Forex Trader Maze: Trading perspectives EUR/USD, GBP/JPY, USD/CAD, EUR/GBP

Yes, you do not have to email me or leave a comment. I know…the ideas I share are far from being traditional or professional as any Barclay’s analyst or the next guy at Commerzbank.

Do you care?

Isn’t it the purpose of a forex trader to make money? It does feel that we all want exclusive entertainment with an avalanche of news and possibilities. It left me thinking about writing this or not! However, I am 100% sure I do not care much for the story nor who agrees, because what you are about the see and review if you move your lazy humanity; are just facts.

Let’s start with the Euro and oh boy! you can be certain no one is going to publish a parity article for a while, it is just amazing how I do not have to hear that ruptured disc for at least the next months.

Yes, why am I calling it Forex Maze? Correct, because I have the Spanish version running at another authority site as tradersdna. It’s not fancy, but it describes the reality of currency trading.

Where I was….yes..the euro!

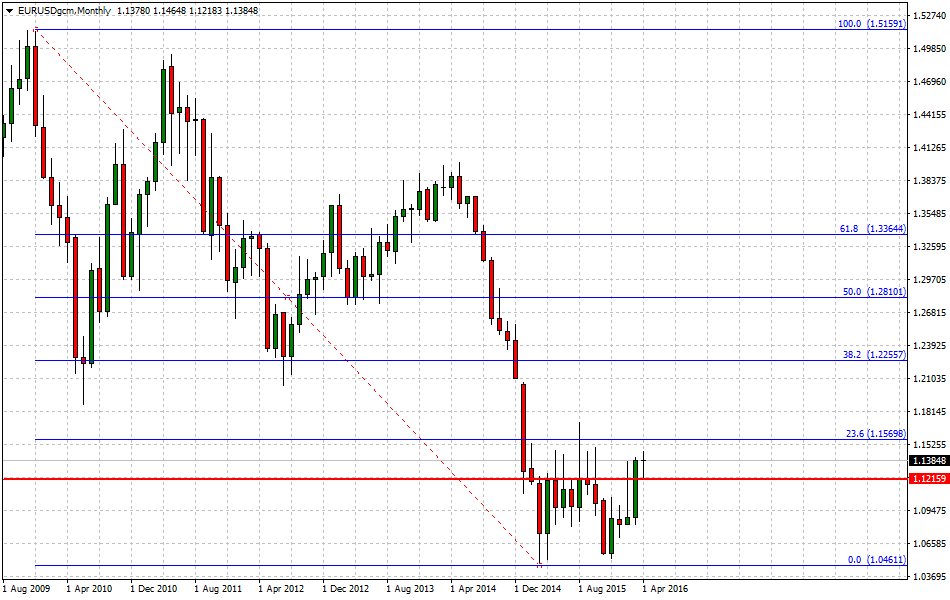

Now, we are looking at a monthly chart to give us a clear idea of the trading range we may expect in the following weeks.

If review this chart we can understand that EUR/USD has been trading within 1,200 pips range from high to low since late 2014. Do not forget how many times, as soon as it approached close to 1.0850 the public summoned a refreshing death sentence over the poor and hated currency.

Can’t stop thinking about those retail and professional traders with short positions around 1.0560 since December 2015. You bet! Another historic moment when it was inevitable to have an aggressive “QE” package by the ECB.

I am sure you do remember how that day ended…Do you?

Let’s us judge this chart and establish the following:

- There is an evident bottom in place; around 1.0560

- Lack of direction from Janet Yellen is not going to help dollar bulls.

- Dollar strength makes a good case for a depressed worldwide economy.

The Eurozone is not the best place to be in due multiple political and demographic challenges, however, it makes a better home for risk takers.

Critical Support: 1.1215 – Challenge: Fibonacci Leve 23.6% – 1.1569

Max Risk: “If” long (meaning “Buy” if you are new to forex trading or our forex trader maze content) let’s keep it clean, 1.0980 and that’s all the risk I am willing, or You should take.

Max Target: Call me crazy, but I think this is the year the euro trades back to its fair value, rather than an “end of days” scenario; conservative it can move towards the Fibonacci Level 38.2% and you know it.

I came back to my screen, and I thought it was a joke when suddenly, I am up almost +400 pips (Thanks to our proprietary algorithm; Osiris).

Think about it for a minute: “It takes weeks to go up, but just seconds to go down.” those shorts made my week and my clients’ trading accounts.

