Brexit, Deutsche Bank and the Beginning of a Financial Apocalypse?

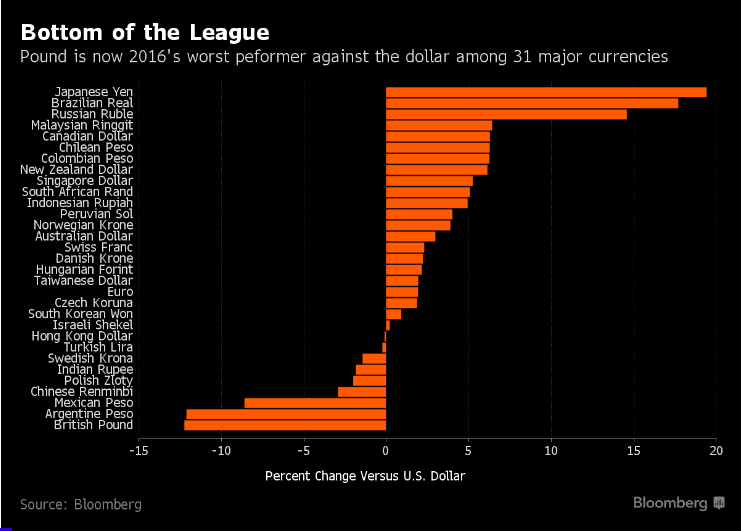

The pound is 2016’s worst performing currency and we are just in the beginning.

As the financial situation of the UK post Brexit continues its work of destruction the value of the GBP sterling goes strange to say less and as Bloomberg highlights The pound is 2016’s worst performing currency.

As worldwide investors face months of uncertainty following the disruptive Brexit vote the question is – is the worst still to come? The confusing and uncertain mechanics and terms (or lack of it) of the U.K.’s exit are yet to be determined, and the nation’s political leadership is still totally unclear with both mainstream partners in internal fights after Prime Minister David Cameron radical resignation with what it seemed any action plan.

Deutsche Bank Edging situation with shares hit a new record low today.

To add to the Brexit pains Deutsche Bank shares hit a new record low recently and many analysts are speculating about this major world bank financial health. Deutsche Bank value has halved since the beginning of the year and the rumours in the industry have been growing. So one of the questions asked by a lot of the financial industry news is: is Deutsche Bank now the most dangerous bank in the world?

According to the International Monetary Fund – it seems… yes. Last week, the IMF said that, of the banks big enough to bring the financial system crashing down, Deutsche Bank was the riskiest. Not only that, it seems more alarming that the Deutsche Bank’s US unit was one of only two of 33 big banks to fail tests of financial strength set by the US central bank earlier this year. It’s not hard to get scared when you see the size of this financial / banking colossus and look at its numbers.

In simple terms any powerful bank is worth the difference between what it’s owed and what it owes. In the case of Deutsche Bank its numbers are the difference between assets of please check 1.64 trillion euros and liabilities of 1.58 trillion euros – it is around 2% of the global economy. The crazy situation is that its net value is 60 billion euros.

If it sounds like a lot and too much big too fail we heard that already but the risk is effectively there. The value of what its owed if it continues this way it doesn’t need to move by much to wipe out its value completely and the systemic risk can come immediatelly if nothing is done.

EU and the dire state of Italian banks after Brexit

The Italian Banks dire situation is another one of the EU fragile situation and at the moment the greatest economic risk for Europe in a critical moment post Brexit. Mihir Kapadia, CEO at Sun Global Investments, has said:

“The ‘08 financial crisis taught the world a lesson on bank bailouts but it remains to be seen how well these lessons were learnt. The EU will try to make sure that the same mistakes aren’t made twice. It will try to insist that Shareholders and creditors, not taxpayers or protected small depositors, take the hit for these losses.

“The 2010-12 European debt crisis hit the PIIGS: Portugal, Italy, Ireland, Greece and Spain. Greece defaulted and the EU and ECB lent huge sums to all these countries. Ireland and to a lesser extent Spain have recovered and resumed growth; Italy and Portugal have not while Greece remains in a very perilous situation. The Italian crisis is larger and more significant since it is a much larger economy than Portugal and Greece. These are dangerous times for banks and for Europe – Brexit has dominated the markets recently but the developing Italian banking crisis is the next biggest economic risk for Europe, and it needs to be addressed.”

Worries about the dire state of Italian banks have recently added to resurgent Brexit concerns across global markets. The figures suggest a remarkable 17% of bank loans in Italy are ‘bad’ – that’s over £300bn of bad credit, many multiples of the levels of debt held during the peak of the ‘08 financial crisis. Recent market volatility – which has been triggered by the Referendum decision – has hit European banks hard and Italian banks harder. By some estimates, the share prices of the latter were down 20% in ten days.

