Forex Trading Fundamental Analysis Masterclass – Part 12.

The importance of a good economic calendar for trading.

“It is always the best discretion to let the market show us where it is going and just simply follow (this would be prudent), rather than predict where the market is going and place a position (this would be gambling).” -Anne-Marie Baiynd

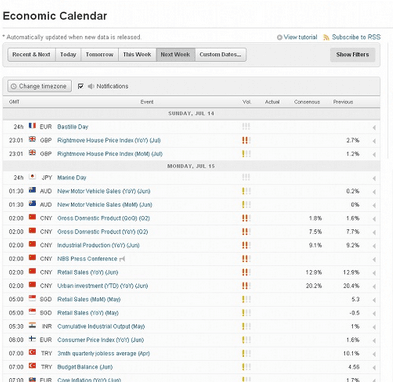

One of the most useful tools at your disposal when performing fundamental analysis for Forex is an economic calendar. A powerful real-time Economic Calendar is critical for covering all the critical economic events and indicators from all over the world, automatically updated when new data is released.

This tells you information about when economic releases that have the potential to move markets are set to occur. They may also contain other details, so that as well as knowing when, for example, the Fed is making an interest rate announcement, you can also find out what rate is forecast, what rate actually occurs, and the impact this change has on the currency market.

The best economic calendars let you sort the information displayed by currency, assign your local time zone, and look at different months and years.

There are so many economic events taking place every day that it can be hard to keep up with it all. Some of this data has the potential to be market-moving in the short term, and accentuate the movement, or change the direction, of currency pairs that you are watching. Thankfully, most of the economic news that is of import to forex traders is scheduled many months in advance.

For Forex traders, the majority of the important announcements are coming out of the US, as the US dollar is involved in over 90% of all currency transactions. Of course, there will be announcements from other central banks and governments that you may need to pay attention to, depending on the specific pairs you are trading. For example, if you are trading GBP/USD, you would need a calendar that included announcements from the Bank of England, whereas if you were trading EUR/USD, you would need to keep an eye out for announcements from the ECB.

Naturally, some economic announcements carry more weight in the forex market than others. For example, the US Nonfarm Payroll number, a gauge of unemployment that comes out every month, is probably the biggest market-mover in the currency markets because it is considered to be a leading indicator for wider economic trends that could later affect things like interest rates and inflation.

There are loads of economic calendars out there to choose from, but in general it is best to stick to those that are provided by the big names – here is our list of recommended calendars:

- Bloomberg

- Financial Times

- FXStreet

- DailyFX

- Forex Factory

- BabyPips

There isn’t a great deal of difference between these, and most of the efforts from lesser-known websites merely scrape information from these, so the best policy is just to try a few out and see which ones are best suited to your needs.

“It’s not whether you’re right or wrong that’s important, but how much money you make when you’re right and how much you lose when you‘re wrong.” -George Soros

Other articles in this series:

Forex Trading Fundamental Analysis Masterclass Part 1

Forex Trading Fundamental Analysis Masterclass Part 2

Forex Trading Fundamental Analysis Masterclass Part 3

Forex Trading Fundamental Analysis Masterclass Part 4

Forex Trading Fundamental Analysis Masterclass Part 5

Forex Trading Fundamental Analysis Masterclass Part 6

Forex Trading Fundamental Analysis Masterclass Part 7

Forex Trading Fundamental Analysis Masterclass Part 8

Forex Trading Fundamental Analysis Masterclass Part 9

Forex Trading Fundamental Analysis Masterclass Part 10

Forex Trading Fundamental Analysis Masterclass Part 11

Forex Trading Fundamental Analysis Masterclass Part 12

Forex Trading Fundamental Analysis Masterclass Part 13

Forex Trading Fundamental Analysis Masterclass Part 14

Forex Trading Fundamental Analysis Masterclass Part 15

Tradersdna is a leading digital and social media platform for traders and investors. Tradersdna offers premiere resources for trading and investing education, digital resources for personal finance, market analysis and free trading guides. More about TradersDNA Features: What Does It Take to Become an Aggressive Trader? | Everything You Need to Know About White Label Trading Software | Advantages of Automated Forex Trading