Another volatile week as Central Bank hawkishness came to the fore. Traders had seen the Fed being Hawkish for sometime but last week was the turn of the BoE and ECB.

The ECB acknowledged inflation is not transitory and their comments moved in a far more hawkish direction. President Christine Lagarde declined to repeat her guidance that rate hike was “very unlikely” this year. Then, Governing Council member Olli Rehn was quoted on Friday that “if there are no setbacks in the pandemic or the geopolitical situation, it would logical for the ECB to hike its key interest rate at latest next year.” Markets are now expecting the deposit rate to be raised from the current -0.50% to 0.00% by year end

The BoE also surprised during the week. The 25bps rate rise was expected but the split of 5-4 with 4 members voting for a 50bps rate rise was unexpected sending the GBP higher.

Friday saw a much stronger than expected non-farm payrolls report which saw large job growth and faster wages growth.

Oil remains simply unstoppable, as it registered its seventh consecutive positive week with a move of over +30%. Shorts continue to get burnt as supply chain issues keep prices elevated. Last week WTI rallied another 5.4% to close the week at $91.95 and is now gunning for triple-digit levels.

The week ahead is relatively quiet data wise with traders mostly digesting the previous weeks news.

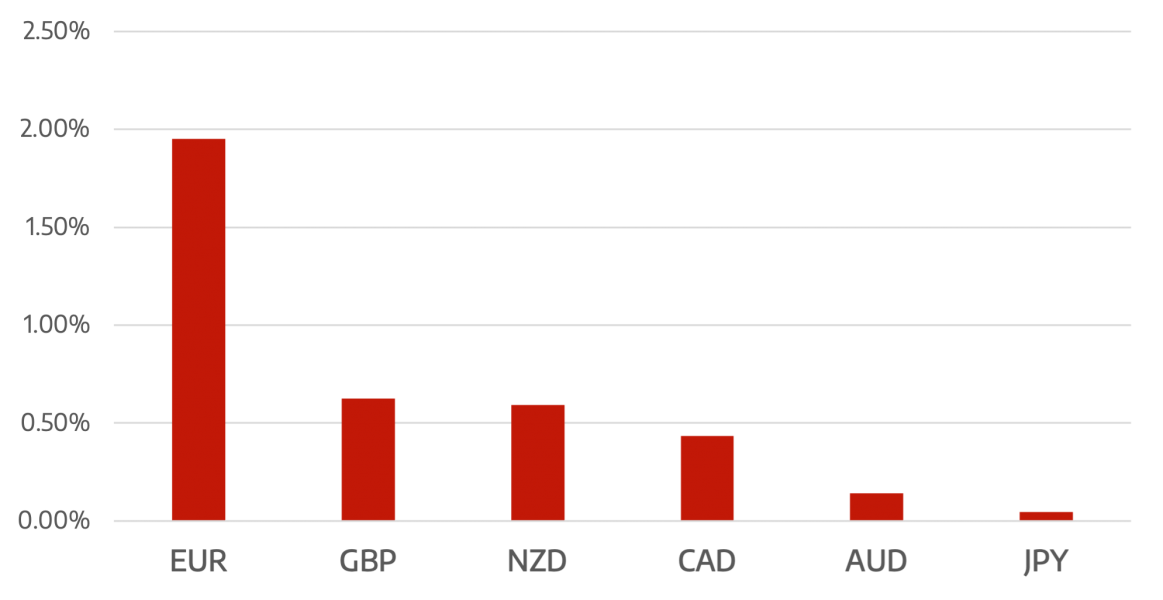

Weekly Majors Market Performance

What is Cromwell FX?

Cromwell FX is a quantitative FX manager offering superior risk adjusted returns. The portfolio is the most liquid pairs . The strategy is fully automated and adhere to strict rick management procedures to control leverage and position limits.

The post <h5>Cromwell FX Market View</h5> <h3>Surprise Hawkish ECB</h3> appeared first on JP Fund Services.

Tradersdna is a leading digital and social media platform for traders and investors. Tradersdna offers premiere resources for trading and investing education, digital resources for personal finance, market analysis and free trading guides. More about TradersDNA Features: What Does It Take to Become an Aggressive Trader? | Everything You Need to Know About White Label Trading Software | Advantages of Automated Forex Trading