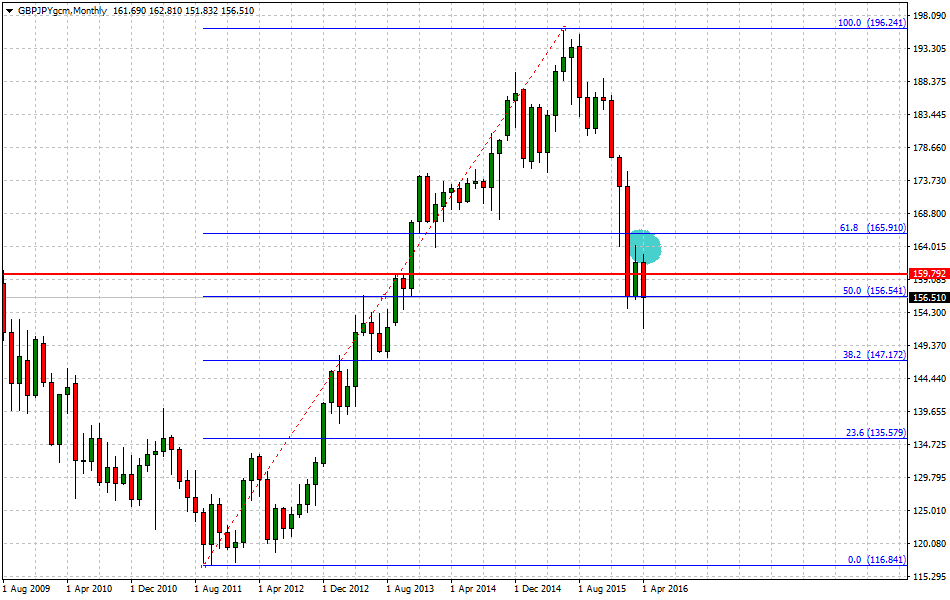

On the other hand, most of my peers’ complaint a lot. Do you know why? Because they were all betting on their “perfecto” scenario. Yes, perfect for them and cloudy for an entire country; Japan. Sure, who cares about 127.1 million people and their finances?

Sadly, it seems that BoJ did something valuable, at least for the next weeks. How are they going to solve the core issue? No idea! You see, unless you find a younger population that wants to live in Tokyo or Osaka or anywhere in Japan that you can think and work giving back to the country most of your income, then there is not much to do.

Not much to do, and on every pullback, I am interested in adding more shorts. GBP/JPY is known for being a wild beast! Yes, and you can capitalize on this opportunity if you manage your risk. (remember risk first, then profits).

Take a look at the monthly chart; there is a little circle or eclipse (not sure what I used) it colors the resistance zone 164.00/162.60 and make no mistake; it is not going back there for a long, long, long time.

Critical Resistance: 159.80 – Challenge: Fibonacci Level 50.0% – 156.50

Max Risk: I am going with 160.50, but you can allocate as your portfolio or trading account allows you.

Max Target: Boy! This one is tricky, I think it goes to the Fibonacci Level 38.2% however, that can take four months if not sooner, but I do expect some sideways action. It is better to accommodate this idea in multiple entries to improve your rate of success.

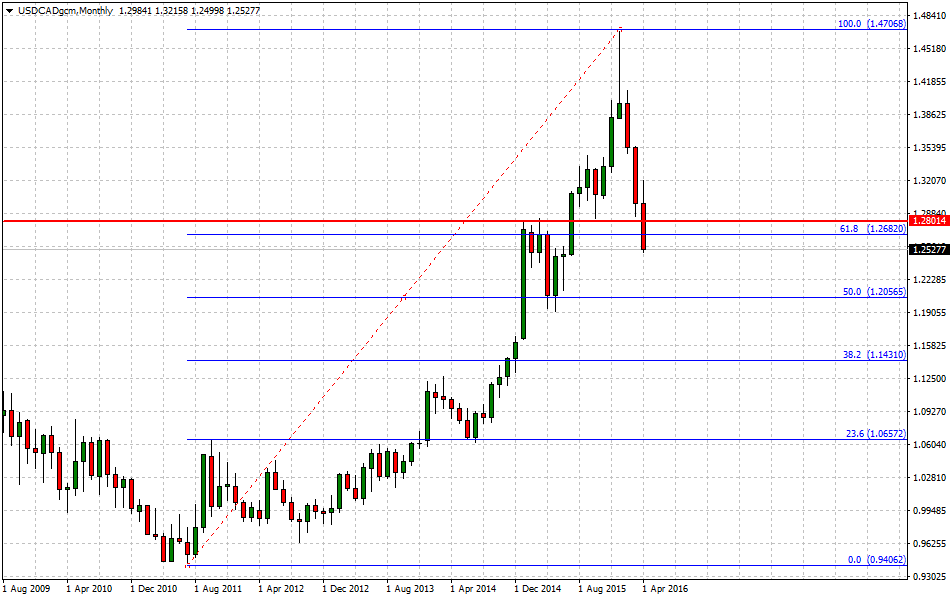

Please, do not think I am not warning you for a valid reason. Indeed, this “trading” job for a forex trader is not easy nor impossible. USD/CAD is another case where it takes months to build up and a lot less to come back to normal. (if deflation can be considered normal)

In general, commodities were pushed to marginal price levels not only because of the basics dynamics demand and offer but the idea created by the Fed.

Which idea may you be wondering?

Not sure is an idea or just a lousy joke, that they were going to hike rates 4x in 2016. There is no way you even considered that lunatic statement. I know, you are always playing defense, so you never bought it. It was just too ridiculous to even for a circus director.

“If” you are still buying dollars I am about to share with you a piece of advice; ready? The trend changed!

