The announcement of huge economic and social reforms in China yesterday boosted the risk appetite among investors, with safe-haven currencies such as the yen and the dollar falling at the expense of higher yielding currencies such as the New Zealand dollar and the Australian dollar.

The news saw China shares post their biggest rise in over two months, while global shares soared to their highest level since 2008.

Meanwhile, the dollar slipped 0.2% to 80.688 against a basket of major currencies, and the dollar’s loss was to prove the euro’s gain, with the euro rising 0.2% against the dollar to $1.3519. The euro was further helped by the release of economic data that showed the eurozone’s trade surplus grew by more than expected in September.

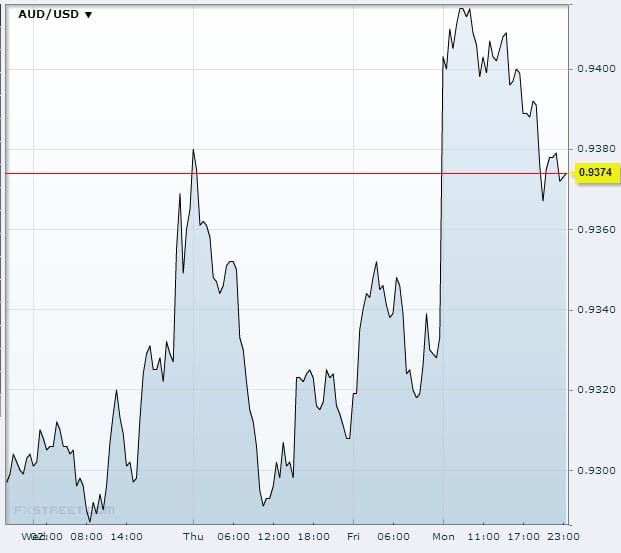

Source: FXstreet

The increase in risk appetite, coupled with the bounce in Asia Pacific markets, saw the Australian dollar rise by 0.7% percent at US$0.9399, while the New Zealand dollar gained 0.3% to US$0.8366.

BK Asset Management’s Kathy Lien said that these currencies continued to benefit from China’s reform policies “as investors hope that more stability for China will mean long-term benefits for the global economy.”

The safe-haven yen also fell against most major currencies, with the Australian dollar rising 0.1% to 94.01 yen and the New Zealand dollar edging up slightly to 83.69 yen.

The dollar has also been pushed downwards by comments from the incoming Federal Reserve chief, Janet Yellen, last week hinting that the Fed would keep its controversial bond-buying programme intact until next year. The majority of investors now expect the Fed to begin the tapering process in March 2014, which means that the supply of dollars is going to remain plentiful for a few months yet. Investors will be keeping a keen eye on forthcoming U.S. data for clues as to the Fed’s tapering timescale. One of the most important pieces of data in this regard is the October retail sales figure, which is due this Wednesday.

Other central banks are making similarly dovish noises, with the Bank of Japan stating its intention to be aggressive in providing monetary stimulus to reach its inflation goal, and the European Central Bank has pledging to do whatever it takes to prevent a deflationary scenario.

Tradersdna is a leading digital and social media platform for traders and investors. Tradersdna offers premiere resources for trading and investing education, digital resources for personal finance, market analysis and free trading guides. More about TradersDNA Features: What Does It Take to Become an Aggressive Trader? | Everything You Need to Know About White Label Trading Software | Advantages of Automated Forex Trading