The Japanese yen (¥ or JPY) is the official currency of Japan, and is the third most traded currency on the forex market after the US dollar and the euro. In addition, it is one of the most widely used global reserve currencies after the US dollar, the euro, and the pound.

From Tokoguwa and Dollars to Yen

During the 19th century, the most common currency in use in Japan and the surrounding countries was the silver Spanish dollar, usually minted in South America. This currency was introduced to the region some 250 years previously via ships travelling to the Philippines from Mexico, known as the Manila galleons. In the latter part of the 19th century, local coins based on the Mexican peso began to appear, with the first of these being the Hong Kong silver dollar in 1866. With China being slow to accept new coinage, preferring Mexican dollars, the Hong Kong government stopped minting these coins in 1869 and sold the machinery to Japan.

With the new machinery on board, the Japanese started minting their own coins, known as ‘yen’, which literally means ‘a round object’. This became an official currency of Japan in May 1871, and entered circulation in July of that year. Like many currencies at the time, the yen was essentially a dollar unit, with its roots in the Spanish ‘pieces of eight’, and had more or less the same value as all other types of dollar up until 1873.

Although the dollar was commonly used in Japan in the 19th century, it was not the official currency. At that time the official currency was a complicated monetary system devised by the Tokugawa Shogunate, which dated back to the Edo period. The official adoption of the dollar-like yen, with a decimal accounting system, was intended to streamline the Japanese monetary system and make it more compatible with international trade. At the outset, the yen was legally defined as being worth 24.26g of pure silver or 1.5 grams of pure gold.

From Parity to Massive Devaluation

The devaluation of silver in 1873, which followed the discovery of vast silver deposits on the West Coast of the United States, saw the yen devalued against the US dollar and the Canadian dollar. Unlike the yen, which was on a bimetallic standard, these currencies were on the gold standard, which kept their value constant amid drops in the value of silver, and by 1897 the yen had halved in value against the dollar. In an effort to arrest the slide, Japan adopted the gold standard and froze the value of the yen at USD $0.50.

During and after the Second World War, the yen depreciated dramatically. In an effort to stabilize prices in the Japanese economy, the yen/dollar exchange rate was fixed at ¥360 per US$1 under the Bretton Woods system, and this rate remained until 1971.

Between 1949 and 1971, Japan had emerged as a major industrial power, and a prolific exporter of goods to the west. This ascent was made much easier by the fixed exchange rate system, which kept the prices of imported Japanese goods artificially low in the US and elsewhere. At the same time, it made imports very expensive, which meant that Japan wasn’t buying many goods from America or Europe.

This imbalance was beginning to take its toll on the US economy, which was already straining under the weight of the huge cost of the war in Vietnam and the arms race with the USSR. To address the imbalance, the Nixon administration took the US dollar off the gold standard, effectively ending the Bretton Woods system, and placed a 10% tax on imports, ultimately leading to the establishment of free-floating currencies in 1973.

Following the ‘Nixon Shock’ of 1971, the dollar was devalued and the Japanese government agreed to a new fixed exchange rate under the post-Bretton Woods Smithsonian Agreement. This set the exchange rate at JPY ¥308 per USD $1. However, the new system of fixed exchange rates brought up the same problems as the previous one, with supply-and-demand pressures creating imbalances, and the idea was abandoned entirely in 1973 to pave the way for free-floating exchange rates.

The Yen, Post-Bretton Woods

Having enjoyed explosive growth due to a weak yen in the 1960s, the Japanese were rightly concerned that a rising yen would make Japanese products less competitive in the global marketplace, which would hurt export growth and the industrial base. To address these concerns, the government adopted a policy of intervening heavily in the foreign exchange market by buying or selling dollars to manipulate the exchange rate.

