In February, Bitcoin’s trading volume surged by $650 billion, reaching $2.33 trillion amid market volatility. The top 10 cryptocurrencies saw a $2.5 trillion increase in trading volume, totaling $8.6 trillion. Tether, Ethereum, USDC, and XRP also recorded significant growth, reflecting heightened investor activity amid price fluctuations across digital assets.

February witnessed significant fluctuations in the cryptocurrency market, leading to a sharp increase in trading volumes. Following a strong start to the year, major digital assets experienced a downturn, driving investor activity across the board. Among the most affected were Solana and Dogecoin, both of which declined by over 40% by the end of the month. Bitcoin also experienced a substantial price correction, dropping 21% from its earlier peak above $100,000 to approximately $80,000.

Despite the price declines, market activity intensified as traders responded to price movements. Some investors sought to capitalise on lower prices by acquiring digital assets, while others engaged in panic selling. This heightened activity contributed to a substantial increase in trading volumes across multiple cryptocurrencies.

Bitcoin’s trading volume increases by $650 billion

Data from CryptoPresales.com reveals that Bitcoin’s trading volume saw an increase of $650 billion in February, marking a significant surge in market engagement. The cryptocurrency recorded a total trading volume of $2.33 trillion for the month, representing a 37% rise compared to January.

This sharp increase in trading volume reflects the continued interest in Bitcoin despite its price volatility. Many investors responded to the price drop by either liquidating their holdings or making strategic purchases. The market reaction suggests that traders viewed the price fluctuations as an opportunity to either secure profits or enter the market at a more favourable price point.

Trading volume growth extends to other major cryptocurrencies

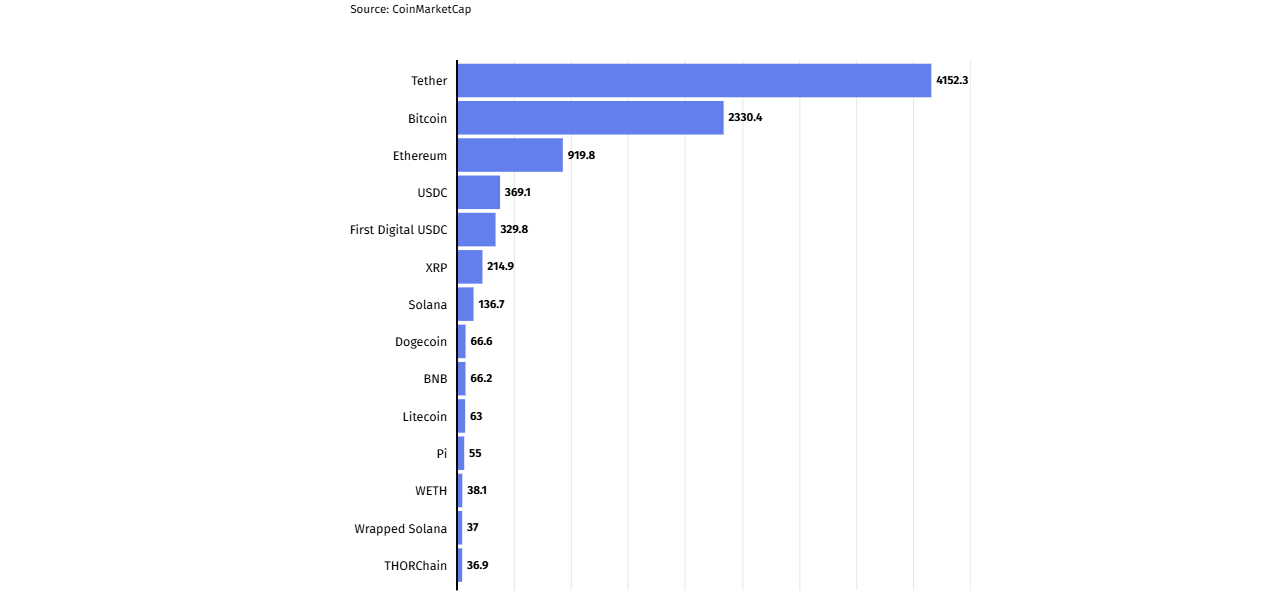

The increase in market activity was not limited to Bitcoin. All major cryptocurrencies recorded double-digit growth in trading volumes during February. Tether, the leading stablecoin, experienced a 48% rise in trading activity, reaching $4.15 trillion in transactions. Ethereum also saw a significant increase, with trading volume climbing 58% to $919.8 billion.

Other notable increases included USDC, which recorded a 41% rise to $369 billion, and XRP, which experienced a 14% growth, reaching $214 billion. First Digital USDC saw the highest percentage increase among major cryptocurrencies, with trading volume soaring by 95% to $329 billion.

Solana and Dogecoin, despite facing substantial price declines, saw increases in trading activity as well. Solana’s monthly trading volume increased by approximately 20% to $136 billion, while Dogecoin recorded a trading volume of $66 billion.

Cumulative trading volume of top cryptocurrencies rises by $2.5 trillion

The overall trading activity across the cryptocurrency market saw a substantial surge. The cumulative trading volume of the ten most traded cryptocurrencies stood at $6.08 trillion in January. By the end of February, this figure had increased by $2.5 trillion, reaching $8.6 trillion.

The sharp increase in trading volumes highlights the market’s responsiveness to price fluctuations. Historically, February has been a volatile month for cryptocurrencies, often serving as a transitional period ahead of stronger market performances in March and April. While some years have seen price surges during this period, others have been marked by corrections. The trading data from February indicates that investors remain highly engaged, with trading volumes reflecting both strategic investment decisions and defensive market moves.