Last week risk off flows continued a pace as global inflation numbers remained high. The US Dollar finally lost some ground to other currencies as the world waits to see if we are turning into a bear market.

The US Dollar had its first losing week in sometime. US data is still showing some levels of weakness as the feds tightening begins to filter into the wider economy. the DXY lost 1.4% last week.

The Euro finally managed to end the week higher despite the Eurozone’s inflation remain far ahead of ECB target piling on pressure for the ECB to act. The are comments beginning to be made about possible rate rises and these may filter through during the summer months.

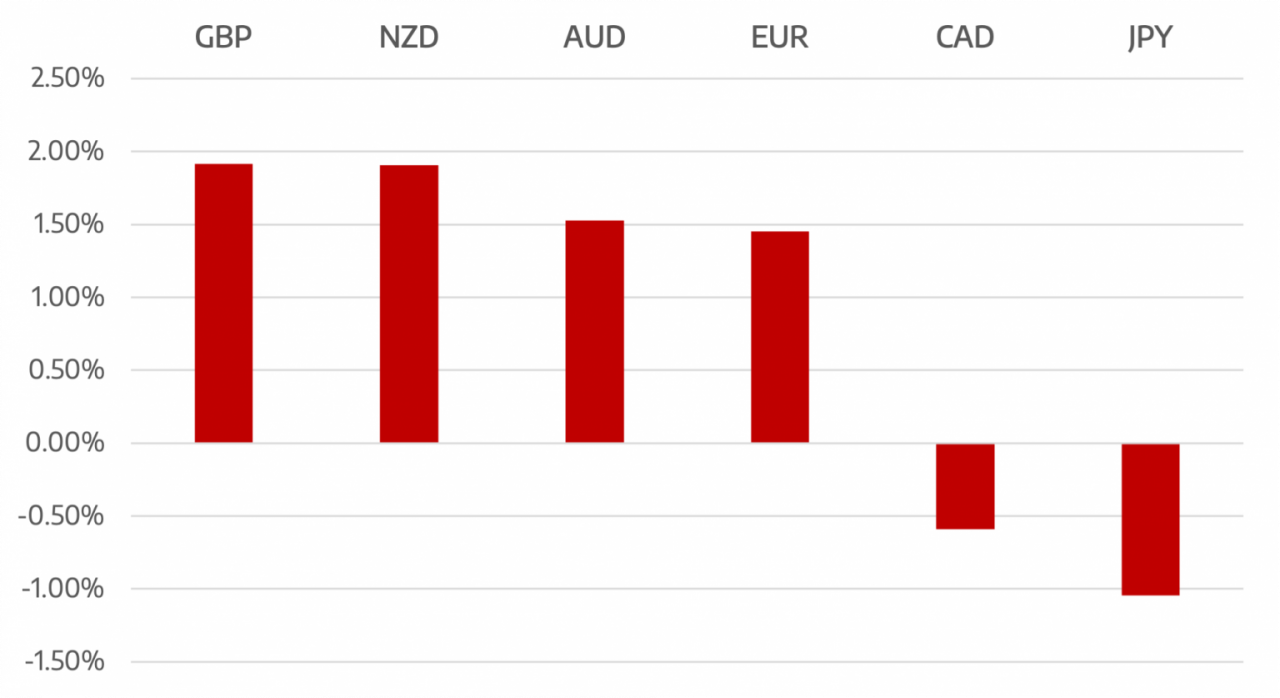

The GBP ends one of the best performers. The UK average earnings came in +7% showing signs of wage inflation on top of CPI inflation. GBP managed to rally 2% pushing the 1.25 level at the close.

General risk / commodity currencies also performed well despite the stock market sell off temporarily breaking their correlation with the stocks.

CAD made modest gains as Oil, despite intra week volatility, closed slightly higher about $110 at $110.52.

The week ahead has GDP data from US and Germany and the RBNZ interest rate decision.

Weekly Majors Market Performance

What is Cromwell FX?

Cromwell FX is a quantitative FX manager offering superior risk adjusted returns. The portfolio is the most liquid pairs . The strategy is fully automated and adhere to strict rick management procedures to control leverage and position limits.

The post <h5>Cromwell FX Market View</h5> <h3>Bear Market… Yes or No?</h3> appeared first on JP Fund Services.