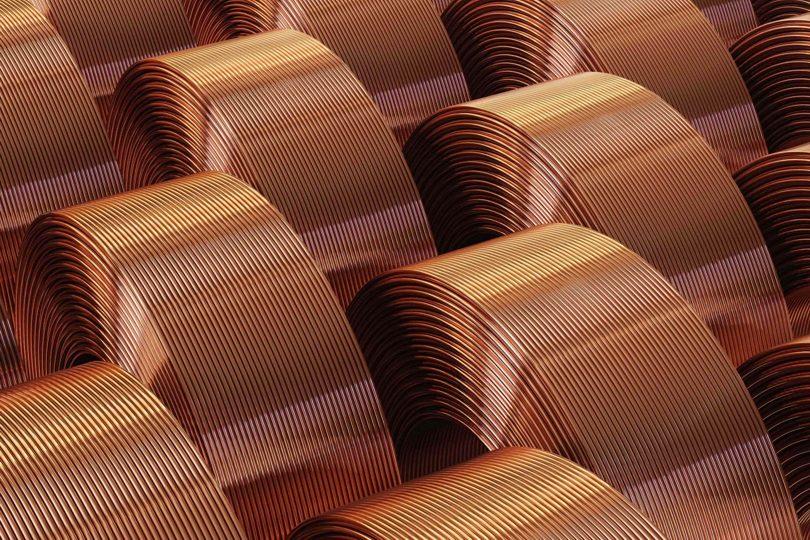

Where China’s economy goes, so do commodities prices. At least that’s the sentiment investors are banking on as the world’s second-largest economy begins to reopen after the coronavirus pandemic shut down virtually all economic activity. Analysts are predicting that China’s reopening is expected to drive a major copper rally in 2023, with prices potentially reaching as high as $10,000 per tonne. This would represent a significant increase from current levels, which were hovering around $7,000 per tonne just a few quarters ago and have surpassed $9,000 per tonne.

Where Investors are Looking for Opportunity

There are several areas investors look to if they want to invest in copper. The first is mining stocks, where junior mining stocks provide more upside than large-cap stocks due to the potential for larger returns. Stocks like Solaris Resources (TSX:SLS) (OTCQB:SLSSF), Amarc Resources, NGEx Minerals, and Los Andes Copper have all seen similar trends. 2022 was a difficult year for copper equities with approximately a 60% correction in all share prices as the underlying metal sold off roughly 30%, presenting significant opportunities for upside and investors are beginning to see solid gains with copper rebounding.

Contributing to this is the constant progress at projects from each of the companies. Solaris Resources continues to issue drill results that grow and expand on the mineral resource at its Warintza project in southeastern Ecuador, one of the biggest copper discoveries in recent years. The reported mineral resource is already a staggering 1.5Bt with a little over 250 Mt in the starter pit. The company’s goal is to double the size of the starter pit to approximately 500 Mt and add 1Bt to the overall mineral resource. At the current 1.5Bt mineral resource, analysts are already valuing Warintza at US$4B net asset value (NAV) at an 8% discount rate and the stock is trading at a massive discount to this at 0.25x P/NAV(8%) which doesn’t even take into account the latest drill results aimed at growing the resource. This is a stock set up for a significant rebound as it’s one of the best greenfield copper development opportunities on the board capturing the interest of many majors.

Another option for investors is to look at futures contracts for copper. By using futures contracts, investors can bet on the price of copper without taking physical delivery of the metal. The copper futures market is highly liquid and offers a variety of contracts, from those with short-term expirations to those with a longer-term horizon. The longer-term contracts can be used to hedge against macroeconomic trends, such as the expected copper rally in 2023.

Finally, investors can look to ETFs that specialize in copper. ETFs provide exposure to a basket of investments, which can include copper futures or stocks of mining companies. ETFs offer investors the ability to diversify their investments and limit their exposure to any single company or asset.

The Reason for the Copper Rally

China’s size and manufacturing prowess make it the world’s largest consumer of copper. As the country begins its reopening, analysts predict a surge in demand for the commodity, driving prices up. This increase in demand is likely to be driven by the country’s stimulus package, which is set to inject billions of dollars into the economy. This stimulus spending is expected to create more opportunities for businesses, which would need more copper to expand their operations. Additionally, China’s reopening could bring back some of the demand that had been lost during the pandemic, as businesses and consumers resume their normal activities.

Possible Impact on the Global Economy

If China’s reopening does indeed lead to a major copper rally in 2023, it could have far-reaching implications for the global economy. The surge in demand for copper could lead to an increase in prices for other commodities, such as aluminum and steel, as investors look to capitalize on the rising demand. This could also lead to an uptick in economic growth, as businesses are able to expand their operations and create more jobs. Furthermore, a copper rally could potentially bring down inflation rates, as production costs are reduced.

Why the Copper Mining Industry is in the Spotlight for Today’s Economy

The copper mining industry is experiencing a resurgence in recent years due to increasing demand for the metal. Copper is a key component in many industries, from electronics and construction to renewable energy and space exploration. It is forecast to become even more important in the coming years as the world transitions to a low-carbon economy. As such, the copper mining industry is in the spotlight as one of the key industries driving the global economy in the 21st century.

For copper exploration companies, this puts their operations and impact in the spotlight in a positive way as they contribute to local communities and economies in many ways. As the world battles broader macroeconomic forces, the mining industry is one of the main drivers for job creation and economic progress in much of the world, and aims to continue doing so in the future.

Tradersdna is a leading digital and social media platform for traders and investors. Tradersdna offers premiere resources for trading and investing education, digital resources for personal finance, market analysis and free trading guides. More about TradersDNA Features: What Does It Take to Become an Aggressive Trader? | Everything You Need to Know About White Label Trading Software | Advantages of Automated Forex Trading