“A perfect storm of slow or zero Italian growth (especially during the Berlusconi years), low interest rates and bad, politically-connected and often corrupt lending have combined to create a situation where the Italian financial system is in need of a large rescue.

“The EU (especially Germany) is opposed to a State bailout. In the new world that came of the global financial crises and the latter intense European debt crisis, it is supposed to be equity holders and holders of subordinated (or junior) bonds who are supposed to take the first losses. In Italy, this is difficult as many of the subordinated bonds have been sold to households and individuals and it will be very difficult – politically – to make them take capital losses for the bad debt problems of the banks. The Italian government wants to inject state funds but the amounts required are huge and such an injection is against EU rules on state aid.

Financial apocalypse?

The Chinese government, the IMF and the US central bank are all worried with the world economy lack of growth and the risky financial economic situation. If the share price of Deustch Bank has fallen early 70% in the last year the risk as it stands is that Germany is the economiuc pilar ofthe EU economy and if its biggest bank has a systemic problem, well so does the rest of the EU. This plus Italy one of the top EU economies…

For all these reasone, many people fear Deutsche Bank, Brexit, the Italian bank crisis, and adding to this the high level of debt of the chinese economy could be the first horseman of a new global financial apocalypse.

Let us hope the fact that US is in a more solid position that could drive the world economy for now but the next elections are a big shadow out there with Trump debt driven populism a riskier gambling for the world economy.

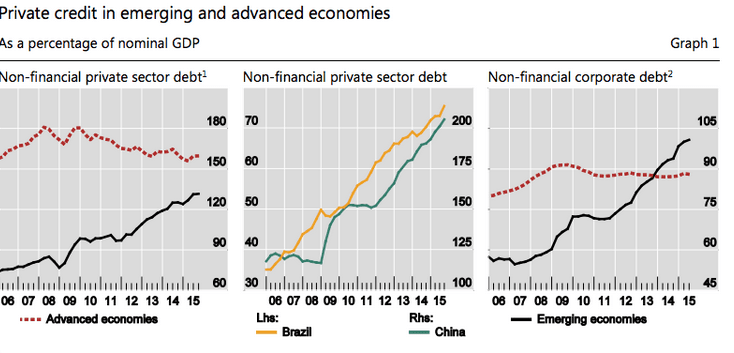

So in this scenario welcome back to a familiar anxiety: global debt contagion. As Bloomberg synthetises the fragile global economy has been straining under a record scary pile of debt. The world economy has continued to borrow hand over fist since the financial crisis, adding nearly $60 trillion since 2007 in the process of pushing the worldwide debt load to $200 trillion, or nearly three times the size of the entire global economy. And that figure takes us only to 2014; we don’t yet have fresh debt tallies from last year, special as the Chinese economy has been pushing these numbers to a new parallel dimension.

Be wise out there! Trade and invest wisely.

Dinis Guarda is an author, academic, influencer, serial entrepreneur and leader in 4IR, AI, Fintech, digital transformation and Blockchain. With over two decades of experience in international business, C level positions and digital transformation, Dinis has worked with new tech, cryptocurrencies, drive ICOs, regulation, compliance, legal international processes, and has created a bank, and been involved in the inception of some of the top 100 digital currencies.

Dinis has created various companies such as Ztudium tech platform a digital and blockchain startup that created the software Blockimpact (sold to Glance Technologies Inc) and founder and publisher of intelligenthq.com, hedgethink.com, fashionabc.org and tradersdna.com. Dinis is also the co-founder of techabc and citiesabc, a digital transformation platform to empower, guide and index cities through 4IR based technologies like blockchain, AI, IoT, etc.

He has been working with the likes of UN / UNITAR, UNESCO, European Space Agency, Davos WEF, Philips, Saxo Bank, Mastercard, Barclays and governments all over the world.

He has been a guest lecturer at Copenhagen Business School, Group INSEEC/Monaco University, where he coordinates executive Masters and MBAs.

As an author, Dinis Guarda published the book 4IR: AI, Blockchain, FinTech, IoT, Reinventing a Nation in 2019. His upcoming book, titled 4IR Magna Carta Cities ABC: A tech AI blockchain 4IR Smart Cities Data Research Charter of Liberties for our humanity is due to be published in 2020.

He is ranked as one of the most influential people in Blockchain in the world by Right Relevance as well as being listed in Cointelegraph’s Top People In Blockchain and Rise Global’s The Artificial Intelligence Power 100. He was also listed as one of the 100 B2B Thought Leaders and Influencers to Follow in 2020 by Thinkers360.