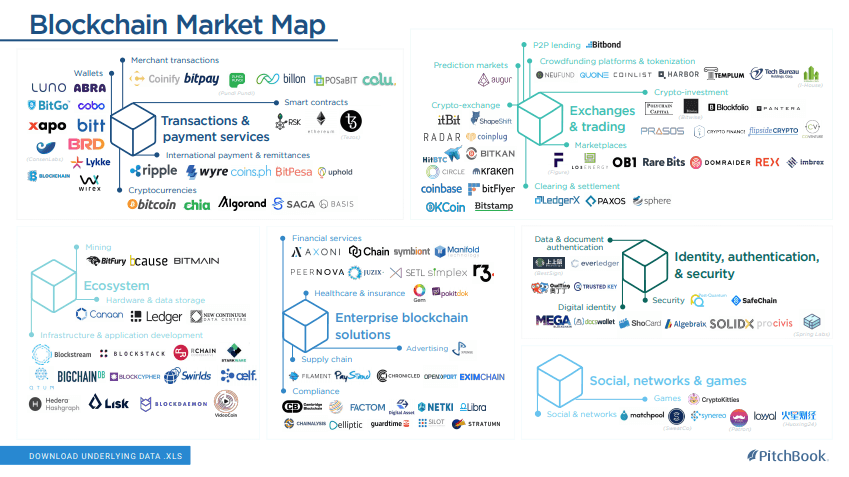

Even though blockchain was born attached to Bitcoin, many developers, investors and other experts saw its potential to power companies of all kinds within a whole array of sectors. It is true, however, that most of current blockchain powered companies are still attached somehow to tokenization and crypto capabilities, either in their funding process or as a way to divert their operations. Without a proper outlook, we don’t really know where the ecosystem is standing right now and where is it heading towards.

Luckily, there is one company brave enough to undertake that tremendous task, Outlier Ventures. And as has been a practice over the past year, the Venture Capital firm have released their first State of Blockchains report for 2019. In it, the company warns that investors may often rush to create opinions and brush-off the ecosystem looking at how token prices have functioned over the course of the year. However, a quick look at metrics beyond mere ticker prices reveals that individuals are indeed building at scale and their projects are beginning to see massive traction.

The first State of Blockchains report for the year explores key metrics that may not have fallen under the public radar but stand as strong indicators of health and growth within the ecosystem.

Lawrence Lundy-Bryan, Partner & Head Research, Outlier Ventures recently said, “We are witnessing an increasing number of teams launching products and seeing early signs of traction. 2019 will likely witness a handful of blockchain projects beginning to rival traditional web companies for adoption. Consumer choice will be between centralised offerings, and their decentralised competitors. The last two years has been about the infrastructure needed to build these products, the next two will be about scaling and attracting users.”

We take a quick look at three key trends found within the report:

