What is Crypto day trading and what are its characteristics? What are the best crypto day trading strategies? What tools and techniques leverage crypto day traders? Learn all about crypto day trading in this detailed guide.

Crypto day trading is a trading strategy that involves opening and closing cryptocurrency positions within a single trading day. It is often referred to as intraday trading because all trades are concluded before the day ends.

Day traders seek to profit from short-term price fluctuations, leveraging the volatility of the cryptocurrency market. This method distinguishes itself from other trading styles, such as swing or position trading, by its focus on immediate price movements rather than long-term trends.

Unlike traditional stock markets, cryptocurrency markets operate continuously, 24 hours a day, 365 days a year. This constant availability eliminates regional trading sessions and allows day traders to define their trading day based on a 24-hour cycle, often aligned with Universal Coordinated Time (UTC).

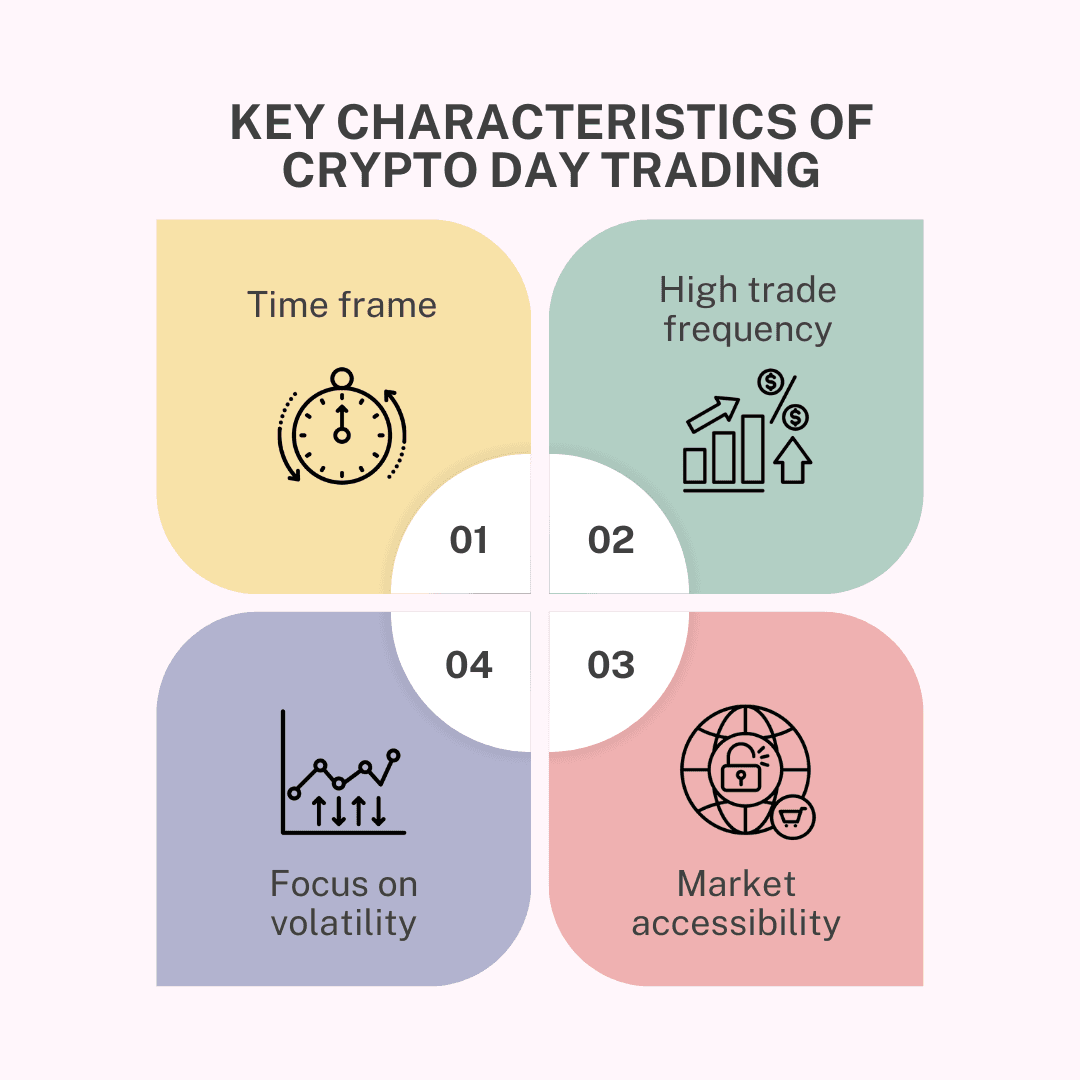

Key characteristics of crypto day trading

- Time frame: Day traders operate within brief time frames, ensuring that all positions are closed within the same trading day. This practice helps mitigate overnight risk, which can arise from unexpected market events while markets are closed in traditional trading.

