Forex Trading Fundamental Analysis Masterclass edition – Part 2 of 15!

In the second part of this 15th chapter book′s language we will be highlighting the importance of fundamental analysis for Forex Traders. This section will detail the usefulness of technical indicators for traders. For some traders, Forex robots offer the greatest possibility of finding the holy grail. And sometimes traders are tempted to believe that a secret report, a news service or something similar will give them the keys to limitless riches.

We want to make sure that if you are taking trading seriously you understand and know that there is no crystal ball, or Holy Grail, just hard and smart work, education, regularity and a sound fundamental analysis with solid risk management. What we do know is that trading is all but magic and if anyone really possesses such tools, what serious Forex Traders do is to be sought among fundamental analysts, because the trading track record of those is very clear.

George Soros, Warren Buffet, Jim Rogers, Marc Faber, and other famous traders and investors who all have stellar track records and reputations, openly declare that they owe their “powers” (definitely not magical) to the mastering of fundamental analysis.

In this chapter we will be looking at:

- How to study the macroeconomic markets arena

- How useful are fundamentals for Forex traders?

- What really happens when an economic report is released.

To make this sound and before we go into the details a quote from Warren Buffet and George Soros that says all about trading, risk management and fundamental analysis:

The quotes below use analogies and metaphors to explain the power of long-term trading and investing. We start with Warren Buffet:

“Someone’s sitting in the shade today because someone planted a tree a long time ago.”

“Calling someone who trades actively in the market an investor is like calling someone who repeatedly engages in one-night stands a romantic.”

“Successful Investing takes time, discipline and patience. No matter how great the talent or effort, some things just take time: You can’t produce a baby in one month by getting nine women pregnant.”

“You do things when the opportunities come along. I’ve had periods in my life when I’ve had a bundle of ideas come along, and I’ve had long dry spells. If I get an idea next week, I’ll do something. If not, I won’t do a damn thing.”

Moving forward now let us look at these important considerations from George Soros:

“I contend that financial markets never reflect the underlying reality accurately; they always distort it in some way or another and the distortions find expression in market prices. Those distortions can, occasionally, find ways to affect the fundamentals that market prices are supposed to reflect.”

“the financial markets generally are unpredictable. So that one has to have different scenarios… The idea that you can actually predict what’s going to happen contradicts my way of looking at the market.”

“I’m only rich because I know when I’m wrong. I basically have survived by recognizing my mistakes. I very often used to get backaches due to the fact that I was wrong. Whenever you are wrong you have to fight or take flight. When I made the decision, the backache went away.”

“The only thing that could hurt me is if my success encouraged me to return to my childhood fantasies of omnipotence — but that is not likely to happen as long as I remain engaged in the financial markets, because they constantly remind me of my limitations.”

It is very important to remember that even large investment banks, hedge funds, and institutional investors that have powerful resources, sometimes have a difficult time arriving at correct predictions on how to analyse correctly market forces evolve. The advice for any Forex Trader is to use Fundamental Analysis to determine a general feel for market directions, the interplay of critical key variables, and that existing monetary policy differences to suggest which currency pairs offer the greatest opportunities at a point in time to trade.

Bear in mind that the objective of every trader is to assess markets conditions daily, and then to modify / adapt his trading strategy accordingly. FA and TA are the best tools for achieving this goal each and the best way to manage every trading day operations.

1. How to study the macroeconomic markets arena.

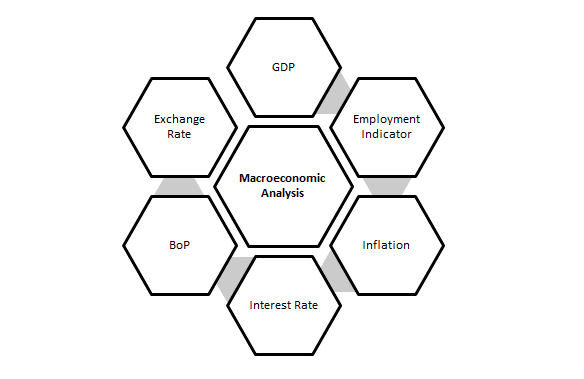

To build wealth, a Forex trader must create a sound strategy and an analytical structure and mind. To create the structure, traders must first establish its core basis of analysis. Macroeconomics is critical for Forex Trading as it is the branch of the economics field that studies how the aggregate economy behaves and correlates with the activity of central governments and the value of the currencies. In the global picture of macroeconomics, a variety of economy-wide phenomena is thoroughly examined with data analysis such as, inflation values, price levels, rate of growth of an economy, national income, gross domestic product and the variation and changes in unemployment – non farm payrolls.

