The Financial Conduct Authority (FCA) is currently consulting on guidance to clarify the boundaries between different investment advice models, such as simplified, or automated, advice. The FCA issued a guidance consultation paper on 11 July, seeking to tackle some of the confusion surrounding the boundaries between various advice models, and clarify what constitutes a ‘personal recommendation’.

The FCA announced that, amid the growth in new advice models in recent years, it wanted to take a closer look at the barriers currently preventing firms from developing distribution models. It is looking at both advised and non-advised distribution models, in addition to the separate existing extremes of full advice and execution-only.

In reality, the FCA’s paper deals with a many more issues than just clarification of what constitutes a personal recommendation. The paper also gives us an interesting glimpse into where the FCA thinks the retail investment sector is heading, and how we can regulate new services that have sprung up as a result of new technological advances and the spread of social media.

But has the FCA even begun to grasp just how the retail investment market, and investors, now use social media? Could it be that the FCA’s latest paper shows up just how far behind the curve regulators are on this issue?

What is the report?

The new guidance, which remains a consultation until 10 October, has been issued with the aim of supporting firms that want to provide simplified advice or sales without a recommendation. The guidance has been issued following ongoing FCA policy work and the output from a thematic review into the growth of new advice models, including simplified advice. The new publication pulls together and replaces previous guidance issued by the FCA.

What is the purpose of this new guidance?

In creating the new paper, the FCA is trying to address many of the important issues facing the new era of financial services firms, as well as the problems faced by investors in this online age in seeking out financial services that they can trust. In essence, the guidance seeks to:

- Address some of the barriers that firms have identified to offering new, streamlined advisory products – some firms fear being reprimanded for offering ‘simplified’ advice by the risk of ‘systemic mis-selling’, for example.

- To clarify the main types of retail investment distribution model.

- To provide further help for firms interested in offering an automated advice service by clarifying when a personal recommendation is given.

- To provide guidance on the boundaries between a range of investment sales models and advice issued through different media, including social media.

Essentially, the FCA has been forced into issuing this guidance by the rapidly changing world of retail investment. New technologies have changed every sphere of business, and we have all been forced to keep up – here the FCA appears to finally be getting on board with that.

Social media concerns

While the FCA may be moving forward, it seems that they may not have fully grasped the nature of social media and how financial services and consumers utilize this communications space. While giving social media its own section within the paper, the FCA still seems undecided as to what truly constitutes a personal recommendation in the online sphere.

How easy is it to give a personal recommendation in 140 characters or less? Is it possible to Tweet a personal recommendation to all of your Twitter followers? The FCA seems to think that any message sent to hundreds or thousands of your social media followers is unlikely to be considered personal, but any suggestion of targeting an individual “Hey@WarrenBuffett! Invest in my new mutual fund!”, or pointing out the circumstances which led you to contact them in the first place, suggests a personal recommendation angle.

Now, there are two factors the FCA has said it would use to determine whether a message constituted a personal recommendation: target audience and content. As far as content goes, context, tone, language is all important – if there is even a hint of personal opinion or a judgement, it’ll be considered a personal recommendation.

The language used by the FCA here doesn’t give much encouragement to those looking for clarification in this area either. Phrases like:

“The fact that a recommendation is made to multiple customers does not automatically mean that it could not be a personal recommendation, but…”

“The selection of the target audience will not automatically mean that the firm is providing personal recommendations. However…”

“…may be viewed as personal recommendations if…”

run throughout this section of the paper, and are rather vague to say the least.

So, where next?

As we mentioned, this guidance remains a consultation until October, so firms have some more time to voice their concerns. So far the bulk of the FCA’s output has been in the form of thematic reviews – and a thematic review has also been published alongside this new guidance. These thematic reviews have been interesting enough so far, have been generally well researched and balanced, and have included helpful indicators on the views of the regulator.

However, by their very nature these thematic reviews are backward-looking – what we have here, and for the first time, appears to be an FCA that is at least genuinely thinking about the future, and that in itself should give firms and investors some level of encouragement.

The full version of this article was originally published on hedgethink.com, a digital thought leadership platform for the alternative investment industry. To see the full range of their daily content, visit the Hedge Think homepage.

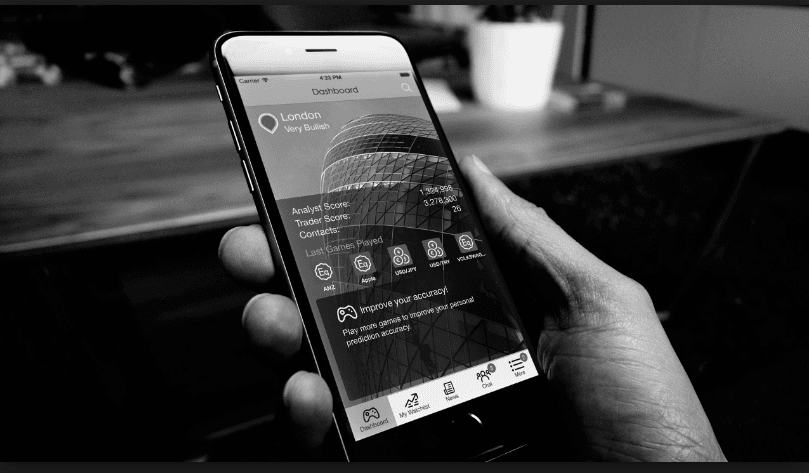

Tradersdna is a leading digital and social media platform for traders and investors. Tradersdna offers premiere resources for trading and investing education, digital resources for personal finance, market analysis and free trading guides. More about TradersDNA Features: What Does It Take to Become an Aggressive Trader? | Everything You Need to Know About White Label Trading Software | Advantages of Automated Forex Trading