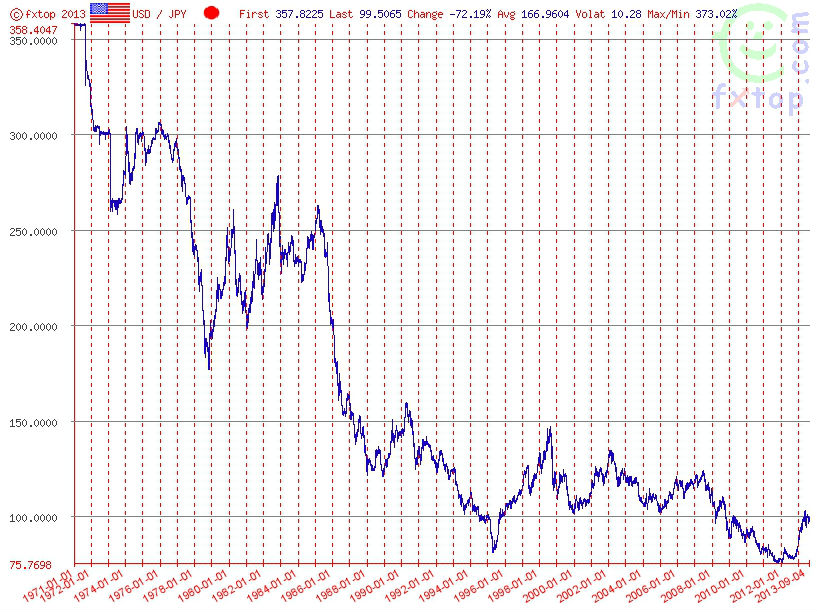

Source: FXTop.com

Even with heavy government intervention, wider market pressures forced the yen to climb dramatically in value, hitting a peak of ¥271 per US$1 in 1973 before the oil crisis hit. The rise in the cost of imported oil drove down the value of the yen, which ranged between ¥290 to ¥300 in the years 1974 to 1976. This saw the re-appearance of trade surpluses, which pushed the yen back up to a high of ¥211 in 1978, but this was reversed by the second oil shock of 1979, which saw the yen drop to ¥227 by 1980.

Despite trade surpluses returning in the first half of the 1980s, the yen actually dropped in value from ¥221 in 1981 to ¥239 in 1985 despite stronger demand for the yen in foreign exchange markets. There are several reasons for this, but one of the main ones was the huge difference in interest rates between the US and Japan. While interest rates were rising in the US, Japan kept theirs at close to zero, which coupled with the deregulation of international capital flows led to an increased supply of yen in the currency markets as Japanese investors chose to invest their money overseas. This kept the yen weak and led to the vast trade surplus built up by Japan in the 1980s.

The Plaza Accord and the Asset Price Bubble

This all changed in 1985 with the Plaza Accord, which was an agreement between several major nations that the dollar was overvalued, and that the yen was therefore undervalued. Coupled with changing supply and demand pressures in the markets, this led to a rapid appreciation in the value of the yen from an average of ¥239 per USD $1 in 1985 to a peak ¥128 in 1988, almost doubling in value in just three years.

This all changed in 1985 with the Plaza Accord, which was an agreement between several major nations that the dollar was overvalued, and that the yen was therefore undervalued. Coupled with changing supply and demand pressures in the markets, this led to a rapid appreciation in the value of the yen from an average of ¥239 per USD $1 in 1985 to a peak ¥128 in 1988, almost doubling in value in just three years.

This contributed to the inflation of an asset price bubble, which drove up the values of property and equities to unsustainable levels. This situation was addressed by a policy of taxation and monetary tightening, which caused the bubble to burst, and the yen dipped in value accordingly. After the end of the asset price bubble years (1985-1991), the yen began to rally strongly, recovering to a new high of ¥123 in December 1992. By April 1995, the yen had appreciated further, hitting a peak of under ¥80, which temporarily made Japan’s economy nearly the size of the US.

Recent History

In the years that followed the Asian financial crisis of 1997, which did not affect Japan directly except through its exposure to these economies, the yen declined again, hitting a low of ¥134 in February 2002. The Bank of Japan’s long-held policy of setting interest rates at zero had discouraged yen investments, and encouraged the ‘carry trade’, worth an estimated $1 trillion annually, of investors borrowing yen at low interest rates and investing in currencies with a higher interest rate. This kept the yen artificially low, and in 2007 the Economist estimated that the yen was undervalued against the dollar by 15%, and euro by 40%.

This downwards trend was reversed after the global economic crisis of 2008, with the yen being seen as a safe-haven currency in times of economic turmoil along with the Swiss franc. In April 2013, Japan’s central bank announced that they would expand their asset purchase programme by $1.4 trillion in two years in an effort to reverse the deflationary trend in the Japanese economy. This will effectively double the money supply, and like previous attempts to devalue the yen, it is intended to boost exports, although this might be counterbalanced by an increase in raw materials and energy costs.

Other Articles in this Series:

Major Currencies: The US Dollar (USD)

Major Currencies: The Euro (EUR)

Major Currencies: The British Pound (GBP)

Major Currencies: The Swiss Franc (CHF)

Major Currencies: The Australian Dollar (AUD)

Major Currencies: The Canadian Dollar (CAD)

Major Currencies: The New Zealand Dollar (NZD)

Tradersdna is a leading digital and social media platform for traders and investors. Tradersdna offers premiere resources for trading and investing education, digital resources for personal finance, market analysis and free trading guides. More about TradersDNA Features: What Does It Take to Become an Aggressive Trader? | Everything You Need to Know About White Label Trading Software | Advantages of Automated Forex Trading