The basis of Forex trading analysis will involve the study of macroeconomics at the global markets scale, special in what relates to the currencies he or she is trading. A Forex trader must establish the structure analytic trading background at the highest level to be able to filter the data and reach at the dynamics of the chosen currency pairs at the lowest level.

In doing so, Forex traders need to examine cyclical dynamics, the monetary policies of major central banks and a few other critical indicators. Past behavior of monetary institutions has great relevance to their future choices, which is why one must keep historical markets data in mind while analyzing the future direction of the markets.

The first phase of Fundamental analysis when it comes to Forex Trading is relatively straightforward, since during a boom the volatility falls, and market liquidity becomes abundant on a global scale; during a bust, bull market the opposite happens. Nonetheless, it’s very important that a Forex trader knows how to isolate the noise from the real data, otherwise he will be a victim of the political, news or social media spin, and his trading analysis will fail.

2. How useful are fundamentals for Forex traders?

Although fundamental analysis can be useful for predicting the future economic conditions, it isn’t so useful – in a direct sense – for predicting currency price direction. In practice, fundamental information such as economic releases and reports or monetary policy announcements provide a much vaguer indication of future price changes than technical indicators. Usually, the analysis of economic releases looks a little something like this:

“An interest rate increase of that 1% MAY cause the US dollar to rise.”

or

“The euro SHOULD go down with an indicator value in that range.”

or

“Since the last report, the Consumer Price Index went up by 3%.”

3. What really happens when an economic report is released.

In reality, the market reacts mainly to how people are feeling, although these feelings can be based on their reaction to economic reports, which in turn are based on their assessment of current market conditions. And as you might expect, there are millions of people with different feelings and ideas about this at any given time.

The upshot of this is that there is no way for certain to tell where a currency pair will go because of some new fundamental data. However, this shouldn’t be taken to mean that fundamental analysis should be dismissed entirely.

Because there is so much fundamental data available at any one time, the vast majority of people have great difficulty in putting it all together. While they can understand a specific report, they can’t factor it into the broader economic picture, as to do this would take an uncommonly deep understanding of the data, not to mention a great deal of time.

Also, because most fundamental data refers only to one currency, you would need the fundamentals for the other currency in the pair and compare the two to obtain a more accurate picture. When trading currencies, it’s all about pairing a strong currency with a weak one.

Other articles in this series:

Forex Trading Fundamental Analysis Masterclass Part 1

Forex Trading Fundamental Analysis Masterclass Part 2

Forex Trading Fundamental Analysis Masterclass Part 3

Forex Trading Fundamental Analysis Masterclass Part 4

Forex Trading Fundamental Analysis Masterclass Part 5

Forex Trading Fundamental Analysis Masterclass Part 6

Forex Trading Fundamental Analysis Masterclass Part 7

Forex Trading Fundamental Analysis Masterclass Part 8

Forex Trading Fundamental Analysis Masterclass Part 9

Forex Trading Fundamental Analysis Masterclass Part 10

Forex Trading Fundamental Analysis Masterclass Part 11

Forex Trading Fundamental Analysis Masterclass Part 12

Forex Trading Fundamental Analysis Masterclass Part 13

Forex Trading Fundamental Analysis Masterclass Part 14

Forex Trading Fundamental Analysis Masterclass Part 15

José Ricaurte Jaén is a professional trader and Guest Editor / community manager for tradersdna and its forum. With a Project Management Certification from FSU – Panama, José develops regularly in-house automated strategies for active traders and “know how” practices to maximize algo-trading opportunities. José’s background experience is in trading and investing, international management, marketing / communications, web, publishing and content working in initiatives with financial companies and non-profit organizations.

He has been working as senior Sales Trader of Guardian Trust FX, where he creates and manages multiple trading strategies for private and institutional investors. He worked also with FXStreet, FXDD Malta, ILQ, Saxo Bank, Markets.com and AVA FX as money manager and introducing broker.

Recently José Ricaurte has been creating, and co-managing a new trading academy in #LATAM.

During 2008 and 2012, he managed web / online marketing global plan of action for broker dealers in Panama. He created unique content and trading ideas for regional newspaper like Capital Financiero (Panamá), La República (Costa Rica), Sala de Inversión América (Latinoamérica) and co-developed financial TV segments with Capital TV.

He is a guest lecturer at Universidad Latina and Universidad Interamericana de Panamá an active speaker in conferences and other educational events and workshops in the region. José Ricaurte worked and collaborated with people such as Dustin Pass, Tom Flora, Orion Trust Services (Belize) and Principia Financial Group.