Last week the US Dollar closed significantly stronger as the previous weeks risk on rally lost its steam and yields rose once again. US Dollar surged as investors adjusted their expectations. With much more data releases before the next FOMC meeting expectations of continued rate rises once again took the fore.

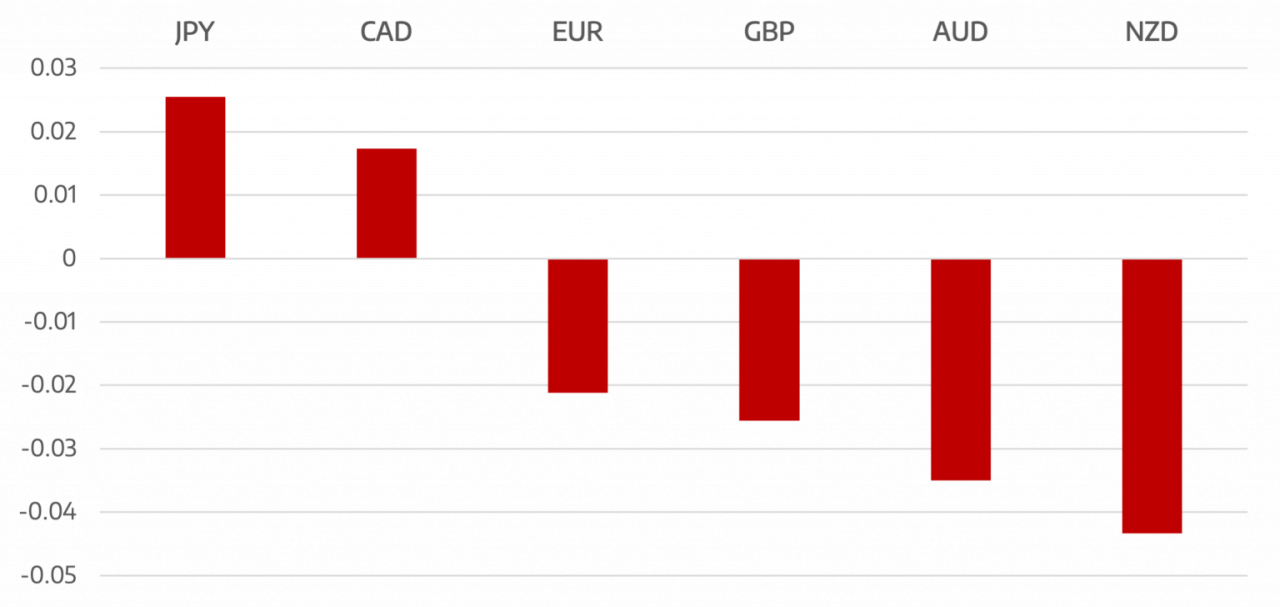

Both the GBP and EUR are still struggling with their own problems. This also continued to contribute to the USD strength. The DXY had its best week of 2022 which led to the USD being the nicest house in a bad neighbourhood. EUR fell by -2.13%, GBP dropped by -2.54%, and JPY rallied +2.54%. The onus for more USD strength in the days ahead falls squarely on the shoulders of the Federal Reserve.

Commodity currencies had a terrible week. With NZD ending the week the worst performer. This was despite the hawkish RBNZ rate rise. The Australian Dollar plummeted more than 3% against the US Dollar over the week, dragging AUD to its lowest level since July 21.

Oil prices had a quiet week with WTI showing little change closing around the $91 level again.

The week ahead continues to be busy and the lower than normal summer volumes could create some volatility. Most important we have the Jackson Hole symposium though Fed Chair Powell may offer little direction for the following week.

Weekly Majors Market Performance

What is Cromwell FX?

Cromwell FX is a quantitative FX manager offering superior risk adjusted returns. The portfolio is the most liquid pairs . The strategy is fully automated and adhere to strict rick management procedures to control leverage and position limits.

Cromwell FX Market View

USD The Nicest house in a bad neighbourhood

appeared first on JP Fund Services.