After a couple of weeks break over the festive period welcome back and Happy New Year.

The last couple of weeks have seen a continuation of the theme as the US Dollar continues to strengthen vs other economies poor data releases. The dominant US theme is of course the incoming US administration and what impact the talked about tariffs may have.

Last week we had US Payrolls which came in a lot stronger than expected giving way to the markets expectation that rate cuts into 2025 will be less likely. US Yields moved higher as this change of focus moved.

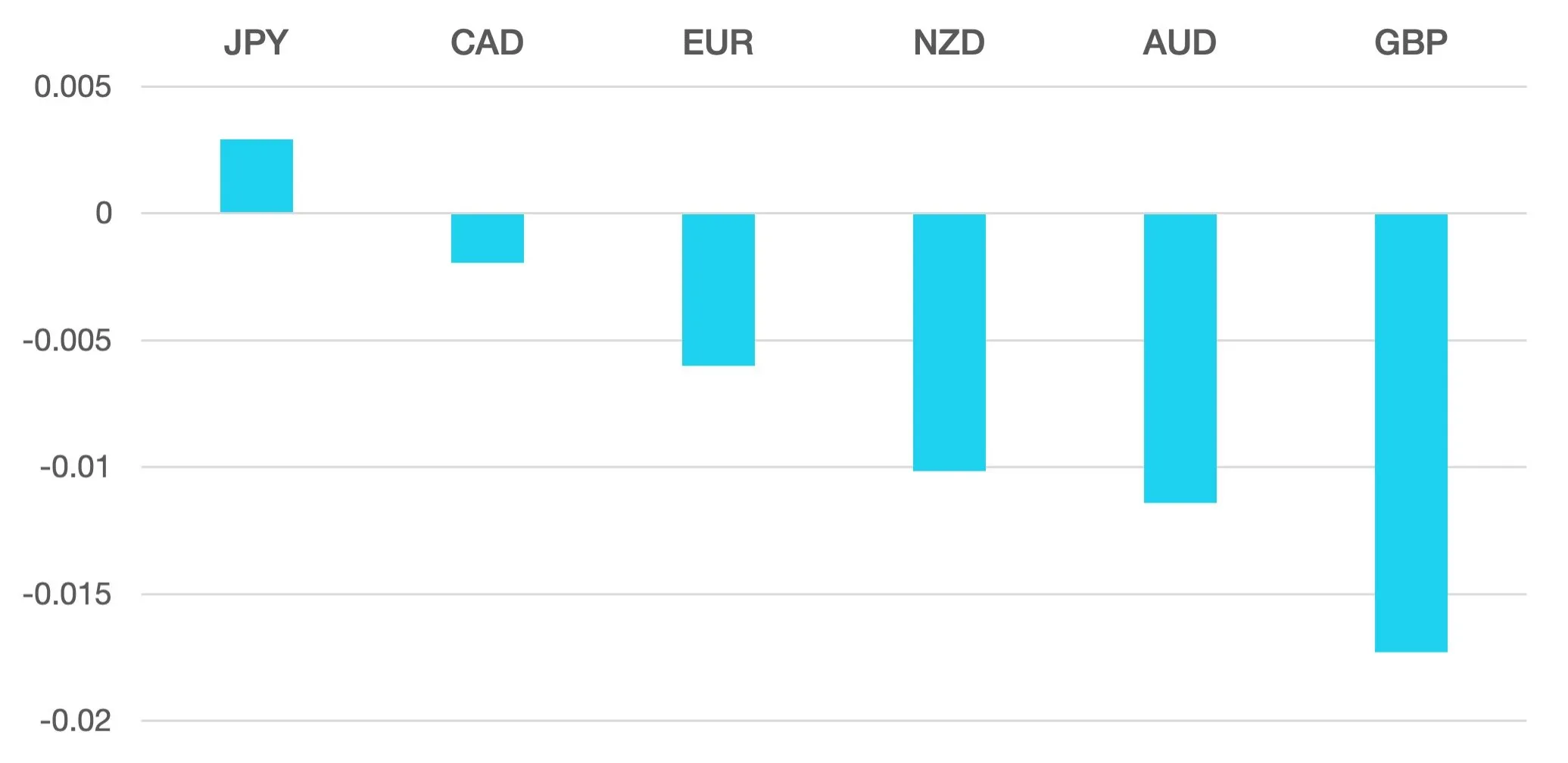

GBP was the worst performer over the break with GBP under relentless pressure. Rising UK Gilts and deepening concerns over the fiscal budget has sent GBP down from 1.25 to 1.22.

Oil bounced back over the period and seems to be once again pushing higher within the long-term trend channel. WTI closed 3% higher around $76.50.

The week ahead we see Yields as still firmly front and center. GBP pressure we think will remain for the week and we should see USD strength be maintained.

In terms of data, we have CPI readings from US, EU and UK which could lead to further volatility.

Weekly Majors’ Market Performance

What is Cromwell FX?

Cromwell FX is a quantitative FX manager offering superior risk adjusted returns. The portfolio is the most liquid pairs. The strategy is fully automated and adhere to strict rick management procedures to control leverage and position limits.

The post Happy New Year and Welcome to 2025 first appeared on trademakers.

The post Happy New Year and Welcome to 2025 first appeared on JP Fund Services.

The post Happy New Year and Welcome to 2025 appeared first on JP Fund Services.