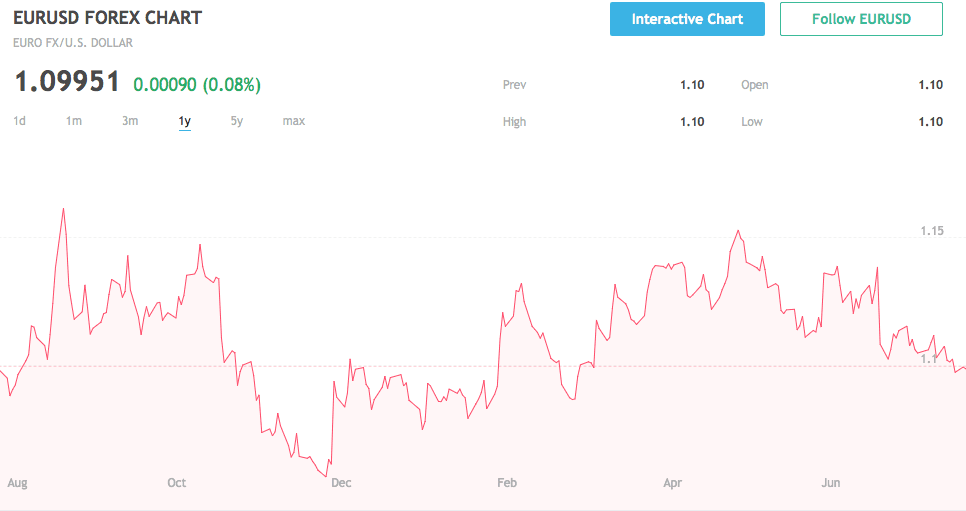

EURUSD Slide Showcases Rapidly Multiplying Euro Area Challenges

After European Central Bank President Mario “do whatever it takes” Draghi betrayed market speculation of imminent easing measures and asset purchase program adjustments during his last press conference, the Euro has since collapsed under its own weight. Flying in the face of reason, Draghi and Governing Council decided to punt on policy, likely until the impact of the British referendum outcome was clearer. However, at a time when inflation is on the cusp of deflation and unemployment remains high, revived banking woes are contributing to a reprisal of the last sovereign debt crisis. Combined with a limited available pool of assets to choose from in the ongoing asset purchase program, confidence in the Euro Area continues to fall. The latest momentum lower in the Euro is a strong reflection of how economic integration means nothing without political integration.

Failing to Exploit Negative Interest Rates

Although the move into negative interest rate monetary policy was greeted with substantial optimism from market participants when first announced, the impact since its implementation has been no show-stopper. Annualized consumer price inflation barely managed to trend into positive territory over the last few months, most recently printing at 0.10% during June with preliminary figures from July due out later this week from Eurostat. Expectations are for more of the same, however, as downside risks remain abundant, especially amid a renewed slide in energy prices after the region flirted with deflationary territory during 3 of the last 5 months. With austerity still prevailing in many indebted countries, implementing fiscal stimulus to complement monetary stimulus is a dim prospect. The lack of consensus amongst member nations in the best way to tackle high unemployment and structural deficiencies only adds to the underlying problem.

One of the benefits of the ECB’s foray into negative territory is record low sovereign borrowing costs for many of the Euro Area’s members. During a period of extraordinary low rates, it would make sense that member countries would borrow above normal needs to retire more expensive debt and fund fiscal stimulus measures. However, mechanisms in the Maastricht Treaty which helped form the monetary union prevent unlimited borrowing by members who must keep deficits below a certain level. While Mario Draghi has stressed the importance of fiscal policy in tackling key problems like inflation and unemployment, so far, no Euro Area leaders have heeded his remarks, adding to the uphill battle facing Central Bank officials. Moreover, because debt issuance is so limited thanks to deficits, the available supply of bonds for the asset purchase program is rapidly shrinking.

More Bailouts in the Pipeline

The banking system in Europe remains fragile as ever, potentially being the monetary union’s undoing considering the vast systemic risks any large bankruptcy poses. The main focus of attention over the last few weeks has been devoted to the Italian banking sector which requires a minimum of €360 billion in recapitalization for the sector to offset nonperforming loans and maintain solvency. However, despite Italy being under the microscope, there are other regions which might add to the amount of assistance required to shore up confidence. Over the weekend, reports that Portuguese banks would once again require assistance has added to fears that a new banking crisis is emerging. After a rescue several years back, banks have been unable to repair balance sheets, especially when income remains low thanks to low interest rates.

Aside from Portugal and Italy, concerns about Austrian and German banks is adding to Euro anxiety, especially ahead of upcoming bank stress tests which are set to be released later in the week. Deutsche Bank remains the risk factor at the top of the list, with its excessively large derivatives portfolio leveraged even higher than Lehman Banks balance sheet before its own demise. S&P recently downgraded the bank’s outlook to negative from stable, underscoring the risks present in the Euro banking environment. At BBB+, a significant downward movement on ratings could quickly affect Deutsche Bank’s collateral and liquidity position, creating a panic. Any whiff of a run on Deutsche Bank could prompt larger fears about the stability of the Euro Area, especially if the current efforts to contain a potential banking crisis fail to materialize.

GDP Waiting in the Wings

Thanks to the enormous amount of risk factors stacking up against the Euro Area, data due late in the week on inflation and gross domestic product which have a dramatic impact on the EURUSD pair. After falling below the 1.1000 psychological level last week, the pressure is on policymakers to show they have the tools and strategies necessary to shore up investor confidence. A weak GDP reading or retreat back into deflationary territory could well add to the Euro’s downside risks. Furthermore, should the banking system show major cracks in the upcoming stress test results, the stage may be set for the Euro to make another run at parity versus the US dollar.

Tradersdna is a leading digital and social media platform for traders and investors. Tradersdna offers premiere resources for trading and investing education, digital resources for personal finance, market analysis and free trading guides. More about TradersDNA Features: What Does It Take to Become an Aggressive Trader? | Everything You Need to Know About White Label Trading Software | Advantages of Automated Forex Trading