Oil producers may keep this game for a while, so you are better selling into resistance USD/CAD because it can trade below 1.2050.

Critical Resistance: 1.2820 – Challenge: Fibonacci Level 50.0% – 1.2056

Max Risk: Let’s consider 1.2920. It takes more than +400 pips from Friday’s close.

Max Target: “If” commodities keep the momentum, I have to think the Canadian dollar can appreciate towards 1.1880, but that’s a big “IF.”

Do we believe Brexit means nothing to the world economy? Well, it depends on how you sell the pitch on this one.

The EU played a winning hand on this matter creating a network of solutions for those with less cash to participate and offered a strange basket of problems to the big players. Take a moment, breath and face it, the so-called union is about to hit the fan.

I do not mind helping or assisting, but to legally allow others to invade and abuse our resources, then I cannot call it “The Union” it is more “The Office” (ya, a funny mess).

But! There are some benefits if the United Kingdom leaves the weak euro zone and dare to organize things step by step. It is going to be ugly, difficult and many as usual, will have no more than a bunch of negative comments.

Let’s discuss the benefits of #VoteLeave in another opportunity; I am going to finish this edition for Forex Trader Maze with EUR/GBP (not my favorite, but there is some pips to take).

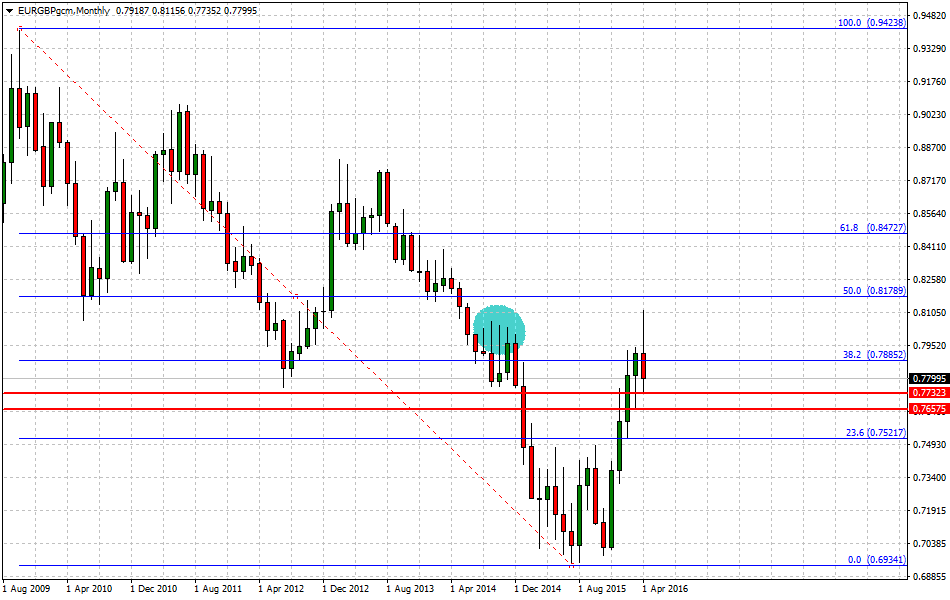

There is a buying zone, a heavy one, around 0.7732/0.7650 the only problem I have with this trade is the rejection of 0.7980 (take a look to your left) between April and December 2014. That’s a tough resistance to break.

Critical Support: 0.7521 – Challenge: Fibonacci Leve 38.2% – 0.7885

Max Risk: Be moderate use the critical support.

Max Target: Well, I am very optimistic about this Brexit drama, so aim to hit the Fibonacci Leve 50.0% that makes your time and trade worth.

Alright! Not much for now, ’til next early Monday in Japan and late night in London and afternoon in NY (it is funny to keep it up) this is your weekly edition of Forex Trader Maze!

(that is a catchy trading name)

José Ricaurte Jaén is a professional trader and Guest Editor / community manager for tradersdna and its forum. With a Project Management Certification from FSU – Panama, José develops regularly in-house automated strategies for active traders and “know how” practices to maximize algo-trading opportunities. José’s background experience is in trading and investing, international management, marketing / communications, web, publishing and content working in initiatives with financial companies and non-profit organizations.

He has been working as senior Sales Trader of Guardian Trust FX, where he creates and manages multiple trading strategies for private and institutional investors. He worked also with FXStreet, FXDD Malta, ILQ, Saxo Bank, Markets.com and AVA FX as money manager and introducing broker.

Recently José Ricaurte has been creating, and co-managing a new trading academy in #LATAM.

During 2008 and 2012, he managed web / online marketing global plan of action for broker dealers in Panama. He created unique content and trading ideas for regional newspaper like Capital Financiero (Panamá), La República (Costa Rica), Sala de Inversión América (Latinoamérica) and co-developed financial TV segments with Capital TV.

He is a guest lecturer at Universidad Latina and Universidad Interamericana de Panamá an active speaker in conferences and other educational events and workshops in the region. José Ricaurte worked and collaborated with people such as Dustin Pass, Tom Flora, Orion Trust Services (Belize) and Principia Financial Group.