By John Hardy, Head of FX Strategy at Saxo

Sterling has traded slightly lower despite a massive shock higher in UK short rates on the back of a spike in April CPI figures. This is an ugly look for the currency. Elsewhere, the kiwi got an enormous negative shock on the RBNZ suddenly declaring an end to its tightening cycle. Elsewhere, a pivot to risk-off yesterday saw the US dollar and Japanese yen rising to the top of the pack.

FX Trading focus:

• Spike in core UK CPI figure with higher rates and low sterling? This could get toxic.

• RBNZ shocks by declaring sudden end of tightening cycle after 25 bp hike.

• US dollar and JPY could become the twin wrecking balls on risk-off deepening.

Trading and bias notes:

• USD: widespread strength outside of USDJPY (as new risk-off tone today and lower yields resets the agenda for the moment for the JPY – more below). Beginning to look like a USD-positive capitulation, with EURUSD failing 1.0725-1.0750 cementing the bigger picture.

• NZD: Downside traction for NZDUSD for those who held on – difficult risk/reward here but likely headed for sub-0.6000 with 0.6200 as resistance. AUDNZD has given both bulls and now bears whiplash. Similar story – more upside risk than downside now, but risk/reward a difficult proposition. Longs to focus on 1.0900+ on break above 1.0750 in coming days.

• GBPUSD: Shorts can tighten stops to just above 1.2450 – eyeing a breakdown of 1.2350 as possibly setting up 1.2200 or even 1.2140.

• USDJPY: neutral now after risk sentiment shift. More interest in long JPY in other crosses if technical line up in coming days and even now if EURJPY stays below 150.00 and GBPJPY if today’s highs just shy of 173.00

Sterling: a new cycle high in core CPI not what the doctor ordered

The UK inflation prints rolling in this morning triggered a tremendous jump in UK short rates, with the 2-year trading almost 30 basis points higher at one point before pulling back. Sterling knee-jerked higher in the initial reaction but then rolled over to the weak side. The most worrying number was the 6.8% YoY rate in core inflation, a massive 0.6% jump and a new cycle high versus the unchanged 6.2% that was expected.

It is a very ugly look for a currency when a huge leap in more hawkish central bank anticipation fails to support the currency. The Bank of England will have no choice but to continue tightening rates, holding its nose all the while on the knowledge that this aggravates the incoming recession risks again, and this just after it was rolling out a more positive message on the economy. The UK is dogged by supply-side shortages, particularly in labor that are the chief Brexit “gift” that just seems to keep in. With inflation this high, the fiscal impulse may also have to weaken or in any case, a stagflationary economy leaves both fiscal and monetary authorities in a bind with no room for manoeuvring. GBPUSD looks set to break down further (last local support in 1.2350 area) and EURGBP just rejected the new local lows posted after the CPI data release this morning. Safe to say that sterling is back on negative watch.

Bank of England Governor Bailey is out speaking on “inflation and the economy” at a WSJ event – hmmm.

RBNZ shocks dovish with end-of-tightening message

The RBNZ administered its own shock overnight by suddenly declaring that its rate tightening cycle is over after hiking the expected 25 basis points, a profound dovish shock that puts an emphatic end to the recent bout of kiwi strength as the market had to neutralize the forward expectations for further hikes. AUDNZD ripped back above 1.0600 and even well above 1.0700 in a huge bullish reversal, and the bottom dropped out of NZDUSD – with the lows for the year suddenly not far away in just below 0.6100 (more below). The RBNZ is solidly optimistic on outcomes for the economy, not ratcheting up concern levels in rolling out this now more dovish forward guidance, but simply declaring that it is confident that has done enough now for the

Chart: NZDUSD

The bottom dropped out of NZD on the RBNZ’s sudden dovish tilt on guidance and the Dollar index is breaking up here, a double whammy for NZDUSD, which has sliced down through the 200-day moving average again, a level that hasn’t really corralled the action very well this year. The lows for the year just below 0.6100 area suddenly not far away and if the current sentiment shift for the worse extends, the pair could be looking at 0.6000 and even deeper retracement levels, like the 61.8% retracement down just above 0.5900

Risk sentiment on tilt – watching out for USD and JPY wrecking ball

A real change in tone was seen across markets yesterday, as we discussed on this morning’s Saxo Market Call podcast. The USD was already firm of late, but today we have seen the Dollar Index in breakout mode higher as EURUSD threatens the last shreds of retracement support just below 1.0750. We are on watch for a full capitulation there and, as we have noted, a solution to the debt ceiling could extend USD strength. USDJPY, meanwhile, is a slightly different story as the JPY might post a comeback in the crosses if this negative mood across persists and is accompanied by stable to lower long sovereign bond yields.