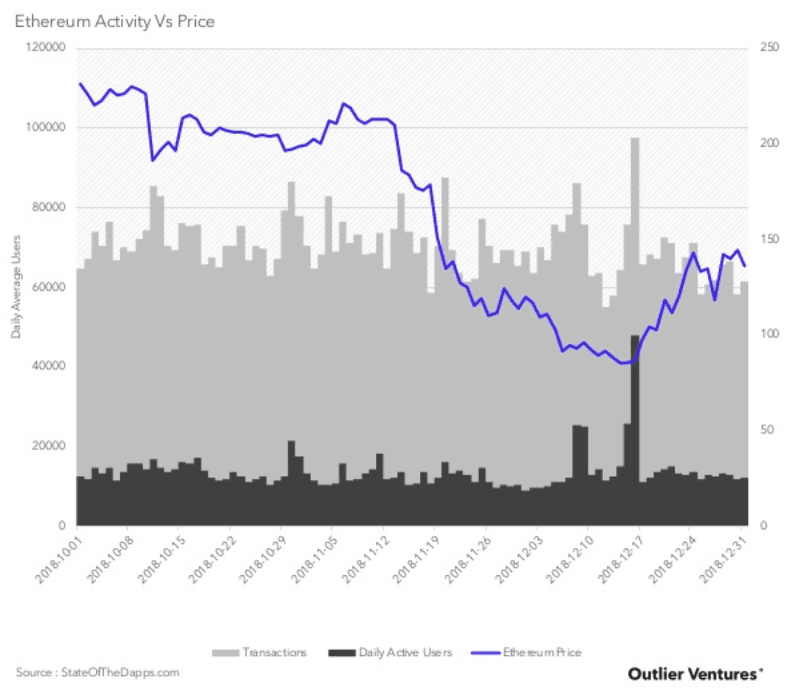

Product adoption not hindered by token prices

The earliest indications of massive interest in Web 3.0 products are here. Teams that build with a heavy emphasis on user experience have begun seeing levels of traction that may soon lead them to compete with their mainstream counterparts. Brave, for instance, has 28,000 publishers, 10 million Android downloads and 5.5 million monthly average users. Figures that any conventional startup its age would be jealous of. Applications on Ethereum witnessed little drops in average daily users despite a roughly ~90% drop in price over the course of the year.

Blockstack’s early app releases have seen impressive growth counts too. For instance, Graphite docs, a decentralised version of Google Documents sees close to 5000 daily average users currently. As awareness increases and challenges in user experiences are solved, we may soon witness a tussle between traditional Web 2.0 apps and emergent Web 3.0 ones for mindshare of the same customers.

Joel John, Research Analyst, Outlier Ventures commented, “Many in the community believed that ETH’s drastic decline was due to heavy selling pressure from start-ups selling ETH raised during ICO, but the numbers show otherwise. It’s more likely that ETH’s price simply declined with entire market, perhaps being oversold on the fear of a stalling ICO market.”

Blue chips emerge among VC backed startups

Data for the quarter reveals that the token winter has not necessarily affected venture capital investments in the ecosystem. Close to $557 million was raised by a total of 147 projects over the course of the quarter. However, capital has begun concentrating on a handful of projects. 70% of the capital raised this quarter went to a mere 20 projects.

Concerns around global macro trends may be pushing an increasing number of VC firms to take larger bets in projects that have their product-market fits proven. Interestingly, even as trading interest wanes, trading platforms and infrastructure has not struggled to raise funds. Coinbase, Kucoin and Bitgo raised follow own rounds over the quarter. We are also seeing rising interest in backing decentralised finance oriented projects. If trends indicate to anything it is that conservative capital is still deploying into projects that are at the right stage to scale and acquire marketshare.

BATFAANGs go crypto!

BaaS as a business model is beginning to sound like a trend of the past. Large, Web 2.0 behemoths are rolling out their own blockchain based products. Given the struggle dApps face in onboarding users, the existing distribution network owned by large firms could give them a competitive advantage in attracting users to the ecosystem. Facebook turned heads early on in the quarter when news emerged that the firm may be working on a stable-coin integration into their messenger application with remittance as a key use case.

Meanwhile, in China, Tencent has partnered with the government alongside twenty other enterprises to create systems that detect malicious activities or Ponzi schemes and fraud enabled by public blockchains. With news of hardware manufacturers like HTC and Samsung integrating blockchain based authentication solutions in their devices and Opera browser integrating token wallets it is becoming evident that larger, more traditional organisations are not going to sit idle and watch these paradigm shifts.

Although there is still a strong feeling that blockchain and bitcoin are entangled, the truth now is that many companies, coming from quite different sectors, are starting to use its ledger and security capabilities to develop their products. As such, this report helps the community and the global market to truly get a real understanding of how the blockchain tech is performing, and how wider its adoption has become.

Hernaldo Turrillo is a writer and author specialised in innovation, AI, DLT, SMEs, trading, investing and new trends in technology and business. He has been working for ztudium group since 2017. He is the editor of openbusinesscouncil.org, tradersdna.com, hedgethink.com, and writes regularly for intelligenthq.com, socialmediacouncil.eu. Hernaldo was born in Spain and finally settled in London, United Kingdom, after a few years of personal growth. Hernaldo finished his Journalism bachelor degree in the University of Seville, Spain, and began working as reporter in the newspaper, Europa Sur, writing about Politics and Society. He also worked as community manager and marketing advisor in Los Barrios, Spain. Innovation, technology, politics and economy are his main interests, with special focus on new trends and ethical projects. He enjoys finding himself getting lost in words, explaining what he understands from the world and helping others. Besides a journalist he is also a thinker and proactive in digital transformation strategies. Knowledge and ideas have no limits.