- High trade frequency: Day traders frequently execute multiple trades in a single day. Depending on the strategy, this can range from a handful of trades to over twenty trades daily, taking advantage of small price movements.

- Focus on volatility: The inherent volatility of cryptocurrencies, characterised by rapid price swings, makes them ideal for day trading. Popular cryptocurrencies like Bitcoin (BTC) and Ethereum (ETH) often exhibit the high liquidity and significant price fluctuations needed for effective day trading.

- Market accessibility: Day traders primarily use centralised exchanges such as Binance, Kraken, or Coinbase. These platforms offer robust trading tools, including advanced charting, multiple order types, and real-time market data, facilitating swift and efficient trading.

Choosing cryptocurrencies for day trading

- Liquidity and volatility: Highly liquid assets with significant daily price ranges are generally favoured by day traders. Liquidity ensures that orders can be executed quickly without causing substantial price changes, while volatility provides opportunities for short-term gains.

- Personal compatibility: Traders often select assets that align with their risk tolerance and trading style. While some cryptocurrencies exhibit high volatility and rapid price changes, others move more steadily, requiring a different strategic approach.

- Exchange support: The chosen cryptocurrency must be supported by the trader’s preferred platform. This ensures access to necessary trading pairs, tools, and reliable execution of orders.

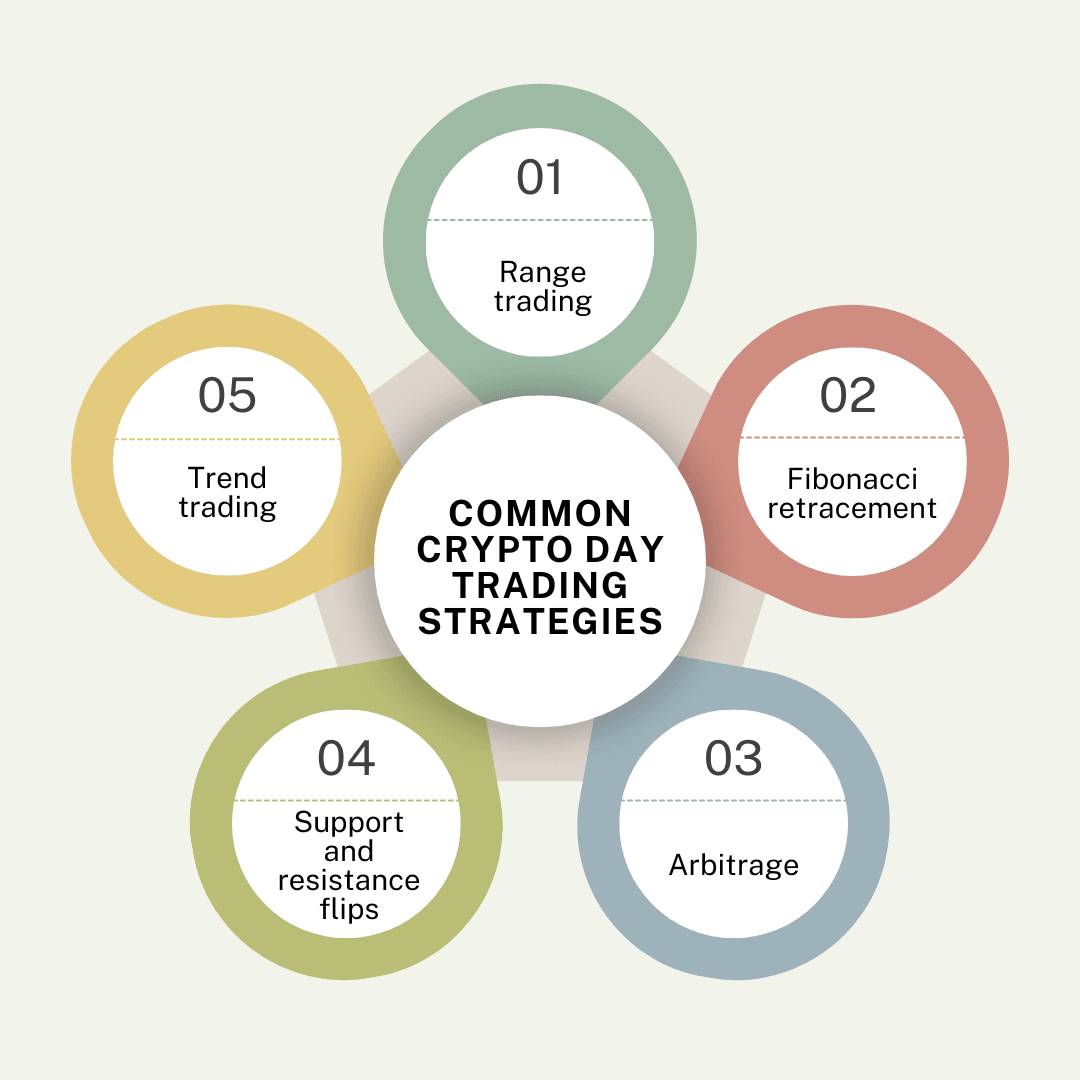

Common crypto day trading strategies

- Range trading: Involves identifying a range where an asset’s price oscillates between a defined support and resistance level. Traders aim to buy at support levels and sell at resistance, profiting from the predictable price movements within the range.

- Fibonacci retracement: Utilises Fibonacci retracement levels to identify potential reversal points on a chart. Traders overlay these levels to identify where the market may pivot, focusing on levels such as 23.6%, 38.2%, and 61.8%.

- Arbitrage: Exploits price discrepancies of the same asset across different exchanges. For example, buying an asset at a lower price on one exchange and selling it at a higher price on another.

- Support and resistance flips: Based on the idea that once a price breaks through a resistance level, it may become a support level. Traders wait for the price to retest the level and enter a trade when the price confirms the flip.

- Trend trading: Focuses on trading in the direction of a prevailing trend. Trend lines and other technical indicators are used to identify the direction and strength of the trend, allowing traders to define entry and exit points.