On the US debt ceiling issue, the latest standoff could mean we have to test Yellen’s time schedule for a US default before some kind of solution emerges. Anything can happen here, but I am convinced that the Biden administration would rather risk a constitutional crisis (for example by invoking the 14th amendment) than allowing even a technical default. Another possibility is that stop-gap bills are passed that only punt the issue a few months down the road at a time, keeping the political blame game thriving until the 2024 election. This could prove very damaging for the severity of the US recession if spending on social programs is impacted.

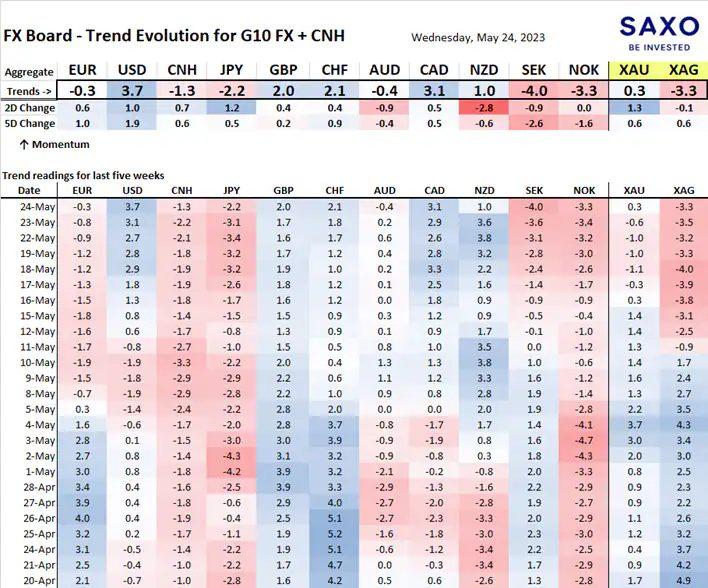

Table: FX Board of G10 and CNH trend evolution and strength

NZD likely to turn negative very quickly after shock today. SEK is currently the weakest G10 currency as EURSEK posted a new high today since the global financial crisis. Closely watching sterling status as a softer currency after a strong rates impulse is a concern. USD now leading on the strong side but note shift of JPY momentum over last two days.

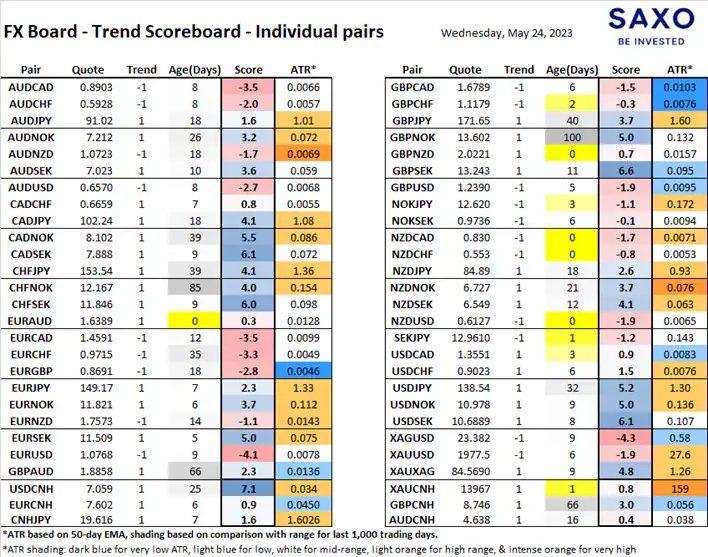

Table: FX Board Trend Scoreboard for individual pairs

A pivotal day for sterling pairs though we should watch for the end of the day to see if sterling ends mixed or pointedly weaker. NZD will be rolling over nearly everywhere once today’s move shows up more in the moving averages. The USD is looking at closing today in an uptrend against all of the other G10 currencies.

Tradersdna is a leading digital and social media platform for traders and investors. Tradersdna offers premiere resources for trading and investing education, digital resources for personal finance, market analysis and free trading guides. More about TradersDNA Features: What Does It Take to Become an Aggressive Trader? | Everything You Need to Know About White Label Trading Software | Advantages of Automated Forex Trading