Capital Market, Volatility and Trump’s first 100 days What to expect?

Investors should expect volatility in global financial markets in the first 100 days of Donald Trump’s presidency.

This is the warning from Tom Elliott, International Investment Strategist at deVere Group, one of the world’s largest independent financial advisory organizations.

Mr Elliott comments: “Market volatility should be expected over the next 100 days, the period in which new administrations like to lay down their mark for the rest of their term of office.

“The likely turbulence will arise from the uncertainty reflected in the mix of appropriate and inappropriate economic policies Trump wants to introduce. Let’s start with his campaign slogan, ‘Make America Great Again’. It is unclear in what sense America is not great, at least in terms of the economy.

“Obama left the U.S. growing at an annualised rate of around 3.5 per cent, the fastest rate of growth of any developed economy, bar Canada. Unemployment is at a modest 4.7 per cent, and other economic data released in recent months all confirm a broad-based surge of growth that started last summer.”

He continues: “However, having campaigned on a promise that America, and its economy, needs fixing in some way, Trump is now obliged to offer solutions.

“Some are sensible, appropriate, supply-side measures that will always win plaudits. These include reform of America’s over-complicated taxation system, which will include a review of the generous tax incentives available to companies who use debt rather than equity to grow their companies.

“Some of Trump’s business deregulation will be welcome, but we can only offer one cheer on this given the risk that regulations that promote consumer health and choice may be ditched, alongside those that are in place simply to protect business and political interests.”

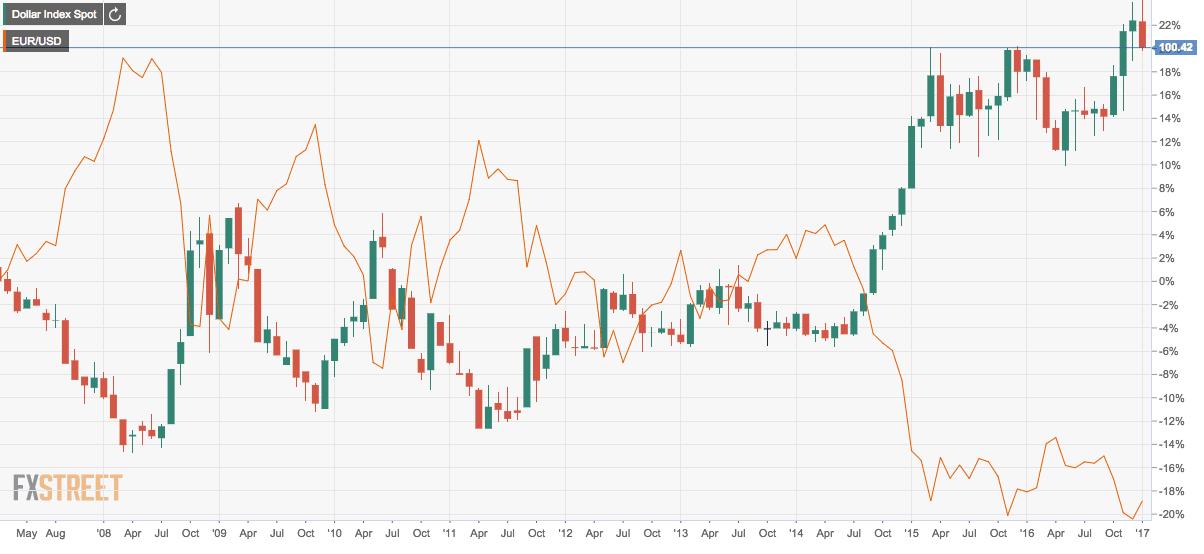

He goes on to say: “It is Trump’s fiscal policies that most analysts worry about, should Congress pass them. The type of fiscal stimulus policies that Trump has promised, such as lower taxes and infrastructure spending, can make up for shortfalls in public spending and so stimulate a depressed economy. Yet the U.S. is not suffering from a depressed economy, and inflation may be the result.

“Furthermore, with the U.S government deficit likely to hit its current $20 trillion mark in March, thanks to a continuing large budget deficit (of 3.2 per cent of GDP), the Treasury market may well take fright at the prospect of both oversupply and inflation should Trump try to enact such a policy.

“Indeed, the Fed has begun to fret that monetary policy may have to be tighter in 2017 than outlined in its December report. In recent days it has speculated that rate hikes may be accompanied by a shrinking of its balance sheet. This would shrink the money supply, forcing up interest rates.”

Mr Elliott adds: “Another worry is that Trump’s instincts on trade appear to be mercantilist rather than liberal, with little understanding of how free trade has helped America’s poorest. It is this group who consume the highest proportion of their incomes on imported goods, and who benefit from low-priced imports. The country’s 2.6 per cent current account deficit with the rest of the world should indeed be a concern to Washington, but not so much for its size (the UK has a deficit of 5.6 per cent for instance), but because of its long running persistence.”

deVere’s International Investment Strategist concludes: “The clock starts ticking today on President Trump’s first 100 days. If in this period we hear conciliatory words from Trump on his more contentious policy ideas, and evidence that his advisors and Congress can control the impulsive side of the man, Trump may confound his critics and have a successful presidency. Markets will be relieved and the Trump rally on Wall Street will resume.

“We expect GDP growth of 3 per cent to 3.5 per cent in 2017, given a recent pick up in business confidence and the stimulus effect of Trump’s economic proposals. But will Congress, which is now controlled by Republicans who favour small budget deficits and free trade, go along with Trump? And if they do, will the Fed tighten monetary policy too soon for the stimulus to have an effect? If Congress does not play ball, or the Fed tightens fiscal policy faster than expected, Wall Street will suffer a correction and Treasuries will rally.”

Tradersdna is a leading digital and social media platform for traders and investors. Tradersdna offers premiere resources for trading and investing education, digital resources for personal finance, market analysis and free trading guides. More about TradersDNA Features: What Does It Take to Become an Aggressive Trader? | Everything You Need to Know About White Label Trading Software | Advantages of Automated Forex Trading