George McDonaugh, Managing Directors and Co-Founder of publicly listed cryptocurrency and blockchain investment firm KR1, provides his insights into what to look out for in the cryptocurrency and blockchain space in 2020, focusing on Facebook’s Libra, the central bank digital currencies and China, including price predictions of Bitcoin.

Facebook’s Libra, Twitter, Nation-Backed Digital Currencies, China and Other Macro Trends

Let’s look at some macro trends circling the esoteric inner core of this ongoing technological revolution. First up there’s Facebook’s Libra, which currently is a swirling mass of confusion. It’s clearly become a major part of the world’s biggest social media giant’s roadmap and they’re throwing a lot of resources at it. For crypto generally, it’s a huge affirmation of the technology and has been utterly out of the realms of expectation just a few years ago. As expected, however, with an entity as big as Facebook, Libra got the world’s major power structures hot under the collar, given that a ‘global stablecoin’, accessible to billions of people around the world, goes straight after government’s grip on monetary policy, which is effectively like trying to wrestle away the ultimate superpower of state.

The major nation state in question, the US, responded by calling those responsible to a hearing where officials, that clearly never read the briefing on what Libra is trying to be, shouted totally irrelevant questions to the treasonous upstarts, betraying the true aims of these hearings, which is to do nothing more than grandstand and bang a drum along party lines. If that wasn’t enough, they then fired off breathtakingly threatening letters to members of the Libra association with the clear intention of performing ‘audits’, which worked just as intended, with Visa, MasterCard, eBay and Stripe all quickly “stepping away” from their previous intention to join Facebook’s Libra network. In 2020, we will see this dance begin to intensify, most likely not only with Facebook but many other powerful players in different regions, think Uber, Grab in South East Asia, possibly Softbank in Japan, the already existing payment networks of WeChat and Alibaba in China and we’ll also see nation-states joining in the competition. Soon after this things will come to a head, perhaps in 2021 when Facebook and others will be forced to launch outside of the US, in smaller jurisdictions as pilot programs. This will hamper their ability to gain strong network effects and end up being the perfect talisman for why decentralisation, in the face of entrenched power structures, is the only way to proceed if the intent is to provide a new means of transacting value globally inclusive of the whole world.

What superpowers like the USA seemingly misunderstand is that although Facebook has lots of users, many more than Bitcoin, their power is already being whittled away by the very fact that permission-less, decentralised digital currencies, for the first time in history, provide a new option and choice for people to exit from centralised fiat currencies that have an average life expectancy of 27 years. It may take decades, but that paradigm shift is not going back in the bag. Jack Dorsey at Twitter has a much better grip on that power boiling away in the background and has just announced he’s set up a research team to investigate how to decentralise the entirety of his platform, Twitter as the decentralised protocol. Validation once again?

Perhaps another global institution that’s seen the light is the ECB, having set up a ‘Digital Currency Taskforce’ where doubtless they will spend most of 2020 eyeing Libra from afar, writing tomes on how fiat currency can work alongside digital decentralised currencies and how they’re going to create their own special crypto recipe to try and stem the ever-growing tide of permissionless stablecoin usage. This is no doubt what Christine Lagarde means by saying they plan to “get ahead of the curve” but in reality, to really get ahead, they’d have to decentralise themselves and that’s a tad hopeful perhaps.

The year 2020 will see yet more strange antics from the world’s most populated country. China is at the very heart of the Bitcoin ecosystem because the mining world, that secures the Bitcoin network with massive computing power, relies on cheap energy and a major percentage of the Bitcoin network’s mining farms find endless amounts of close to free energy, by camping out around the many nuclear power plants that service China’s massive ghost cities. But that’s not all! It’s going to get even stranger, as we watch China’s government battle with two sides of the same coin. They’re clearly enthralled by the prospect that a state run blockchain could bring a paradigm shift in its intent on surveilling its populace, but their desires to harness the technology might by necessity usher in a swathe of decentralised technologies that even the great firewall couldn’t keep at bay. Perhaps this technology is the ultimate trojan horse? Tune in for the next episode in 2020 when they release their state run DCEP ‘cryptocurrency’, take the vast spending data they’ll capture and add it into their citizen points scheme database and then triangulate all of this in real time with their pervasive facial recognition systems and hey presto, they go from 2020 to 1981 at the flick of a switch.

Market Overview

Now let’s explore what the future looks like through the lens of each of the main areas of the blockchain ecosystem. As we at KR1 see it, the areas of most interest are Bitcoin as a digital store of value, macro trends including Facebook’s Libra and other corporate or nation-state-backed currencies, the flourishing Ethereum ecosystem especially in Decentralised Finance (DeFi), specific competing projects to watch closely and the wonderful world of non-fungible tokens.

