How many times have you heard on the news that the financial markets are on a downward spiral? How many of your friends or family members constantly complain about how little they’ve made from their investments over the past 12 months, while some may even have lost money?

With all this pessimism in mind, it’s essential to sit down and look at some ways to make money, even in challenging economic conditions. One place where there is always growth potential is in the complex world of CFDs.

What is CFD trading in Australia?

Currency futures, or CFDs, are short term derivative instruments that have been around for many years. In fact, they may have been the first form of financial derivatives. Compared with more modern-day products, their relatively simple nature has also resulted in their being a vital part of any trader’s arsenal.

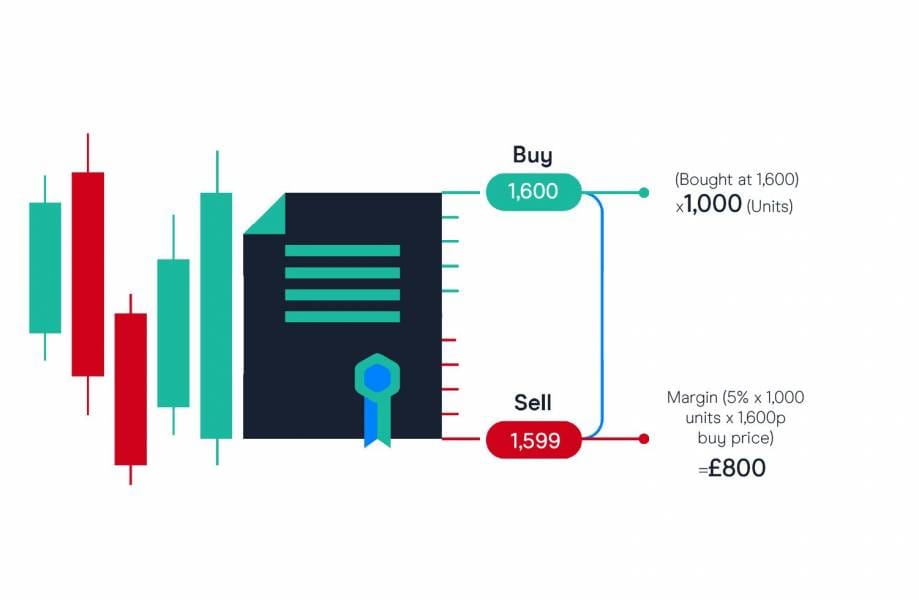

CFD stands for ‘Contract For Difference’. It is an agreement between two parties – a buyer and a seller – where one party will pay another the difference between the price at which a contract was entered into and the current market price if this current market price goes against them (in other words, make them worse off). This price movement can be because of an actual change in value (e.g., dropping share value) or simply a change in the current market sentiment (e.g., a drop in support for a particular government).

Which markets offer CFDs?

Consequently, CFDs are often referred to as derivatives because their value depends on the price of an underlying asset. These underlying assets can be anything from shares and indices to commodities such as oil and metals. In fact, if you’ve ever wondered why foreign exchange is referred to as an ‘exchange rate’ or ‘forex’, it’s actually derived from the fact that currency itself is one of the most traded underlying when it comes to CFDs.

Can novices trade CFDs?

CFDs are becoming more popular every year with Australian traders because they allow people new to trading to try it out without making any significant investment. What’s more, they have the potential to increase in value – when trading CFDs, you can buy when prices are low and sell when they’re high. This means that you can profit without having to actually purchase a stock or commodity – unless you want to.

At the same time, it’s worth remembering that even simple investments have the potential for making a loss if they go wrong. With CFDs being riskier than traditional assets, there is a lot of money to be made in this market and a large amount of money to be lost. This brings us to our next point: always make sure that your financial situation allows for this level of risk. If you begin trading with CFDs and lose money due to a lack of funds, you’ll never be able to make a profit.

Four tips for CFD trading in Australia:

- Only use your disposable income on riskier investments, not your rent or bills

- Always start with low investment amounts until you are comfortable with the types of products that are available (for example, CFDs)

- Don’t give up if you experience losses – learn from them and try again! With this type of product, there is no need to go wholesale into the market with large sums of money. Transactions can be as small as $1 each. Trading with small amounts is also good for those with limited budgets who want to test the waters before moving on to more significant transactions.

- Finally, always remember that risk is involved with CFDs. This means that it’s essential to start trading with small amounts until you are familiar with the market and have learned how to read charts, etc.

Final word

Learning to trade financial instruments is exhilarating, but it can also run your nest egg to the ground if you jump in unprepared. Patience is a crucial virtue of pro-traders. Make use of a demo account until you’re comfortable, and always reach out to trusted and expert brokers.

Tradersdna is a leading digital and social media platform for traders and investors. Tradersdna offers premiere resources for trading and investing education, digital resources for personal finance, market analysis and free trading guides. More about TradersDNA Features: What Does It Take to Become an Aggressive Trader? | Everything You Need to Know About White Label Trading Software | Advantages of Automated Forex Trading