As further news and statistics on the newly discovered Omicron variant were being digested by traders Fed Chair Powell stirred up the markets further, by talking up faster tapering. Although early signs are the new variant is less severed markets remained risk averse preferring to wait for any news before looking to rally.

The S&P ended the week down 1%, its worst week since October 2020, while oil has dropped almost 25% since November 10th.

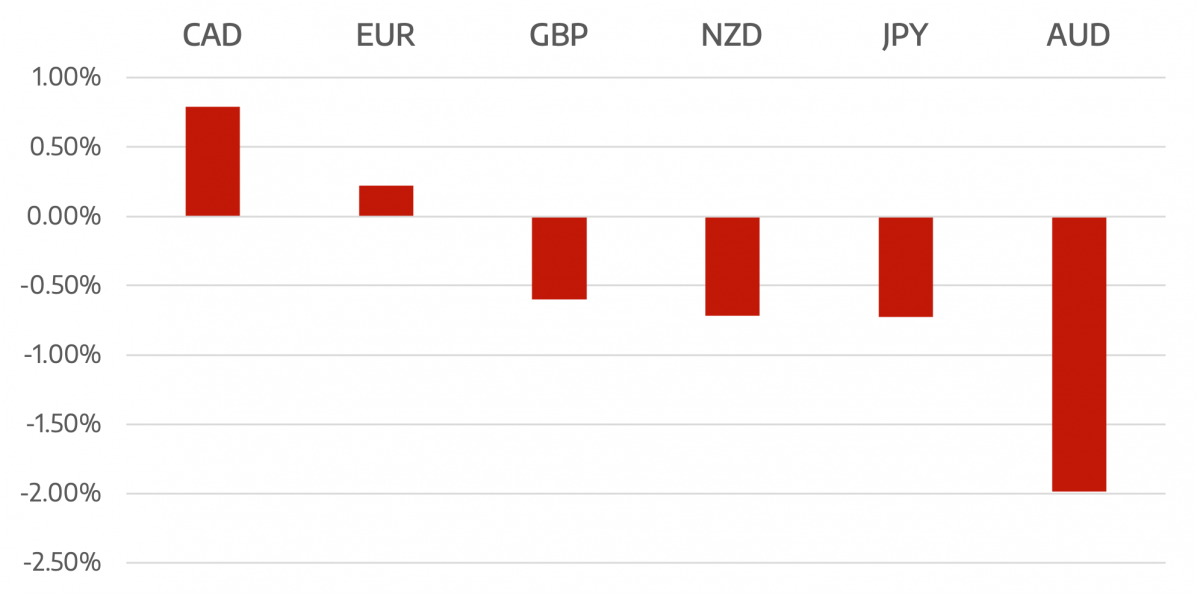

Australian Dollar was the worst performer, followed by New Zealand Dollar and then Sterling. Current developments suggest that for the near term, there will be more downside in stocks and more so in yield. Yen will likely to outshine the others.

Last week saw the us non-farm payrolls released. The headline print was way below forecast at +210,000 vs +550,000 expected. However, the Unemployment Rate fell from 4.6% to 4.2% ,with an increase in the participation rate. But this data will matter little to the FOMC when they meet in 2 weeks.

The week ahead sees RBA and BOC meet to discuss monetary policy. The RBA is expected to remain on hold after dropping the yield curve control program at the November meeting. The BoC surprised markets at their October meeting by ending its QE program.. Although unlikely to raise rates at this meeting forward guidance will be key as traders look for clues how they will navigate inflationary pressures in 2022.

Weekly Majors Market Performance

What is Cromwell FX?

Cromwell FX is a quantitative FX manager offering superior risk adjusted returns. The portfolio is the most liquid pairs . The strategy is fully automated and adhere to strict rick management procedures to control leverage and position limits.

The post <h5>Cromwell FX Market View</h5> <h3>Fed Look To Taper And Omicron Nervous Markets</h3> appeared first on JP Fund Services.

Tradersdna is a leading digital and social media platform for traders and investors. Tradersdna offers premiere resources for trading and investing education, digital resources for personal finance, market analysis and free trading guides. More about TradersDNA Features: What Does It Take to Become an Aggressive Trader? | Everything You Need to Know About White Label Trading Software | Advantages of Automated Forex Trading