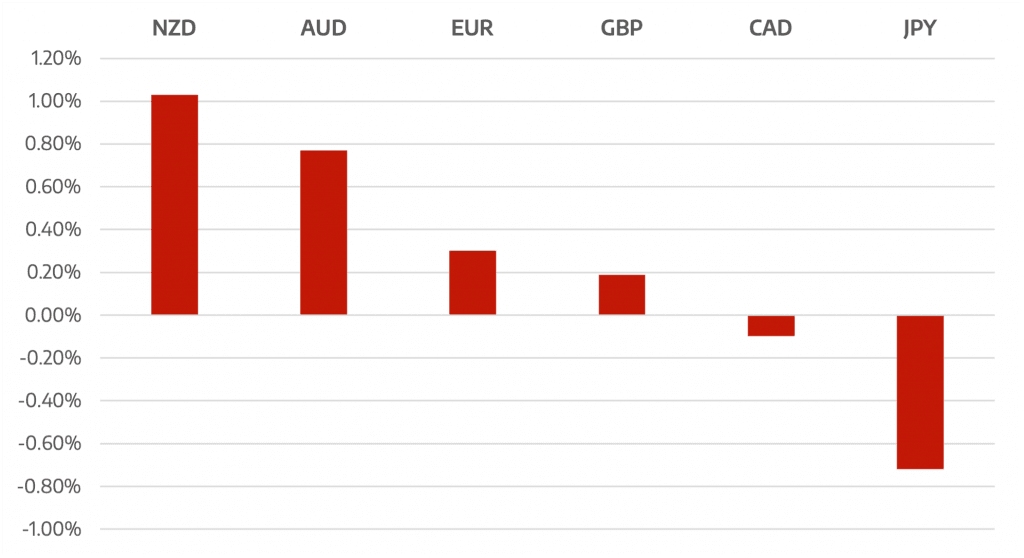

The US dollar drifted lower throughout the week continuing its negative correlation with risk assets. Optimism in risk assets meant the USD lost ground against commodity pairs such as NZD and AUD. Fed Chairman Powell spoke and he confirmed that the taper is coming with a base case start of November. We still see a firmer dollar market in place despite these headwinds given the anticipated growth and yield advantages.

Despite a general risk on move and oil prices continuing to climb, CAD lost ground during the week suggesting a degree of caution and some mild profit-taking setting in on the CAD ahead of next weeks BoC policy decision.

The week ahead sees top tier economic event risk from ECB, BoC and BoJ rate decisions. Markets will be watching how the central banks are viewing current inflationary trends. Friday sees Core PCE data from the US which is the Feds choice gauge of inflation.

Weekly Majors Market Performance

What is Cromwell FX?

Cromwell FX is a quantitative FX manager offering superior risk adjusted returns. The portfolio is the most liquid pairs . The strategy is fully automated and adhere to strict rick management procedures to control leverage and position limits.

Cromwell FX Market View

Dollar drifted as Fed taper all but confirmed

appeared first on JP Fund Services.

The post Cromwell FX Market View Dollar drifted as Fed taper all but confirmed first appeared on trademakers.

The post Cromwell FX Market View Dollar drifted as Fed taper all but confirmed first appeared on JP Fund Services.

The post Cromwell FX Market View Dollar drifted as Fed taper all but confirmed appeared first on JP Fund Services.