- Dashboard informs traders of volumes and when they exceed norms and if this underpins price fluctuations

- Constant news feed providing updates that could potentially impact prices

- Long/short ratio graph to identify differences in supply and demand

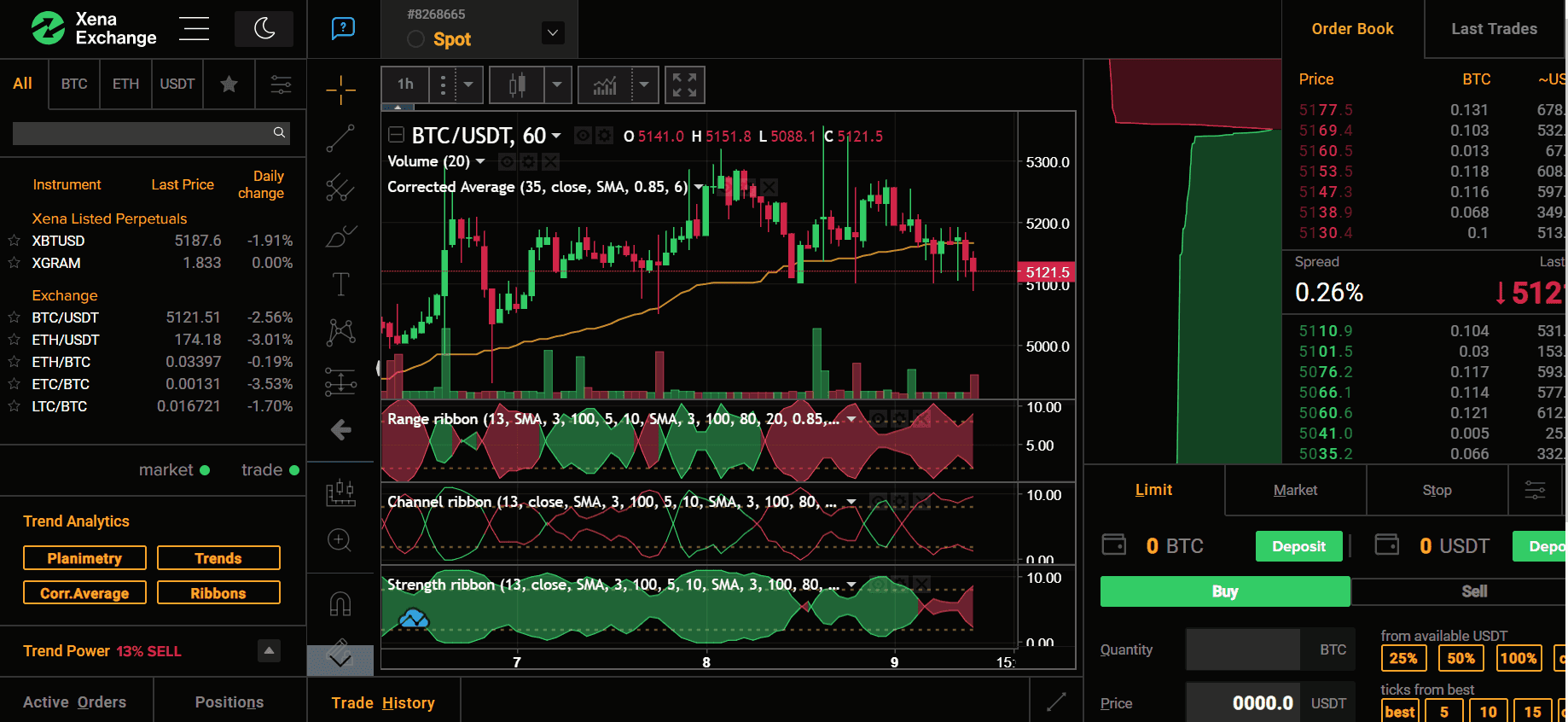

Xena Exchange announced the launch of its product Xena Market Barometer. The barometer is a 360-degree analytics tool that aggregates data from the biggest digital-asset exchanges and represents it in unique graphs assembled in one place. The first eight indicators are already live and are free to use. The Xena Market Barometer combines numerous data sources and uses complicated processing algorithms to display information in an easy-to-understand format. All data sources can be divided into three categories: live trades and order books from major cryptocurrency exchanges, blockchains, and media.

The first version collects live data from Huobi, Coinbase Pro, Bitstamp, Bitfinex and can be used by active traders to assess the direction of possible price moves in the short term. Charts show support and resistance levels calculated using live order books and the profile of volumes traded at different price levels.

The Xena Market Barometer is designed to keep a pulse on the market and optimize the trading process, while reducing the number of monitors needed for efficient trading in order to save traders’ time, money, and nerves.

Anton Kravchenko, CEO Xena Exchange said: “Traders are overloaded with big data they need to interpret in the right way. They need to constantly switch from one monitor to another, searching for the right signal or pattern. This results in stress, and stress results in mistakes. The Xena Market Barometer is meant to make the analytics ergonomic and provide the trader with all the information they seek on one dashboard.”

The company also mentioned recently that in the next few months, it plans to expand the number of graphs available. Currently, all the information is available completely free of charge, but in the future, some advanced tools may become available only for those who purchase a subscription.

Xena Exchange was founded by previous employees of well-known investment banks and technology companies such as J.P. Morgan, Deutsche Bank, UBS, Russian Stock Exchange, Kaspersky Labs, and others. The Xena Exchange team has significant industry experience, including combined totals of 45 years of FICC, equities and derivatives trading; 25 years of risk management; 110 years of software development; and 35 years of finance-related institutional security in both DevOps and cryptography.

Tradersdna is a leading digital and social media platform for traders and investors. Tradersdna offers premiere resources for trading and investing education, digital resources for personal finance, market analysis and free trading guides. More about TradersDNA Features: What Does It Take to Become an Aggressive Trader? | Everything You Need to Know About White Label Trading Software | Advantages of Automated Forex Trading