Why do you need a trading plan?

One of the main benefits of having a trading plan is that it can make your life a lot simpler.

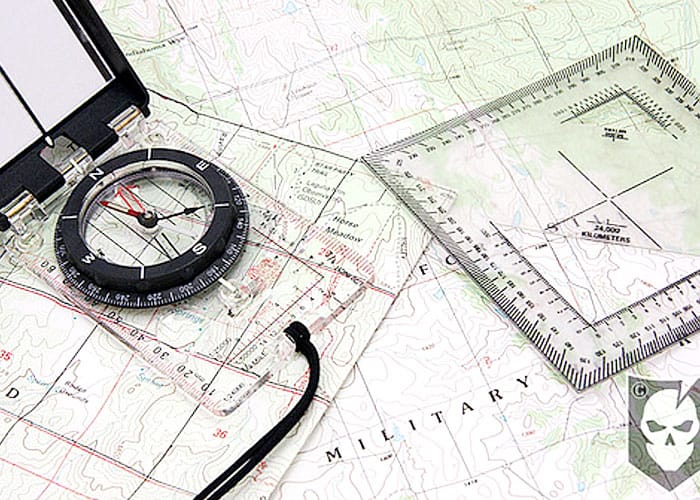

A good analogy is that of a map. When you set out on a journey, you can mark your destination, and set out a route that you plan to take. Over the course of your journey, you can keep referring back to the map to see if you are still on the right track, and if you have made a wrong turn, it shows you how to get yourself back in the right direction.

A trading plan is like a map for trading, showing your current destination and giving you help in getting towards the desired destination, which is consistent profitability. You wouldn’t embark on a journey to a place you had never been before without a map, and following on from the logic of our analogy, you shouldn’t trade without a plan. Without it, you will have no way of knowing whether or not you are headed in the right direction, and you will probably end up losing all the money in your account.

A trading plan enables you to know if you are indeed headed in the right direction, with a framework for measuring your trading performance that you can keep referring back to. This means less stress – and less emotion-based decision making (also known as ‘bad’ decision making!)

If you try to trade without a trading plan in place, you’ll be relying on such noted unreliables as your gut instincts, signals from strangers, or guesses – which is a lot closer to gambling than it is to trading. Although you may well have a few winning trades, your account balance will most likely swing up and down like a rollercoaster, carrying your emotions with it.

Another advantage of a trading plan is that it tells you where you are going wrong. Most people perform poorly when they start out, but they don’t always know why. However, if you have a plan, then you will know that you are either failing because there is a problem with your trading plan, or because you are not sticking to it.

Without a plan, it is impossible to tell whether you are doing the right thing or the wrong thing at any given point, because you have no framework within which to evaluate your results. As the old saying goes, “a failure to plan is a plan for failure”.

While a trading plan won’t guarantee that you will be successful, a good plan that you stick to will help you to stay afloat for longer than traders who don’t have a plan in place.

As a new trader, your primary goal should be survival, which may not be exciting but it is a lot better than failure. 90% of new traders blow through their initial account balance and never trade again. The remaining 10% aren’t necessarily making a profit – they just managed to survive long enough to improve as a trader to the point where they can make consistent profits.

So while it may be tempting to trade by the seat of your pants, without a trading plan in place, you will find it very difficult to make consistent profits in this way.

Other articles in this series:

Developing a Forex Trading Plan – Part 1

Developing a Forex Trading Plan – Part 3

Tradersdna is a leading digital and social media platform for traders and investors. Tradersdna offers premiere resources for trading and investing education, digital resources for personal finance, market analysis and free trading guides. More about TradersDNA Features: What Does It Take to Become an Aggressive Trader? | Everything You Need to Know About White Label Trading Software | Advantages of Automated Forex Trading