Could Fed Tapering Cause an Emerging Markets Crisis?

The process of tapering the Fed's quantitative easing programme was never painless, and while it has barely started, already some emerging market countries are...

Forex Trading: Analysing the Market Environment Part 7

The market is inherently unpredictable, and retracements can turn into reversals without any warning. That's why it's important to use trailing stops when trading...

Forex Trading: Analysing the Market Environment Part 6

In the previous lesson, we looked at the differences between reversals and retracements, and some strategies to use when you are unsure. Today, we...

Forex Trading: Analysing the Market Environment Part 5

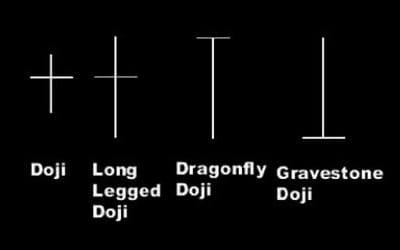

Retracement or Reversal?

One of the trickiest things to predict when trading currencies is whether what you are witnessing is a retracement (a temporary blip...

Interview with Lisa Campbell, CEO and Founder of the London Investor...

Today on Traders DNA, we have the pleasure of an exclusive interview with one of the foremost organisers of investor and Forex shows, Lisa...

Tradingfloor.com – First Multi-Asset Social Trading Portal

Tradingfloor.com - First Multi-Asset Social Trading Portal

Copenhagen-based investment bank, broker, and software developer Saxo Bank has unveiled what it describes as a 'groundbreaking' new...

Forex Trading: Analysing the Market Environment Part 4

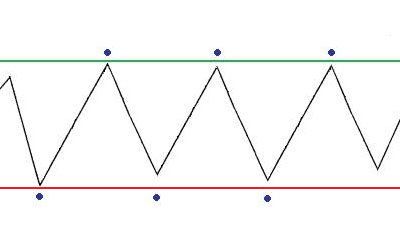

What is a ranging market?

A ranging market is the opposite of a trending market, in that the price is bouncing between a high price...

Forex Trading: Analysing the Market Environment Part 3

Moving Averages in a Trending Market

The ADX can be a useful tool for determining the strength of trends, but it's more reliable if you...

Forex Trading: Analysing the Market Environment Part 2

What is a trending market?

When a price is mostly moving in one direction - up or down - over a given period of time,...

Forex Trading: Analysing the Market Environment Part 1

Before diving in and making a forex trade, it is always worth taking a wider view of the market environment that you will be...

Using Equity Indices to Trade Forex: Part 4

To recap, whenever an investor wants to buy stocks listed abroad, they need to buy some local currency first. This drives up demand -...

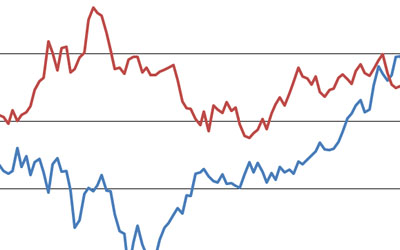

Using Equity Indices to Trade Forex: Part 3

One potential problem with using the equity markets to inform your forex trades is that it can be hard to tell which market is...

Using Equity Indices to Trade Forex: Part 2

Yesterday, we looked at the relationship between stock markets and currencies. Today, we're going to take a look at the most important stock indices...

Using Equity Indexes to Trade Forex: Part 1

Many traders will look at the economic news releases, the currency charts, or both when assessing whether a currency pair is likely to go...

Forex Trading Golden Rules Part 10: Don’t Make Excuses

As much as we would all like it to be possible for every trade to be a winner, it just isn't possible. Even the...

Forex Trading Golden Rules Part 9: The Folly of ‘Perfect’ Strategies

One of the most commonly-heard pieces of advice for novice traders is to work out a strategy using demo mode and/or backtesting and only...

Ten Trading and Economic Outrageous Predictions for 2014

What are the most Trading and Economic Outrageous Predictions for 2014?

Leading online trading provider Saxo Capital Markets has brought together its TradingFloor.com team of...

Forex Trading Golden Rules Part 8: Don’t Add to a Loser

As we covered in a previous Golden Rule, wishful thinking can be the undoing of a trader. One of the most common manifestations of...

Forex Trading Golden Rules Part 7: Timing Is Everything

Wishful thinking can be a great thing in the right context. However, for a forex trader, it's suicide. Yet, many traders indulge in this,...

Forex Trading Golden Rules Part 6: Use Technical AND Fundamental Analysis

One of the most commonly-asked questions among novice traders is "Should I use technical or fundamental analysis?". Well, there are a lot of traders...