Bitcoin as a Digital Store of Value

As the Bitcoin narrative still forms the backdrop to the ecosystem, both in terms of new participants entering into the space and price action, let’s begin there. We’re at a critical stage in Bitcoin’s price trajectory. We had a parabolic rise from 2016 through to the end of 2017 with the price peaking at just under $20,000, followed by a 54 week bear market which saw close to an 87% retracement in price down to a value of $3200. This was the 4th such retracement since the birth of Bitcoin in 2009.

Between March and July 2019, we saw the pendulum swing back, with Bitcoin reaching just under $13,000, signalling an end to the bear market. Since then however we’ve had six months of sliding prices back to a low of $6,300 and this could well continue down to the $5,000 area towards the middle of January 2020. However, we think that with the clear over-enthusiasm that signalled the end of the bear market, combined with the strong fundamentals behind the scenes such as hashing power, transaction volume and new Bitcoin wallets being created, Bitcoin will most likely bounce back strongly from a steep dive in price and return to the $7,500 mark and then move higher into the middle of 2020. It’s important to understand that Bitcoin’s issuance model, with the halving coming up in May 2020, combined with a strong ‘digital gold’ narrative and the dominant ‘hard money’ philosophy of the asset, which maintains a very powerful set of ‘strong hands’ will create many boom and bust cycles, you could say they’re somewhat baked into the protocol by design.

The Flourishing Ethereum Ecosystem: The Future is in Decentralised Finance

Away from nation-state superpowers and Bitcoin, diving a little deeper into the technology, the area causing the most commotion and interest is Decentralised Finance (DeFi) on the Ethereum blockchain. The DeFi movement essentially is a suite of flourishing financial applications that allow for seamless interaction and interoperability with each other. It seems there is a new project launching every other day that is building on the composability with previously launched projects. As an example of the flow available to people who hold digital assets, you could use a token swap exchange such as Uniswap to exchange the volatile Ethereum (ETH) asset to a stablecoin, that is pegged to 1 USD by market forces such as Maker’s DAI, send it to a smart contract lending platform like Compound, where you can lend your assets and stablecoins out for a yield and then you could cover the value held in the lending platform smart contract with an alternative insurance provider such as Nexus Mutual. In essence, this is not dissimilar to using a peer-to-peer lender to loan out money you have and earn interest in return, plus a ‘decentralised’ stock market where one can exchange unlimited amounts of assets and a digital and ‘decentralised’ alternative to a specific insurance contract all in one.

All of this can be achieved in very little time, we’re talking seconds or minutes here, without any paperwork permisionlessly and at very little cost. As a testament to the growing use of that network, the USD value of assets locked up in Ethereum-powered DeFi applications crossed an all-time high of $700 million USD recently, despite the depressed market sentiment especially regarding Ethereum. We do not expect this trend to halt any time soon, in fact we foresee major uplifts in use as the underlying systems gain trust, the applications boost their numbers, improve their offerings and become more accessible to wider audiences. We look forward to watching 2020 continue to be the year where money legos connect together to build a financial fortress.

What’s New on the Radar? Cosmos, Polkadot and the Battle for Developers

Not mentioned so far, we’re seeing huge interest recently launched or soon-to-launch competing layer-1 blockchains, especially in the ‘interoperability’ or ‘application-specific’ blockchains ecosystems. In opposition to Bitcoin’s energy and computing-intensive Proof-of-Work, most of these platforms are Proof-of-Stake networks, where participants guarantee their truthful behaviour by putting up a financial deposit that is at risk instead of wasting computer resources and energy. Staking will be a major trend in 2020 and we’ve already seen Coinbase and Binance, the world’s largest exchanges move directly into the space. By staking assets, the process where tokens of value are used as collateral or deposit that is at risk, in return for securing the network and agreeing on transactions that happened, stakers are receiving a healthy yield. This system has become a core use case for digital assets in many projects but especially underpins two projects that we will see break new grounds over the next year, Cosmos and Polkadot. Both are providing interoperability for application-specific blockchains while increasing throughput by some order of magnitudes. As of writing, Cosmos is live with a strong community of developers and validators that form the backbone of the staking ecosystem. The key feature of Cosmos, which aims to allow for the seamless transition of tokens between different chains, is IBC (Inter-Blockchain Communication Protocol), which is due to come online in the next year and should showcase the true potential of the protocol. There are currently lots of developer teams that are building on the Cosmos technology stack (including Binance) but thus far those networks are still isolated. With IBC properly enabled we’ll see all of these sovereign networks starting to communicate and interact with each other through the Cosmos Hub network.

