The ongoing military build-up in eastern Europe continued to dominate the market headlines. In the early stages of the week there was general optimism about the situation, with risk rallying on hopes of the situation getting diffused. However, in the latter part of the week the fear of escalation returned, and risk assets got sold.

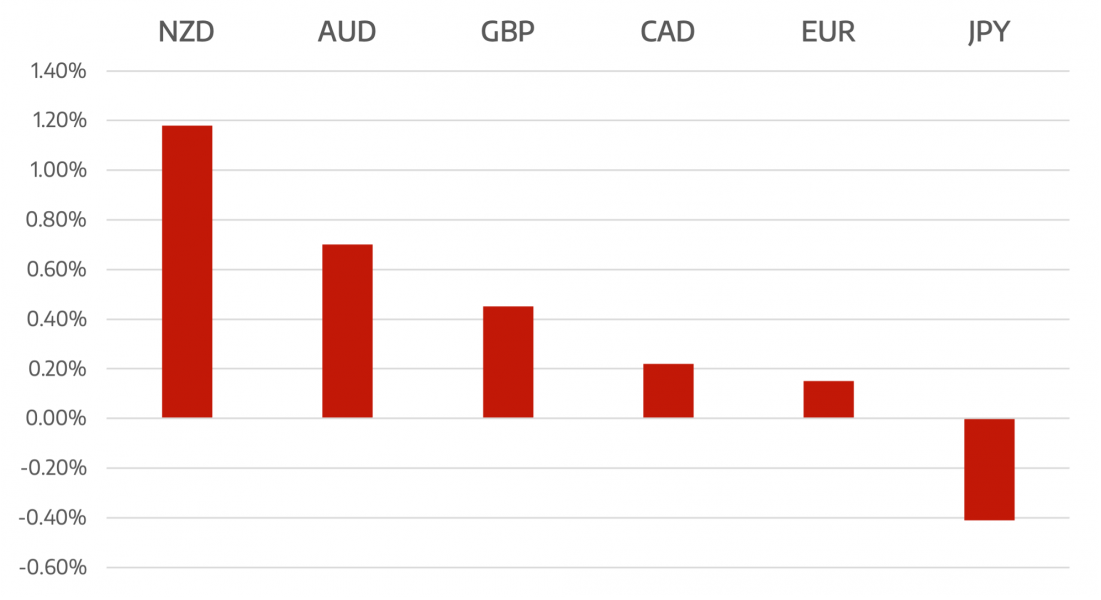

Commodity currencies which usually trade in line with risk but last week was an exception. AUD and NZD both performed well. Oil had a negative week but this could be a pause before moving closer to $100/bbl.

Most EM currencies strengthened against the dollar this week, despite the generally risk-off tone in global markets, continued high commodity prices meant currencies of commodity exporters faired the best.

Next week sees several economic data releases, but it’s likely that they will be overshadowed by the developments in the Ukraine. The US government seems to believe that a Russian invasion is very likely, and this will probably put yet more pressure on risk assets. We have several PMI releases, the RBNZ interest rate decision, as well as the US GDP and PCE.