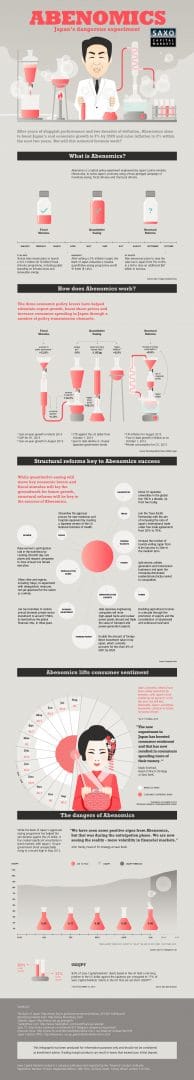

One of the biggest currency stories of late has been the strong downtrend in the Japanese yen, which has been largely brought about by the radical economic policies of Japan’s prime minister Shinzō Abe. And, so far, these policies seem to be having the desired effect, with data last week showing inflation at a five-year high – a sign that Japan may finally be exiting its 15-year deflationary cycle.

Abe’s reforms are a hitherto-untried mix of fiscal stimulus, monetary easing, and structural reforms. Earlier this year, Abe commited $116 billion of public spending to infrastructure projects and renewable energy in an effort to kickstart Japan’s sclerotic economy, create jobs, and inspire private investment.

The initial effects of the reforms have triggered a huge rally in Japanese stocks, with which the yen has historically had an inverse relationship. The weaker yen, in turn, has made things easier for exporters, giving growth a further boost. Yet, all these positive developments have come at the price of building up a huge national debt, and it remains to be seen how Japan can cope with public debt of over 200% GDP. Will it spark a long-term recovery, or will it prove to be a dangerous flash in the pan?

Whatever the outcome, these developments will doubtless be of huge interest to investors in the currency and stock markets. In the following infographic, analysts from Saxo Capital Markets take a look at the implications of Abe’s radical reforms, the potential complications, and what it means for traders.

Tradersdna is a leading digital and social media platform for traders and investors. Tradersdna offers premiere resources for trading and investing education, digital resources for personal finance, market analysis and free trading guides. More about TradersDNA Features: What Does It Take to Become an Aggressive Trader? | Everything You Need to Know About White Label Trading Software | Advantages of Automated Forex Trading