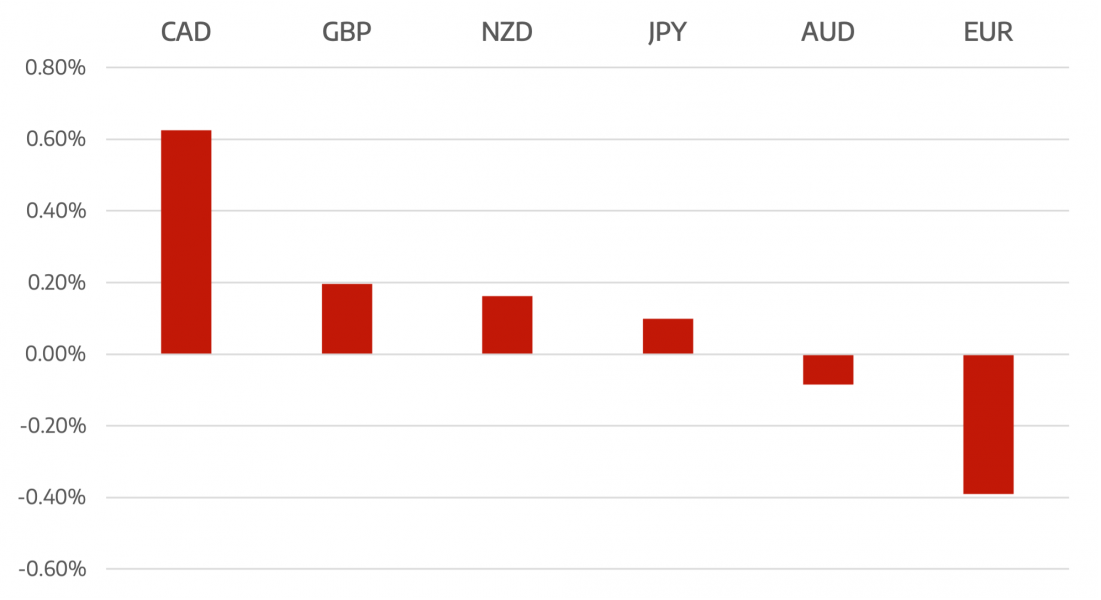

The week saw a slew of central banks reporting surprises. The Fed indicated that next year there will be up to 3 interest rate rises, followed by the Bank of England raising interest rates. Then the ECB reported in less dovish tones than the market expected

Eventually it took a late sell off in stocks on Friday for the US Dollar to shine through.

Canada Dollar was the worst performer as Oil prices failed to find any direction and short term rate spreads contracted dramatically.

Markets still have a growing undertone of Omicron concerns and if / when further restrictions maybe brought in coupled with continued inflationary pressures. Central banks are beginning to have their hand forced in dealing with inflation concerns.

The week ahead has less economic data as the last trading week before the festive break. The markets will be thin on volume so Omicron headlines and further restriction could lead to increased volatility

Merry Christmas all.

Weekly Majors Market Performance

What is Cromwell FX?

Cromwell FX is a quantitative FX manager offering superior risk adjusted returns. The portfolio is the most liquid pairs . The strategy is fully automated and adhere to strict rick management procedures to control leverage and position limits.

The post <h5>Cromwell FX Market View</h5> <h3>Dollar Shines… Eventually</h3> appeared first on JP Fund Services.

Tradersdna is a leading digital and social media platform for traders and investors. Tradersdna offers premiere resources for trading and investing education, digital resources for personal finance, market analysis and free trading guides. More about TradersDNA Features: What Does It Take to Become an Aggressive Trader? | Everything You Need to Know About White Label Trading Software | Advantages of Automated Forex Trading