Last week was a volatile week as UK politics came to a head with Prime Minster Truss resigning and a shortened selection process implemented. USD hit 150 vs the Yen which saw the Bank of Japan intervene once more. Yen moved from 150 down to 145.50 only to move back towards the 149 level.

Euro had a mixed week ended the week slightly stronger. CPI came in at 9.9% which was slightly lower than expected but remains at highly elevated levels.

GBP is reluctant to show any direction and spent the week being moved by political headlines hour by hour almost. If as expected Rish Sunak is the next Prime Minister GBP should outperform as he is seen as more market friendly. There is an outside risk that we do go to a General Election which could cap any upside potential.

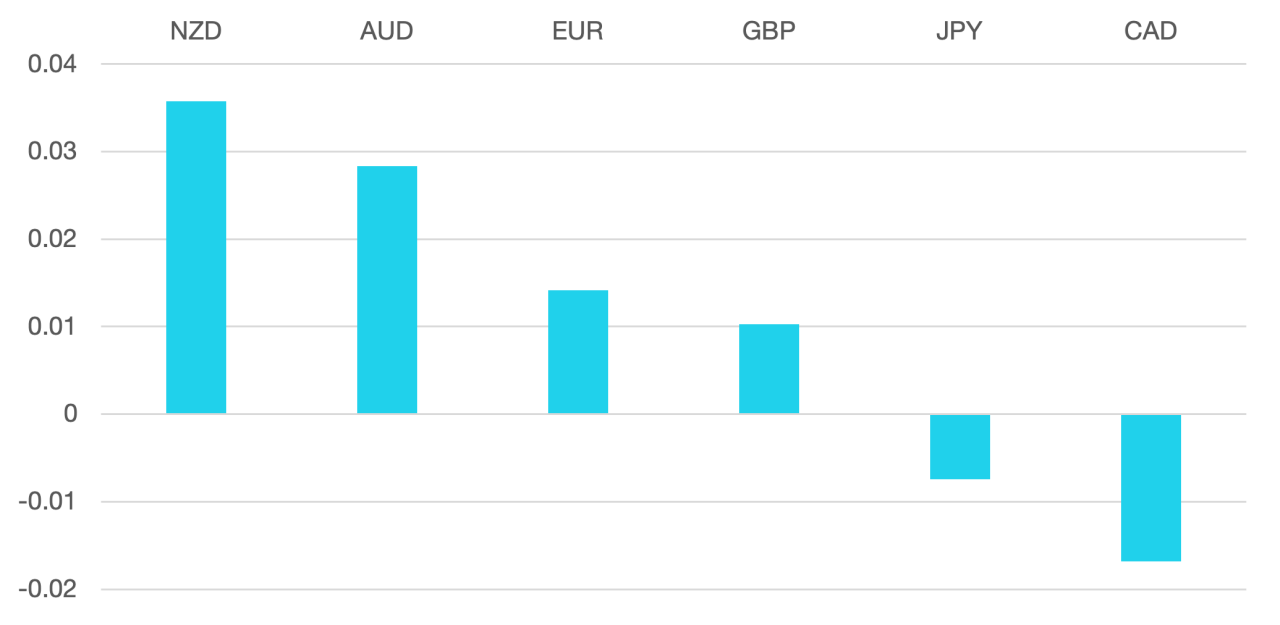

Commodity currencies finally arrested the slide as risk assets rallied. AUD and NZD both gained around 3% vs the US Dollar.

Oil prices continue to look for support. given the supply situation a medium term move back to $100 could be possible but in the short term WTI fell 0.6%.

The week is the last week of October and moving ever closer to the next round of Interest Rate decisions. The market could be more defensive as the markets look towards the Fed rate decision of next week.

Weekly Majors Market Performance

What is Cromwell FX?

Cromwell FX is a quantitative FX manager offering superior risk adjusted returns. The portfolio is the most liquid pairs . The strategy is fully automated and adhere to strict rick management procedures to control leverage and position limits.

Cromwell FX Market View

Truss Resigns BoJ Intervenes

first appeared on trademakers.

The post Cromwell FX Market View Truss Resigns BoJ Intervenes first appeared on JP Fund Services.

The post Cromwell FX Market View Truss Resigns BoJ Intervenes appeared first on JP Fund Services.