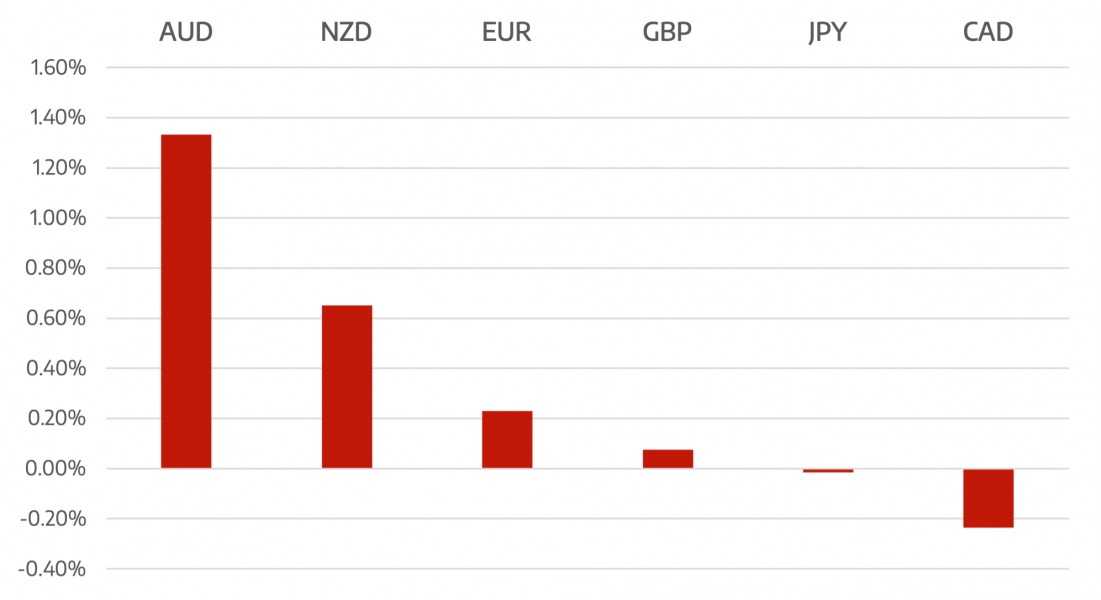

FX markets were mixed but the general theme of risk on returned as investors temporarily put Omicron fears behind them. Commodity currencies were strongest but moves seemed more corrective.

the USD remained range bound vs European majors and Yen. With additional restrictions being introduced in the UK Sterling came under pressure but soon reversed as follow through selling evaporated.

Crude oil prices soared, with WTI seeing its best 5-day gains since late August lifting commodity backed currencies through the week. Australian dollar saw its best weekly gain vs the US Dollar since August.

Central banks from the world’s largest economies meet this week. All eyes are on the Fed, where traders will be tuning in for their economic projections and decision on whether or not policymakers will speed up the pace of tapering asset purchases. The European Central Bank, Bank of England and Bank of Japan are also on top for the Euro, British Pound and Japanese Yen respectively. Commentary on their views on inflation will be in focus.

Weekly Majors Market Performance

What is Cromwell FX?

Cromwell FX is a quantitative FX manager offering superior risk adjusted returns. The portfolio is the most liquid pairs . The strategy is fully automated and adhere to strict rick management procedures to control leverage and position limits.

The post <h5>Cromwell FX Market View</h5> <h3>Markets Put Omicron Behind Them. Temporarily?</h3> appeared first on JP Fund Services.

Tradersdna is a leading digital and social media platform for traders and investors. Tradersdna offers premiere resources for trading and investing education, digital resources for personal finance, market analysis and free trading guides. More about TradersDNA Features: What Does It Take to Become an Aggressive Trader? | Everything You Need to Know About White Label Trading Software | Advantages of Automated Forex Trading