Data presented by Bankr indicates that Bitcoin’s $421.28 billion market cap is higher compared to any bank globally as of December, 2020. This data comes after Bitcoin has surpassed the $20,000 milestone.

Institutional investors push Bitcoin’s market cap to new highs

JP Morgan’s $367.82 billion market cap is the largest in the banking sector but trails Bitcoin. ICBC is the second-largest bank with a market cap of $258.07 billion followed by Bank of America at $248.45 billion.

China Construction Bank ranks fourth at $186.81billion with the Agricultural Bank of China caps the top five spot with a market cap of $165.62 billion.

SoftBank ranks in the sixth spot with a market capitalization of $142.2 billion followed by Bank of China at $130.52 billion. Citigroup follows with a market cap of $124.39 billion.

Wells Fargo has a market capitalization of $122.58 billion while the Royal Bank Of Canada ranks in the tenth slot with a market cap of $116.24 billion.

The Bankr report traces the surge in Bitcoin market value over the recent months. According to the research report:

“Investments made in Bitcoin by major companies like MicroStrategy and Stone Ridge, public support for crypto from prominent financial experts, the recent Bitcoin halving, and other factors have also given Bitcoin’s price a major boost over the past few months. As the benchmark cryptocurrency, Bitcoin has gotten to a place where institutional investors and banks are legitimately looking at investing in the sector as a defense against currency devaluation.”

‘$20,000 is undoubtedly a momentous milestone for bitcoin’

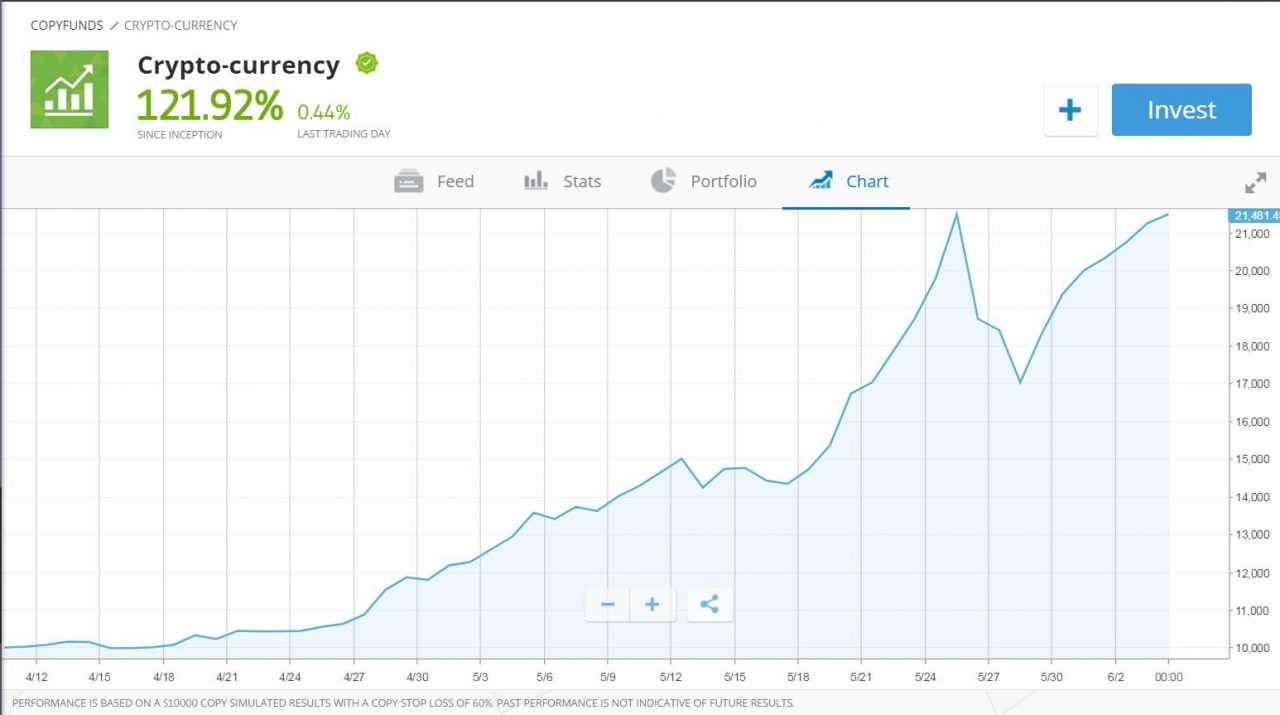

According to Yoni Assia, CEO and co-founder of eToro: “Whilst it is easy to focus on the short-term price gains, which are headline-grabbing and attention worthy, it is also important to recognise how far bitcoin has come.

“We have seen a significant shift in the demographic of those interested and invested in crypto. No longer the domain of just computer programmers and fintech advocates, I have seen bitcoin capture the attention of the masses, since adding cryptoassets to the eToro platform in 2013. From data programmers and blockchain scientists to plumbers and hairdressers, bitcoin has excited people from all walks of life.

“We’ve also started to see financial institutions wake up to crypto with many well known banks and hedge funds buying bitcoin this year. We expect this to continue into 2021 as fears of inflation continue to creep up globally.

“Now, people all across the world recognise the ways that crypto can be adopted, whether that’s as part of an investment portfolio or using it to pay for a pizza.

“I’ve been a big believer in blockchain technology for many years and think it can help solve some of the world’s ills by helping to bank the unbanked and reduce wealth inequality. Our not-for-profit initiative GoodDollar has already started to try and level the playing field, by developing a crypto based on a universal basic income (UBI) principles.”

Tradersdna is a leading digital and social media platform for traders and investors. Tradersdna offers premiere resources for trading and investing education, digital resources for personal finance, market analysis and free trading guides. More about TradersDNA Features: What Does It Take to Become an Aggressive Trader? | Everything You Need to Know About White Label Trading Software | Advantages of Automated Forex Trading