Last week saw the FED rise interest rates by the expected 75bps. The big surprise was the comments post meeting. The markets had priced in further interest rates through to end of 2022. The comments coming out where that the Fed will be more data driven potentially signalling a slow in rate rises.

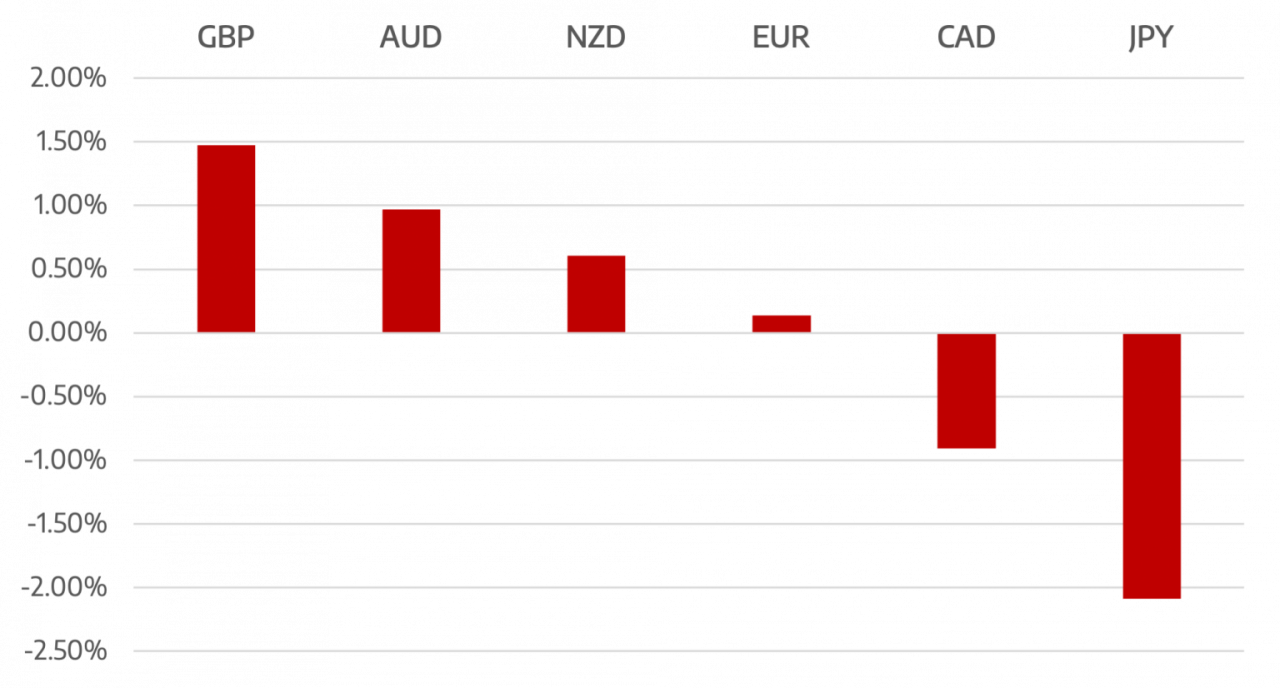

Euro failed to deliver any follow through from the previous week and the ECB meeting. This will concern those long the single currency. Eurozone CPI and GDP beat expectations but again this failed to lift the euro from around flat on the week.

GBP gained as a week of light data meant the currency was left to its own devices. The GBP still looks to trade heavy and it seems hard to find any conviction to be bullish the currency. The BoE rate decisions this week will be an important release with the market pricing in a 25bps rise. Could the BoE do 50bps?

Commodity currencies were strong as stock markets embraced the Fed comments and risk rallied across the board. The correlation remains strong between these. AUD, NZD and CAD all rallied around 1% over the week.

Oil prices had traded lower over the last couple of weeks but rallied almost 3.5% to end the week at $98.28

The week ahead is busy on economic releases with BoE and RBA interest rate releases along with a number of PMI releases.

Weekly Majors Market Performance

What is Cromwell FX?

Cromwell FX is a quantitative FX manager offering superior risk adjusted returns. The portfolio is the most liquid pairs . The strategy is fully automated and adhere to strict rick management procedures to control leverage and position limits.

Cromwell FX Market View

The FED to be more data driven

appeared first on JP Fund Services.