Challenges of crypto day trading

- High volatility: Cryptocurrencies are known for their dramatic price swings, which can be both an opportunity and a risk. Traders must be adept at handling rapid market changes to avoid significant losses.

- Emotional discipline: Day trading requires exceptional emotional control. Traders must accept losses as part of the process and avoid letting emotions dictate decisions.

- Transaction costs: Frequent trading results in higher transaction fees. These costs can erode profits, especially for traders who execute a large number of trades daily.

- Learning curve: Becoming a consistently profitable day trader requires extensive study, backtesting, and practice. The high failure rate among day traders underscores the difficulty of mastering this trading style.

Tools and techniques for crypto day trading

- Technical analysis: Utilises indicators like moving averages, Relative Strength Index (RSI), and Bollinger Bands to identify trends and entry points.

- Candlestick charts: Visualise price action, helping traders identify patterns and potential reversals.

- Time frames: Lower time frames, such as one-minute or five-minute charts, are commonly used to analyse short-term movements.

- Order types: Limit orders allow traders to specify prices for execution, while market orders prioritise speed.

- Risk management tools: Online calculators help determine position sizes and risk levels to prevent overexposure.

Final thoughts

Crypto day trading offers opportunities to profit from the dynamic and volatile cryptocurrency market. However, it is a high-risk endeavour requiring advanced skills in technical analysis, risk management, and emotional discipline. While the potential for rapid gains is enticing, the high failure rate underscores the need for thorough preparation and a cautious approach. Aspiring traders should practise extensively with demo accounts, refine their strategies, and adopt a disciplined mindset before committing real capital.

Read More:

Himani Verma is a seasoned content writer and SEO expert, with experience in digital media. She has held various senior writing positions at enterprises like CloudTDMS (Synthetic Data Factory), Barrownz Group, and ATZA. Himani has also been Editorial Writer at Hindustan Time, a leading Indian English language news platform. She excels in content creation, proofreading, and editing, ensuring that every piece is polished and impactful. Her expertise in crafting SEO-friendly content for multiple verticals of businesses, including technology, healthcare, finance, sports, innovation, and more.