It seems not a week goes by without some level of event driven volatility. Late in the week rumours of Russia / Ukraine escalation saw Euro move lower. Oil surged to a new 7 year high and Equities lost ground. In the background we still see the Fed tightening rates ahead.

Investors were concerned that a Russian invasion of Ukraine could begin any time. US urged their citizens to leave Ukraine right away, and that was followed by a wave of other nations including the UK, Japan, Latvia, Norway, Netherlands, Australia and New Zealand.

Last week saw higher than expected US CPI which at 7.5% surpassed market expectation. Different from the previous 2015-2018 rate-hike cycle, inflation is much higher this time due to unprecedented monetary and fiscal stimulus put in place to shore up growth amid the Covid-19 pandemic Labour market conditions have improved tremendously in recent months, with the latest nonfarm payrolls report showing a robust increase in job numbers and solid wage growth.

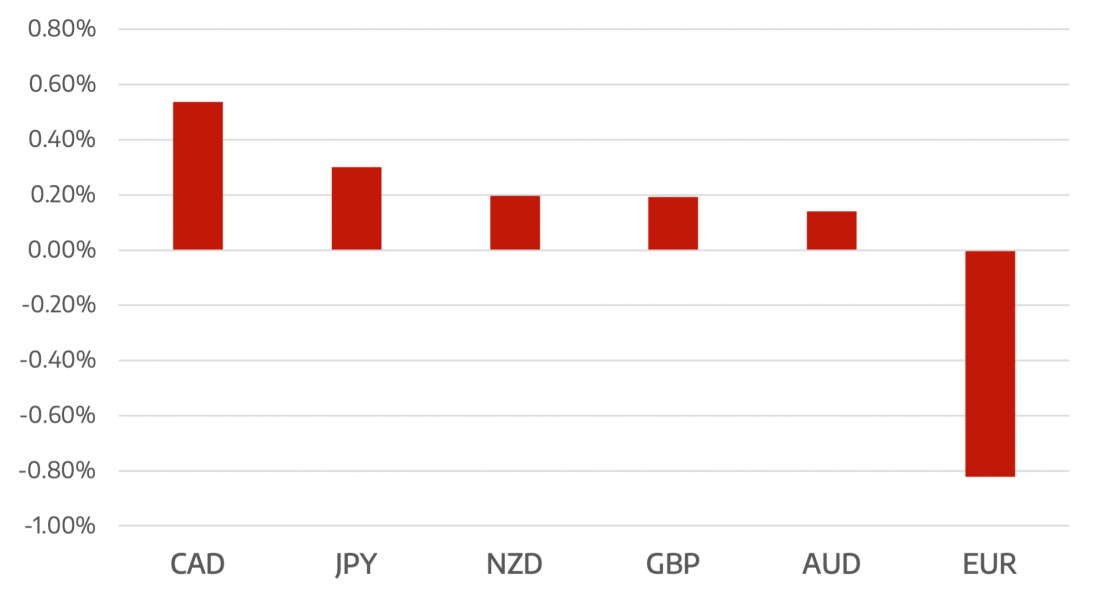

Euro was the worst performer as the USD gained momentum and the continued risk of Russia/Ukraine weighed heavily on the single currency

The week ahead is looking at the geopolitical situation in Ukraine. Should Russia pull back we will see the potential for some level of risk on, but don’t forget inflation and central bank tightening is still very much on the horizon.

Weekly Majors Market Performance

What is Cromwell FX?

Cromwell FX is a quantitative FX manager offering superior risk adjusted returns. The portfolio is the most liquid pairs . The strategy is fully automated and adhere to strict rick management procedures to control leverage and position limits.

The post <h5>Cromwell FX Market View</h5> <h3>Ukraine in Focus</h3> appeared first on JP Fund Services.

Tradersdna is a leading digital and social media platform for traders and investors. Tradersdna offers premiere resources for trading and investing education, digital resources for personal finance, market analysis and free trading guides. More about TradersDNA Features: What Does It Take to Become an Aggressive Trader? | Everything You Need to Know About White Label Trading Software | Advantages of Automated Forex Trading