Polkadot is an equally powerful system that, with a different digital architecture, aims to both allow cross chain data and token transmission while also radically increasing throughput. Polkadot lies at the core of a new vision for the internet, the Web 3.0, where data sovereignty, property privacy protections and permissionless applications become a new internet for the world. Currently a ‘canary’ network ‘Kusama’ is live, which aims to test many of the systems already put in place by the Parity development team, who is in charge of bringing the Polkadot network to the world. We expect to see a full roll out of Polkadot in the first half of next year and hope it will be a leap forward for the whole ecosystem.

Other technologies that deserve a notable mention for what they will achieve next year are mesh networks like Althea Mesh that bring faster and more private community-based internet to areas of the world that need it most. For example, in parts of Africa people are now getting high speed, low cost internet access when they didn’t before, all enabled by Althea and the blockchain ecosystem.

There will also be clear excitement next year for ‘tBTC’, brought to us by the Keep Network, which enables a trustless bridge to move Bitcoin as an asset onto Ethereum or other networks like the previously mentioned Cosmos and Polkadot. Considering the strong DeFi trend currently, there will be those with major positions of Bitcoin that will jump at the chance to get their wealth working for a return in the rapidly expanding DeFi ecosystem.

Layer-2 scaling technologies will again be at the forefront of the space, including Matter Lab’s ZKsync implementation and other solutions like optimistic rollups. Counterfactual and Connext’s efforts are continuing to gain traction with their state channel technology allowing developers to enable instant, low-cost Ethereum transactions in their wallets, browsers, and applications. With the complete scope of the release of Ethereum 2.0 still some time away, layer-2 technologies performing settlements on the main Ethereum 1.0 blockchain will become far more prominent next year and beyond. We will also see far greater interest in privacy focused technologies such as the Nym project, who are looking to bring mixnet technology back from the computer science labs of the 1980s. There’s an opportunity for network layer privacy projects such as Nym to form a major layer in the forthcoming Web3 stack. Another project tackling this area is HOPR, who are building an incentivised data transmission system that rewards nodes for passing on messages anonymously as they ‘Hop’ from node to node, before finding their true destination. When combined with an endless flow of cover traffic through the network, privacy can be fully achieved.

The Wonderful World of Non-Fungible Tokens

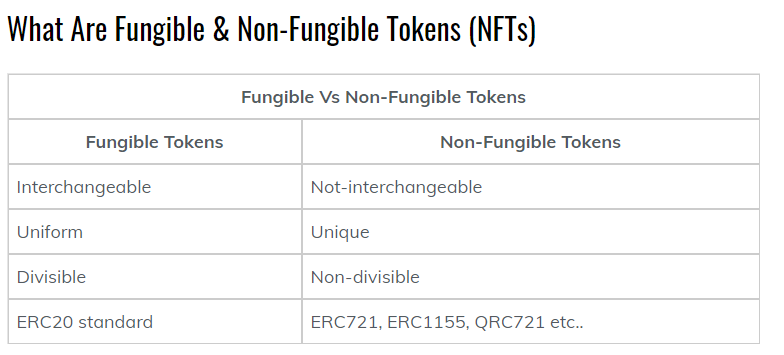

Lastly, a look to next year wouldn’t be complete without mentioning the rising star of Ethereum adoption charts, non-fungible tokens (NFTs). Digital scarcity is no better represented than through one-off unique tokens that represent in-game items, collectibles and even art works. All areas are gaining adoption by the day with games, market places, galleries and more all appearing at an astonishing rate. Next year we will see this go into overdrive as some of the big names in the entertainment business begin to experiment with issuing their own NFTs.

There’s plenty to be excited about, far more than current prices would reflect. We’re only just beginning to understand the vast breadth of use cases unlocked by programmable money, assets and scarcity in the digital realm. Each year brings new and exciting opportunities and 2020 will be no different.

KR1’s Bitcoin Price Predictions

Mid 2020: $7,500

End 2020: $20,000+

Tradersdna is a leading digital and social media platform for traders and investors. Tradersdna offers premiere resources for trading and investing education, digital resources for personal finance, market analysis and free trading guides. More about TradersDNA Features: What Does It Take to Become an Aggressive Trader? | Everything You Need to Know About White Label Trading Software | Advantages of Automated Forex Trading