The impact of Bitcoin Halving is often a subject of speculation and analysis within the cryptocurrency community, as it has historically influenced the supply dynamics and, consequently, the market value of Bitcoin. Phil Harvey, CEO of Sabre56, a World Top 3 blockchain data center operator, comments on bitcoin halving.

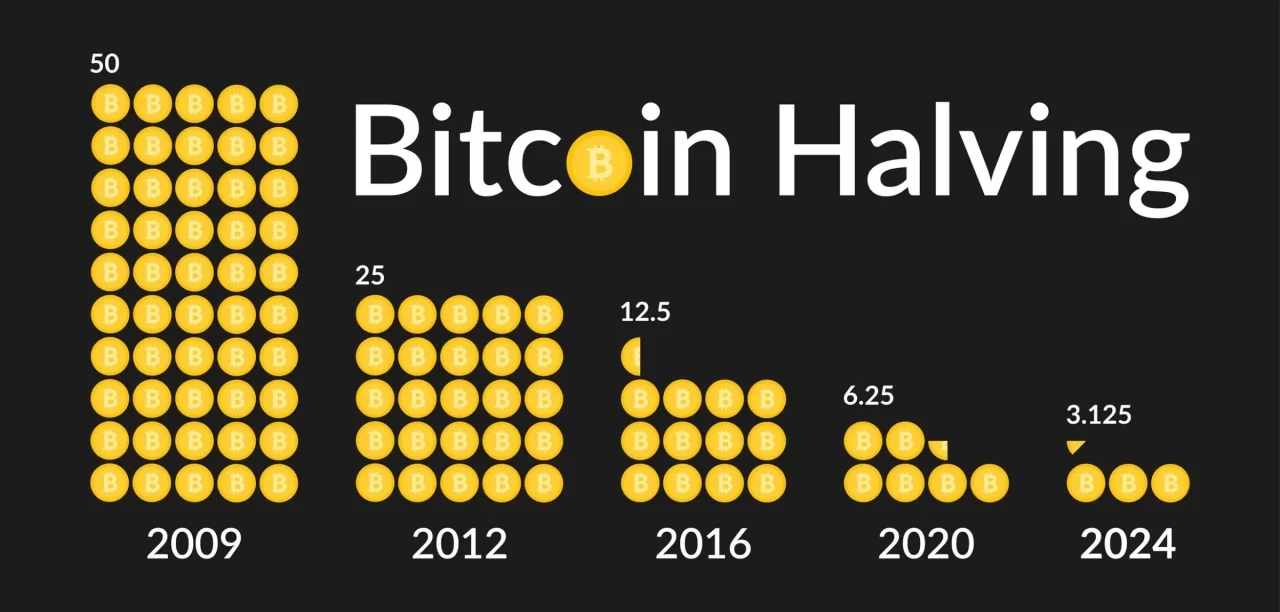

Bitcoin Halving is a fundamental event embedded in the cryptocurrency’s code that occurs approximately every four years and entails a reduction in the reward that miners receive for validating transactions on the Bitcoin network. The mechanism is programmed to limit the total supply of Bitcoin to 21 million, promoting scarcity akin to precious metals like gold.

Phil Harvey is the CEO of Sabre56, a World Top 3 blockchain data center operator. a seasoned media commentator, he shares his insights on Bitcoin halving, on who may prosper or fail, and opinion on the wider landscape.

The impact of halving on the BTC price

“Time will tell, but historical data strongly suggests a significant increase over 18 months. When analysing mining economics…power prices have remained notably and relatively stable, while equipment efficiency has improved. This enhancement allows margins to be maintained even with a higher BTC price. Consequently, BTC’s price must rise for miners to sustain the necessary margins.

Alternatively, if BTC’s price stays unchanged, older miners will gradually exit the network as they become inefficient – replaced by newer, more efficient models. This replacement of outdated equipment leads to increased margins. But, over time, the price is likely to rise as industry reinvestment industry grows.”

Price predictions and timelines

“Realistically and conservatively, BTC should stabilise between $60,000-$80,000 – with a potential high of $150,000 during the next halving cycle.”

Impact of halvings with the block reward reduced to 3.125 BTC

“Supply and demand fundamentals will take effect. Account for the final BTC to be mined c. 2140, the current halving cycle ensures a steady accumulation of BTC per block.”

Impact on the 4-year cycle – with less BTC released each block and existing supply/trading volumes

“It is hard-coded for a block to be mined every 10 minutes or so, with the algorithm adjusting the difficulty every two weeks based on block completion times. If average block time exceeds 10 minutes, the difficulty decreases. If it falls below 10 minutes, the difficulty decreases for the next two weeks. Post-halving, we can expect a change in difficulty as hash power decreases on the network due to reduced margins.”

How does halving affect miners?

“Those with more efficient miners and lower operating costs will prosper post halving, – just as with previous cycles.”

Centralisation of Bitcoin mining

“The halving could possibly lead to further centralisation of Bitcoin mining. We are witnessing the industrialisation of mining, but it is worth noting there are still numerous miners globally. As long as this continues, mining – and BTC – will stay decentralised, albeit among fewer players.”

Market dynamics: Reaction to the EFT launch/the impending halving

“I’d like to think the US ETF will add further stability to the industry as a whole. The halving will still be new to many and a post-halving market is ripe for many deals to be done. The US ETF should add robustness and maturity to the industry with less future volatility.”

Tradersdna is a leading digital and social media platform for traders and investors. Tradersdna offers premiere resources for trading and investing education, digital resources for personal finance, market analysis and free trading guides. More about TradersDNA Features: What Does It Take to Become an Aggressive Trader? | Everything You Need to Know About White Label Trading Software | Advantages of Automated Forex Trading