Brexit Self Destruction Effects For the UK Economy Continues!

As the GBP Pound continues its falling way most of the economic numbers that continue to follow up on the Brexit effect are more and more negative and it seems a self destructing machine that is yet to stop.

Alone if maintaining the UK’s membership of the EU’s single market that fact could add an extra 4% to its economy, according to the Institute for Fiscal Studies (IFS).

The IFS think tank in a report: The EU Single Market: The Value of Membership versus Access to the UK by Carl Emmerson, Paul Johnson, Ian Mitchell and Copy-edited by Judith Payne – The Institute for Fiscal Studies – weighed up the benefits of staying in the single market compared with membership of the World Trade Organization alone.

Major Economic indicators all point for negative directions:

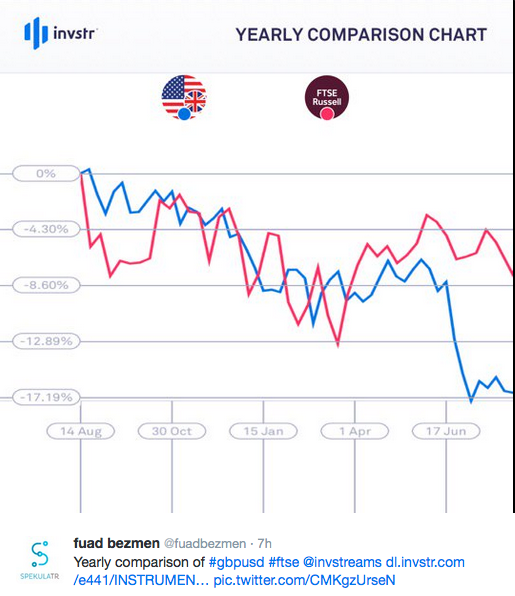

Yearly comparison of #gbpusd #ftse @invstreams https://t.co/LuqhK3Ao06 pic.twitter.com/CMKgzUrseN

August 9, 2016

The UK’s economy is predominantly service-sector based. However, the UK is unusual in that services play a significant role in trade – they have grown significantly in the last 15 years and the country exports considerably more than it imports, creating a service ‘trade surplus’ equivalent to some 5% of national income.

Speaking in relation to the Bank of England’s bond-buying dilemma yesterday, Mihir Kapadia, CEO and Founder of Sun Global Investments, has said:

“Yesterday’s bond-buying shortfall presents a problem for the BoE so soon after the announced increase in the quantitative easing strategy. Falling £50 million short of the target number of gilts they had intended to buy on Tuesday stirred the markets – UK gilt yields have already hit a new low as a result with 10 year yields at 0.529%, 15 bps lower than just two days ago. Buyers were perhaps more reluctant to sell than the BoE estimated, but this may just reflect the fact that many traders, fund managers and other decision makers are on holiday.

“Although the news has come as a surprise to investors, it is much too early and too simplistic to say the BoE’s plan to mitigate the impact of Brexit was unsuccessful. The BoE will try again in a series of planned regular purchases and may well be able to buy in the required amounts. However, it is clear that the move has had some market impact and the purchases are likely to be at higher prices than anticipated.”

The Single Market the critical partner for the UK economy, has focused increasingly on smoothing trade in services in the last two decades. As for UK service exports, the EU is by far the largest market accounting for almost 40%, the uncertainty is big as whereas emerging economies such as Brazil, Russia, India and China together account for less than 5% there is a big work to do where the UK can drive its business efforts. Paul Johnson, IFS director, said there was a big difference between access and membership of the single market.

“We’ve heard a lot of people saying of course we’ll have access if we leave the single market union.

“Broadly speaking, yes, we will, as every other country in the world does. You can export into the EU wherever you are from, but there are different sorts of barriers to doing so.”

The IFS report affirms something that most of the international market analyst have been saying as it argued that the special advantage of being an EU member was that its single market reduced or eliminated barriers to trading in services, such as the need for licences or other regulations.

The IFS said that the absence of trade barriers for services was far more important than removing tariffs on the trade in goods between EU members, such as customs checks and import taxes.

It said that while leaving the EU would free the UK from having to make a budgetary contribution of £8bn, loss of trade could depress tax receipts by a larger amount.

It found new trade deals would be unlikely to make up for lost EU trade, which accounts for 44% of British exports and 39% of service exports.

The confusing situation continues deteriorating the UK economy as the government has yet to start negotiating the UK’s departure. The IFS think tank has issued stark warnings over the impact of Brexit ahead of the EU referendum, which have made some question its views. Mr Johnson has said on the subject that he hoped the IFS was proved wrong.

“We wait to see what the economic consequences are going to be, but we’ve already seen the Bank of England significantly reduce its predictions of growth over the next couple of years and increase its view of where unemployment will be”

UK Economy is Particularly vulnerable

The same report said also that UK services, the powerhouse source of incoming of the economy, would be particularly vulnerable if the government were unable or unwilling to negotiate a replacement deal and become a member of the European Economic Area (EEA), like Norway.

The IFS report puts some important questions about the health of the UK economy and has added that financial services, which generate 8% of the UK’s economic output, might be the ones to suffer more in particular if a final Brexit deal meant they lost their so-called “passporting rights” that allows them to be sold directly to EU customers and businesses.

Tradersdna is a leading digital and social media platform for traders and investors. Tradersdna offers premiere resources for trading and investing education, digital resources for personal finance, market analysis and free trading guides. More about TradersDNA Features: What Does It Take to Become an Aggressive Trader? | Everything You Need to Know About White Label Trading Software | Advantages of Automated Forex Trading