the expanded flat can significantly enhance one’s trading strategy.

By carefully analysing each wave, using Fibonacci retracements, and combining technical indicators, traders can confidently recognise and trade expanded flat patterns, contributing to a well-rounded trading approach in volatile markets.

Key takeaways

- The expanded flat is a corrective pattern in Elliott Wave Theory, characterised by three waves—A, B, and C—where waves B and C extend beyond wave A.

- Expanded flats can vary, with types including regular, running, and overshooting, each defined by the range and position of waves B and C.

- In an expanded flat, wave B typically retraces 105% to 138% of wave A, while wave C extends between 100% to 165% of wave A, forming a distinctive price pattern.

- Many traders wait for wave C to complete before entering a position, often using Fibonacci levels and stop-loss orders to manage risk.

- Key identification factors include wave B extending beyond wave A’s start and wave C exceeding the endpoint of wave A, alongside wave structure analysis.

- Avoid premature entries by waiting for wave C completion, confirming the overall market context, and correctly distinguishing the pattern from similar corrections.

Read More:

Himani Verma is a seasoned content writer and SEO expert, with experience in digital media. She has held various senior writing positions at enterprises like CloudTDMS (Synthetic Data Factory), Barrownz Group, and ATZA. Himani has also been Editorial Writer at Hindustan Time, a leading Indian English language news platform. She excels in content creation, proofreading, and editing, ensuring that every piece is polished and impactful. Her expertise in crafting SEO-friendly content for multiple verticals of businesses, including technology, healthcare, finance, sports, innovation, and more.