In the first part of our series on the Carry Trade, we explained the logic behind this popular trading strategy. Today, we’re going to look at the most important aspect of this strategy, namely the risk, and how to assess and manage it.

The Importance of Risk Appetite

In general, carry trades only tend to work when the market as a whole has an appetite for risk. This means that investors are optimistic about economic conditions, and feel confident enough to buy high-yielding currencies and sell low-yielding ones. This doesn’t necessarily mean that you can only do carry trades during boom times – all it means is that investors are hopeful that conditions will improve in the foreseeable future.

Basically, this means that when risk aversion is high, the carry trade isn’t going to work too well. If economic conditions in a country are tough, then people will be more likely to put their money into investments that are low-paying but safe, rather than high-yielding risky ones. In these conditions, people are more concerned with keeping the money that they already have than risking it in search of a bigger return. This gives them some security in the event that they should suffer a drop in income, such as the loss of their job. Therefore, you could say that the negative economic conditions are making the people who live in that country more risk-averse.

The same logic applies to major institutional investors in the forex market. During times of economic uncertainty, these investors will tend to put their money into safe haven currencies that offer low interest rates, such as the Japanese yen and the US dollar. This is the opposite of the carry trade, in that capital is flowing into safe assets, causing currencies with low interest rates to gain in value against those with high interest rates. That’s why the carry trade is said to disappear during times of economic uncertainty, and return when things are looking up.

What to Look For

There are two things you need to look for when choosing a suitable pairing for a carry trade: a high interest rate differential, and a pair that has been stable or in an uptrend in favour of the higher-yielding currency. The latter gives the opportunity to stay in the trade for as long as possible, allowing you to profit from the interest rate differential.

As you should already be aware, the most important question you should ask before entering into any trade is “What is my risk here?”. By assessing your maximum risk, you can determine whether or not the trade is acceptable in terms of your risk management rules.

As with any other type of forex trade, you can set your stop loss level to limit your maximum losses. So, if your strategy determined that you could only afford to lose £1000 on a single trade, then you would set the stop loss accordingly. So, even if you hit this level and the trade closed automatically, you would still benefit from the interest payments accrued during the time when the trade was open, and these can be factored into your risk assessment. This could mean that you could potentially take on a little more risk in terms of the exchange rate fluctuations, as the interest differential would compensate for some potential losses.

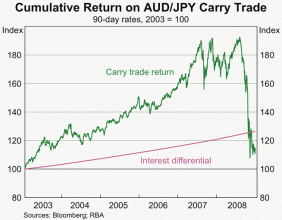

Source: rba.gov.au

One important thing to remember about the carry trade is that profits are cumulative, so the longer you can keep the trade open, the more interest you will accrue. So, if you set the stop loss at too high a level, the trade could close – at a loss – before you had time to make any money out of the interest. If, however, you were able to take on more risk, you could potentially ride out the fluctuations and exit the trade when prices returned to more or less the same level, or better, pocketing the interest rate differential in the process.

The flipside of this is that, if the trade goes badly against you, you could end up losing more than if you had placed the stop at a more conservative level. That’s why it’s so important to assess the risk beforehand. If your strategy prevents you from setting the stop loss at a level that allows you to ride out the kind of fluctuations that you can reasonably expect, given the history of the pairing, it’s better to stay out of the trade altogether, rather than deviating from your risk management strategy. To find out more about risk management, check out my article about How to Manage Risks in Forex Trading.

Conclusion

It’s worth keeping in mind that the global economic and political landscape are changing on a daily basis, and also that interest rates and interest rate differentials between currencies can also change. Therefore, as with a standard directional trade, you should always limit your losses when you are engaging with the carry trade, and you should only consider this type of trade when the conditions are right. When applied correctly, in the right market conditions, the carry trade can add a significant extra income to your forex trading activities.

Other articles in this series:

Forex Trading Strategy: The Carry Trade Part 1

Tradersdna is a leading digital and social media platform for traders and investors. Tradersdna offers premiere resources for trading and investing education, digital resources for personal finance, market analysis and free trading guides. More about TradersDNA Features: What Does It Take to Become an Aggressive Trader? | Everything You Need to Know About White Label Trading Software | Advantages of Automated Forex Trading