Forex Trading MBA Part 3: Currency Quotes!

There are different approaches to learning to trade. The important is to avoid the ones that are not very effective. In this tradersdna Forex Trading MBA you will learn practical market information, technical requirements for any trader, strategies drawn from performance psychology and our team vast personal experience of training and developing professional traders, with the aim of accelerating your trading learning, create a solid risk management strategy and helping you avoid losing unnecessary money.

Trading in the FX, Forex market the most liquid of the capital markets is a powerful way to start creating additional income, and you can also make it to trade professionally, as we mentioned before it is core to understand and learn the basics of Forex universe ecosystem. We believe that the best traders have a laser focus in learning and having a sound technical education, plus managing to get into the best approach and best networks, such as professional forum and other resources.

This 3d part of our tradersdna Forex Trading MBA will highlight the aim of Forex trading technical set up basic, that is to exchange one currency for another in the hope that the currency that you bought will increase in value compared to the one you sold.

Currencies in trading are quoted in pairs, for example the USD/EUR is the U.S. dollar/euro. Using this quotation, the value of a currency is determined by its comparison to another currency. The first currency of a currency pair is called the base currency, and the second currency is therefore called the quote currency. The given currency pair shows how much of the quote currency is needed to purchase / trade one unit of the base currency.

Here is an example of a profitable Forex trade:

You buy 10,000 British pounds at the GBP/USD exchange rate of 1.4100, which costs you $14,100.

A week later, you exchange your 10,000 pounds back into US dollars at the GBP/USD exchange rate of 1.5200, which nets you $15,200 – a profit of $1,100

Currency quotes tend to look something like this:

GBP/USD = 1.4100

The ISO code to the left of the slash indicates the base currency, and the code to the right indicates the quote currency. The number after the equals sign is the exchange rate, which indicates how much of the quote currency you can buy with one unit of the base currency.

If you want to know how much of the base currency you can buy with one unit of the quote currency, you simply have to divide 1 by the exchange rate, for example:

GBP/USD = 1.4100

1 / exchange rate = amount of GBP you can buy with one USD

1 / 1.4100 = 0.7092

Buying and Selling Currency Pairs

In the world of forex, traders tend to talk in terms of ‘buying’ or ‘selling’ currency pairs. However, this is a little misleading, as what you are really doing is buying one currency and selling the other.

So, if you were to ‘buy’ GBP/USD, you would really be buying GBP and simultaneously selling USD. Similarly, if you were to ‘sell’ GBP/USD, you would be buying USD and selling GBP.

You would only buy a currency pair if you think that the base currency will gain value relative to the quote currency. If you think that the base currency will lose value relative to the quote currency, you should sell the pair.

To make matters even more confusing, traders often refer to these buy and sell trades as ‘going long’ and ‘going short’.

To make matters even more confusing, traders often refer to these buy and sell trades as ‘going long’ and ‘going short’.

To ‘go long’ or ‘take a long position’ on a currency pair means that you are ‘buying’ the pair, or buying the base currency and selling the quote currency.

To ‘go short’ or ‘take a short position’ on a currency pair means that you are ‘selling’ the pair, or selling the base currency and buying the quote currency.

Remember:

Long = Buy

Short = Sell

Bid/Ask

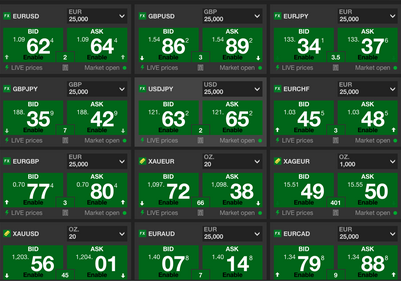

On a forex trading platform, forex quotes are always quoted with two prices, known as the bid price and the ask price. The bid price is always a little lower than the ask price. Here is an example of how that might be displayed:

EUR/USD

Bid 1.3234 Ask 1.3238

The bid price is the price at which your broker is willing to buy the base currency in exchange for the quote currency.

The ask is the price at which your broker will sell the base currency in exchange for the quote currency.

The difference between the bid and ask prices is called the spread. In this case, the spread is 0.0004, or four pips (percentage points).

In the EUR/USD quote above, the bid price is 1.3234 and the ask price is 1.3238. If you wanted to sell EUR, you would click ‘sell’ and you would buy the euros at a rate of 1.3234. If you wanted to buy EUR, you would click ‘buy’ and you would buy the euros at 1.3238.

All The Forex Trading MBA series here:

Forex Trading MBA Part 1: Introduction

Forex Trading MBA Part 2: Exchange Rates and Currency Pairs

Forex Trading MBA Part 3: Currency Quotes

Forex Trading MBA Part 4: Market Depth and Liquidity

Forex Trading MBA Part 5: Key Terms Explained

Forex Trading MBA Part 6: Placing Trade Orders

Tradersdna is a leading digital and social media platform for traders and investors. Tradersdna offers premiere resources for trading and investing education, digital resources for personal finance, market analysis and free trading guides. More about TradersDNA Features: What Does It Take to Become an Aggressive Trader? | Everything You Need to Know About White Label Trading Software | Advantages of Automated Forex Trading