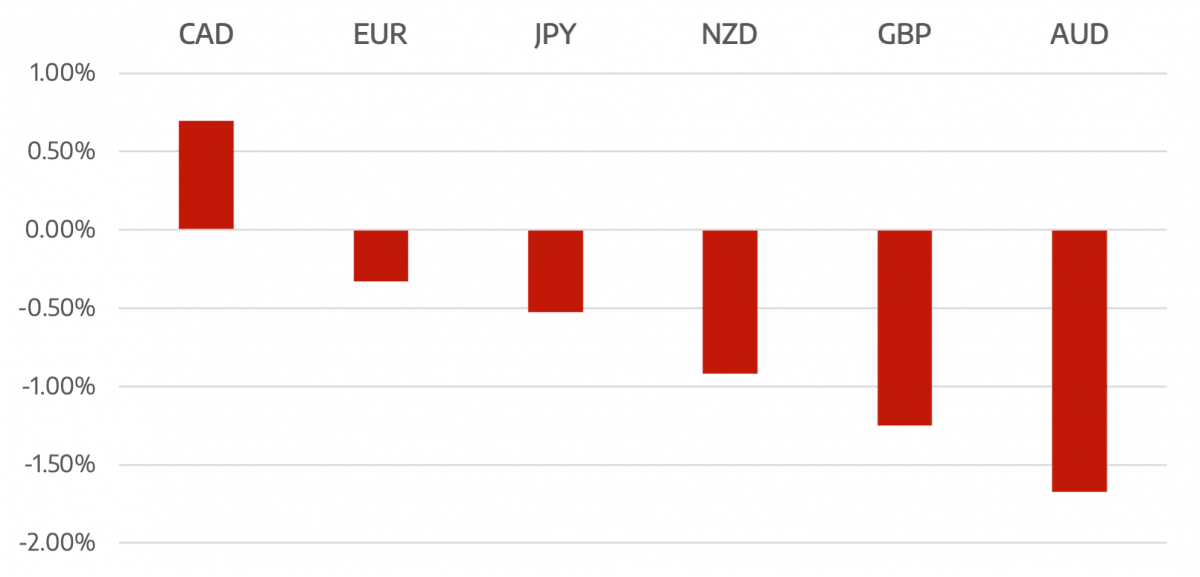

Central banks pushed back against the markets hawkish interest rate expectations last week. RBA started the week and set the tone. While ending the yield curve control, any decision to raise interest rats in 2022 was called a complete overreaction. This pushed AUD to be the worst performer of the week.

However the largest surprise came from the BOE not rising rates in their announcement later in the week. The market had priced in a 15bps rate rise and a further 25bps rise in December after announcement earlier that monetary policy will have to act. the market has now priced in a 25bps rise in December.

The EUR continued its downward momentum only regaining some of its poise late on Friday. However EUR is still expected to continue its fall vs the USD. The Fed meeting last week continued the dovish tone from the Central Bankers, with any potential rate rise into mid to late 2022.

Aster the busiest week in a while the markets will need some time to digest the central banks position. Data wise we have inflation and GDP data.

Weekly Majors Market Performance

What is Cromwell FX?

Cromwell FX is a quantitative FX manager offering superior risk adjusted returns. The portfolio is the most liquid pairs . The strategy is fully automated and adhere to strict rick management procedures to control leverage and position limits.

The post <h5>Cromwell FX Market View</h5> <h3>Central Bank Surprise?</h3> appeared first on JP Fund Services.

Tradersdna is a leading digital and social media platform for traders and investors. Tradersdna offers premiere resources for trading and investing education, digital resources for personal finance, market analysis and free trading guides. More about TradersDNA Features: What Does It Take to Become an Aggressive Trader? | Everything You Need to Know About White Label Trading Software | Advantages of Automated Forex Trading