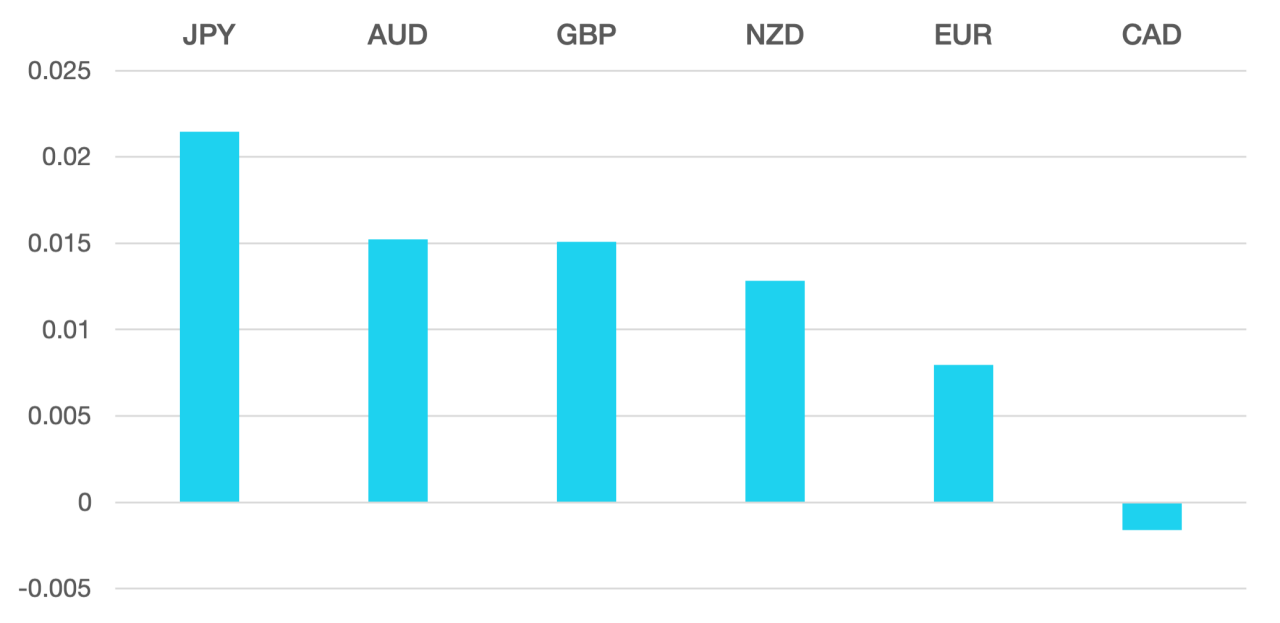

Last week we finally saw the Fed move. The cut of 50bps had been on the cards for a while and the markets reacted accordingly. The Dollar was on the back foot but posted gains vs the JPY as it continued to hold firm with good support around these levels.

The Yen was the loser of the week. A cautious tone adopted by the BoJ weighed on its currency. Its desire not to rush interest rate rises this year finally took the Yen lower which had been under pressure from rising Yields in both the US and Europe.

GBP came out a winner as it broke key resistance in both USD and EUR. A growing economy and it being possibly one of the standout G7 performers helped the pound move higher. While the BoE kept rates at 5% as expected it has adopted a more gradual approach to rate cuts. The market still expects a November cut.

Both GBP and EUR had a non-moving week. The market is now expecting the BoE to skip making any changes at the next meeting.

Oil continued to build on recent gains. WTI posted a 2.9% gain to close just bout $71.

The week ahead the markets will be fully understanding the Feds 50bp cut and we could continue to see risk assets appreciate. GBP we could see move higher continuing that theme.

Data wise we have US GDP along with rate decisions from the RBA & SNB.

Weekly Majors’ Market Performance

What is Cromwell FX?

Cromwell FX is a quantitative FX manager offering superior risk adjusted returns. The portfolio is the most liquid pairs. The strategy is fully automated and adhere to strict rick management procedures to control leverage and position limits.

The post Fed cuts by 50 first appeared on trademakers.

The post Fed cuts by 50 first appeared on JP Fund Services.

The post Fed cuts by 50 appeared first on JP Fund Services.