Last week saw the US Dollar finally move lower after several strong weeks. With inflation remaining high and mixed economic data markets saw no clear path for accelerated tightening by the Fed in the upcoming meeting.

Euro moved higher and away from parity as the ECB surprised the market with a 50bps rate hike. The market was expecting a 25bps but the initial gains were soon lost as the press conference gave more questions than answers in terms of guidance going forward.

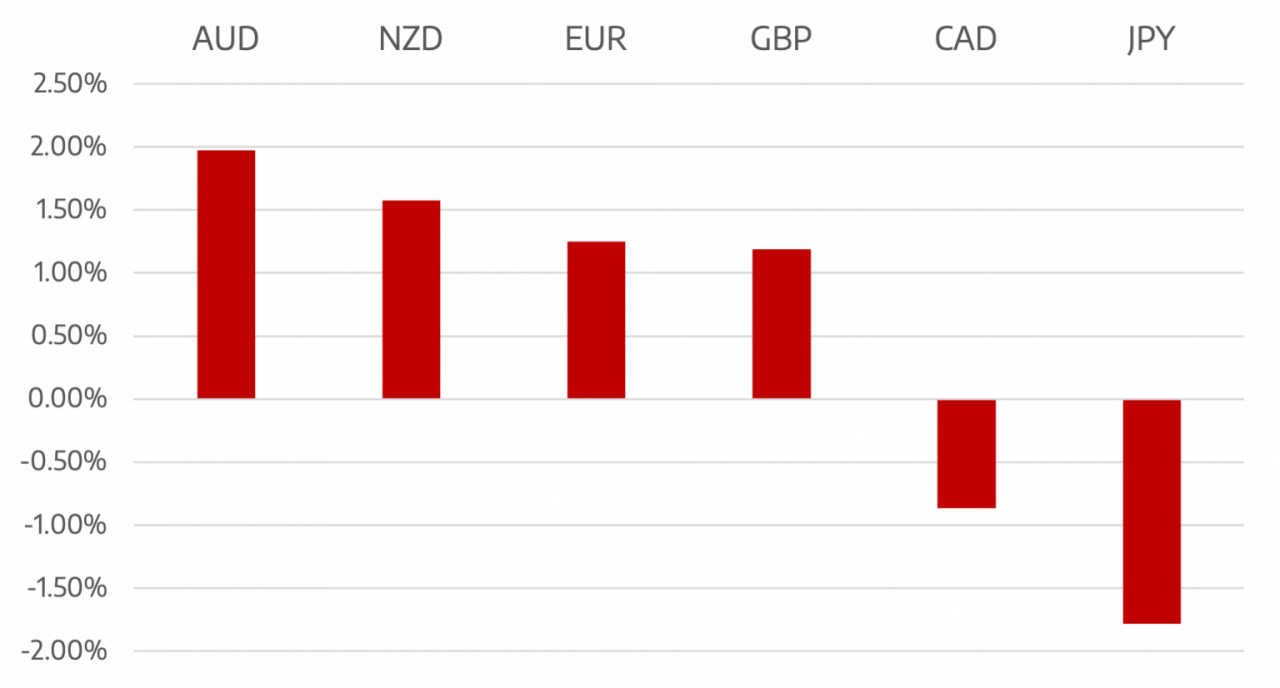

GBP gained as both Inflation PMI numbers beat expectations. The GBP saw a 1% rally but the currency still remains very fragile.

Stocks at last had a positive week and took risk currencies with it. NZD and AUD were the best performers on the week as correlation to stocks remains tight.

Oil prices continued to fall. Oil has lost nearly 25% from the June highs. WTI lost 2.5% to close around $95.

The week ahead will be dominated but the US and Federal Reserve with the markets looking to understand where the rate hike cycle ends…

Weekly Majors Market Performance

What is Cromwell FX?

Cromwell FX is a quantitative FX manager offering superior risk adjusted returns. The portfolio is the most liquid pairs . The strategy is fully automated and adhere to strict rick management procedures to control leverage and position limits.

The post

Cromwell FX Market View

ECB Surprise

appeared first on JP Fund Services.

Read More:

business development manager skills

how to get personal loans with income verification?