Learn about the Advantages and Disadvantages of Forex Rebates

Forex rebate websites are essentially marketing machines used by brokers to bring in more customers. Traders get a small amount from their spreads back...

Forex Trading Golden Rules Part 5: Don’t Go With Your Gut!

There's a time and a place for going with your gut instinct. Deciding on whether to accept a marriage proposal is a good one....

Forex Trading Golden Rules Part 4: Stick to Your Stops

Sticking to your strategy is one of the hardest things to do as a forex trader, especially when your emotions are running riot mid-trade....

Forex Trading Golden Rules Part 3: The Magic 2%

One of the most common - and most frequently ignored - rules in trading is to never risk more than 2% of your capital...

As Greenback surges up, optimism grows for US economy

This might be a good Christmas gift for the US policymakers after all.

After a cocktail of economic data were released as we close 2013,...

Forex Trading Golden Rules Part 2: Protect Your Profits

There is nothing worse than seeing one of your trades up by 40 pips one minute only to see it reverse shortly after and...

Forex Trading Golden Rules Part 1: Always Pair Strong With Weak

In any contest, there is almost always a favourite. Sometimes, competitors will be quite evenly matched, but more often than not there is one...

Guide to Trading Forex Futures Part 4: Speculating

While forex futures are commonly used as a hedging strategy for directional spot trades, they can also be used in isolation as instruments for...

Guide to Trading Forex Futures Part 3: Hedging Strategies

Yesterday, we looked at the differences between traditional futures and forex futures. Today, we'll be looking at the one of the main uses for...

Guide to Trading Forex Futures Part 2: FX Futures vs Traditional...

Yesterday, we looked at how futures contracts tend to work across a variety of asset classes. Today, we're going to zone in on forex...

Guide to Trading Forex Futures Part 1: What Are Futures?

With a daily trading volume of over $2 trillion a day, the spot forex market is by far the world's biggest market. However, spot...

This Week’s Market Movers

The long-awaited announcement that the US Federal Reserve will finally begin tapering its QE programme boosted the dollar across the board last week. The...

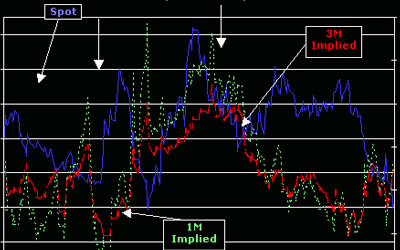

Guide to Forex Options Trading Part 10: Option Volatilities

Option volatilities are a measure of the magnitude and frequency of the changes in the price of a currency. On the other hand, implied...

Guide to Forex Options Trading Part 9: Risk Reversals

Risk reversals reflect the expectation of the market in terms of the direction of an exchange rate. When used in the correct context, risk...

2013 last push amid mixed reviews

2013 is about 2 weeks away from being closed in our trading books but markets across the face of the Earth are vying to...

Guide to Forex Options Trading Part 8: Theta and Vega

Theta

Theta measures the time decay associated with an option, which is the amount that an option will lose each day as a result of...

Guide to Forex Options Trading Part 7: Delta and Gamma

The price of options don't always move in exact correlation to the price of the underlying currency pair, as other factors such as volatility...

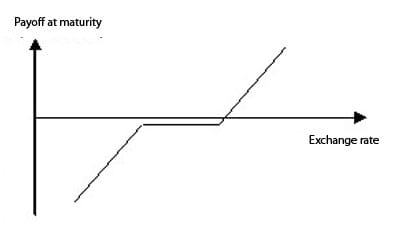

Guide to Forex Options Trading Part 6: Hedging Strategies

One of the most common uses for FX options among forex traders is to use them as a hedge against cash positions. Today, we're...

Guide to Forex Options Trading Part 5 – A Worked Example

In the previous instalments, we've looked at the differences between the various types of option. Today, we're going to look at an example of...

Guide to Forex Options Trading Part 4 – Pricing

There are several factors that influence the value of options. These are:

Intrinsic value

This is a measure of how much the option would actually be...